Eleven accredited Bitcoin ETFs have painted the pioneering cryptocurrency with a recent coat of legitimacy. By receiving an official blessing from the Securities and Alternate Fee (SEC), an institutional investing barrier has been lifted.

With this barrier gone, monetary advisors, mutual funds, pension funds, insurance coverage corporations and retail traders can now obtain Bitcoin publicity with out hassling with direct custodianship. Extra importantly, a taint has been scrubbed off from Bitcoin, beforehand likened to “tulip mania”, “rat poison”, or “index of cash laundering”.

Following the unprecedented domino of crypto bankruptcies all through 2022, Bitcoin value reverted to November 2020 degree of $15.7k by the top of that 12 months. After that nice FUD reservoir was drained, Bitcoin slowly recovered throughout 2023 and entered 2024 at $45k degree, first visited in February 2021.

With the 4th Bitcoin halving forward in April, and with ETFs setting new market dynamics, what ought to Bitcoin traders count on subsequent? To find out that, one should perceive how Bitcoin ETFs elevated BTC buying and selling quantity, successfully stabilizing Bitcoin’s value volatility.

Understanding Bitcoin ETFs and Market Dynamics

Bitcoin itself represents the democratization of cash. Not beholden to central authority just like the Federal Reserve, Bitcoin’s decentralized community of miners and algorithmically decided financial coverage ensures that its restricted 21 million coin provide can’t be tampered with.

For BTC traders, this implies they are often uncovered to an asset that isn’t on an inherent trajectory of devaluation, which is in stark distinction to all current fiat currencies on the earth. That is the inspiration for Bitcoin’s notion of worth.

Alternate-traded funds (ETFs) current one other democratization pathway. The aim of ETFs is to trace an asset’s value, represented by shares, and allow buying and selling all through the day not like actively managed mutual funds. The ETFs’ passive value monitoring ensures decrease charges, making it an accessible funding automobile.

In fact, it might be as much as Bitcoin custodians like Coinbase to enact ample cloud safety to instill investor confidence.

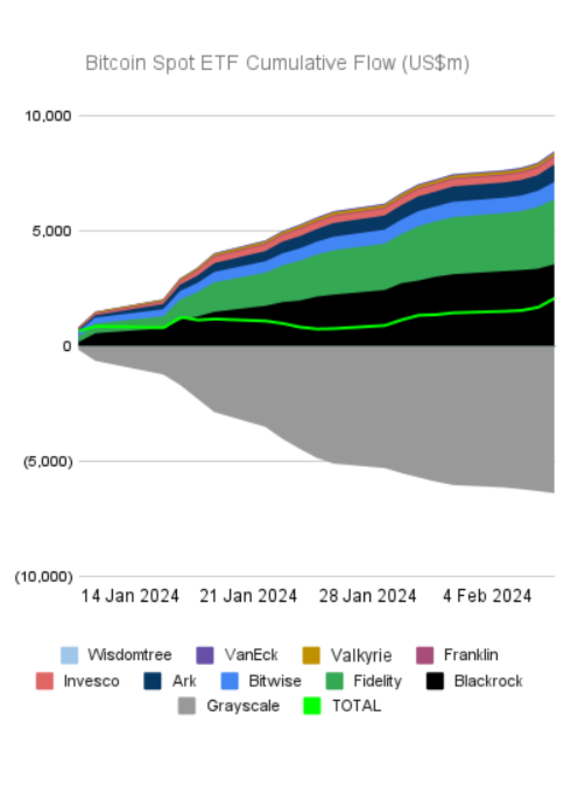

Within the ETF universe, Bitcoin ETFs have demonstrated excessive demand for a decentralized asset that’s proof against centralized dilution. Altogether within the final 15 days, they’ve resulted in $29.3 billion buying and selling quantity towards $14.9 billion stress from Grayscale Bitcoin Belief BTC (GBTC).

