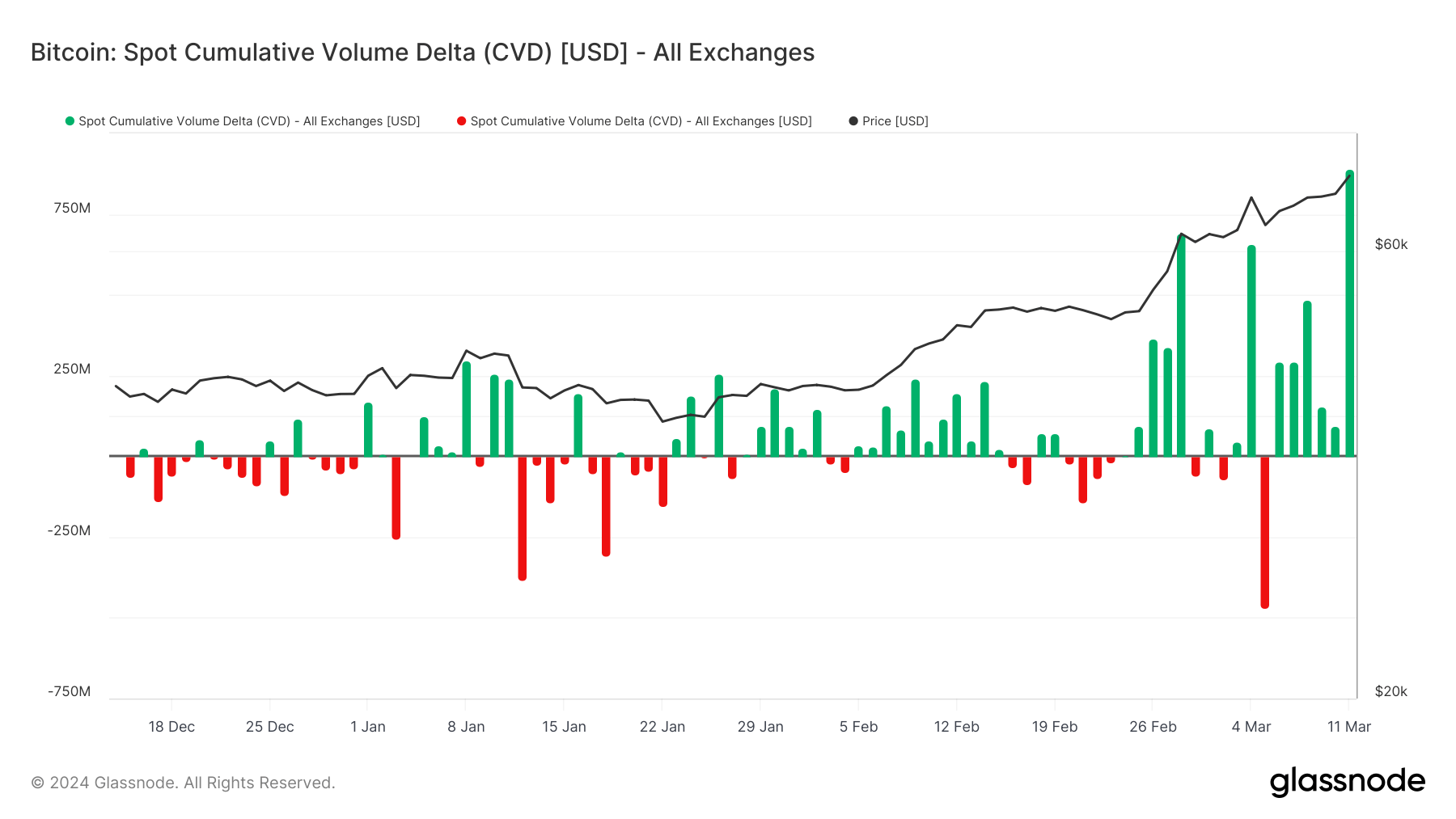

Glassnode’s Bitcoin Spot Cumulative Quantity Delta (CVD) registered its highest studying of 2024 on March 11, hitting practically $900 million. This surge within the CVD, which measures the online distinction between aggressive shopping for and promoting stress throughout main crypto exchanges, alerts a powerful bullish sentiment within the Bitcoin market.

Wanting on the hourly knowledge, a surge of over $360 million occurred round 7 am UTC as Bitcoin rose from $68,500 to $71,200 within the span of three hours. The remaining purchases occurred largely earlier than 8 pm UTC, with round $70 million in promoting stress occurring round 10 am, then once more later at 3 am on March 12.

[Editorial Note: it is important to note that the CVD data may not consider all Bitcoin activity due to high OTC trading levels off-exchange. The correlation of $360 million leading to a $3,000 increase in Bitcoin price is only a part of the story. Creating ratios from this figure alone may create overly bullish sentiment. That said, this is a critical piece of the puzzle in determining purchasing multiples for Bitcoin.]

The March 11 spike comes on the heels of volatility within the CVD all through the primary months of 2024. The 12 months began with the indicator in constructive territory earlier than plunging into unfavorable figures in early January, suggesting a shift to promoting stress following the spot ETF launches within the US. Nonetheless, the CVD rebounded sharply constructive by late January and early February, indicating renewed shopping for exercise.

All through February, the CVD fluctuated between constructive and unfavorable ranges, reflecting a tug-of-war between patrons and sellers. A notable spike in late February coincided with Bitcoin’s value surging above $40,000. Coming into March, the CVD skilled extra ups and downs, together with a steep drop in early March that aligned with a Bitcoin value dip.

The March 11 studying, nonetheless, stands out as a doubtlessly vital bullish sign amid the latest volatility. As an on-chain metric that may mirror and doubtlessly foreshadow appreciable value strikes, the Bitcoin Spot CVD offers worthwhile insights into Bitcoin’s provide and demand forces. The record-high March 11 determine means that aggressive shopping for stress could also be constructing, which might bode properly for Bitcoin’s value within the close to time period.

The publish $360 million despatched Bitcoin from $68k to $71k amid highest spot shopping for of 2024 appeared first on CryptoSlate.