This isn’t shocking. As Bitcoin value moved up on account of Bitcoin ETF hype, 88% of all Bitcoin holders entered the revenue zone in December 2023, finally reaching 90% in February. In flip, GBTC traders had been cashing out, inserting a downward stress value $5.6 billion on Bitcoin value.

Furthermore, GBTC traders took benefit of decrease charges from the newly accredited Bitcoin ETFs, shifting funds from GBTC’s comparatively excessive 1.50% charge. On the finish of the day, BlackRock’s iShares Bitcoin Belief (IBIT) is the amount winner at 0.12% charge, which is able to go as much as 0.25% after a 12-month waiver interval.

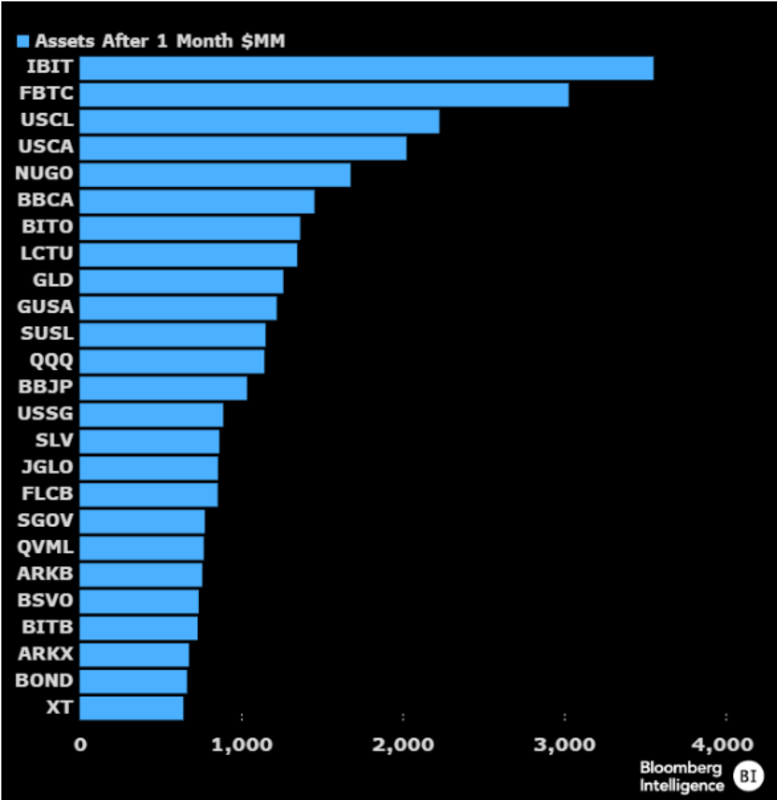

To position this within the context of the broader ETF universe, IBIT and FBTC managed to outpace iShares Local weather Aware & Transition MSCI USA ETF (USCL), launched in June 2023, inside a month of buying and selling.

That is notably indicative provided that Bitcoin’s historical past is considered one of assaults coming from the sustainability course. It bears reminding that Bitcoin value fell 12%, in Might 2021, shortly after Elon Musk tweeted that Tesla not accepts BTC funds exactly on account of eco issues.

Throughout January, IBIT and FBTC discovered themselves at eighth and tenth place respectively as ETFs with the most important web asset inflows, headed by iShares Core S&P 500 ETF (IVV), based on Morning Star report. With each day ~10,000 BTC streaming into ETFs, this represents a significantly lopsided demand over ~900 BTC mined per day.

Transferring ahead, because the GBTC outflow stress wanes and influx pattern will increase, the regular stream of funds into Bitcoin ETFs is poised to stabilize BTC value.

The Mechanism of Stabilization

With 90% of Bitcoin holders coming into the revenue zone, highest since October 2021, selloff pressures can come from many sources, institutional, miner and retail. The upper influx pattern in Bitcoin ETFs is the bulwark towards it, particularly heading into one other hype occasion – 4th Bitcoin halving.

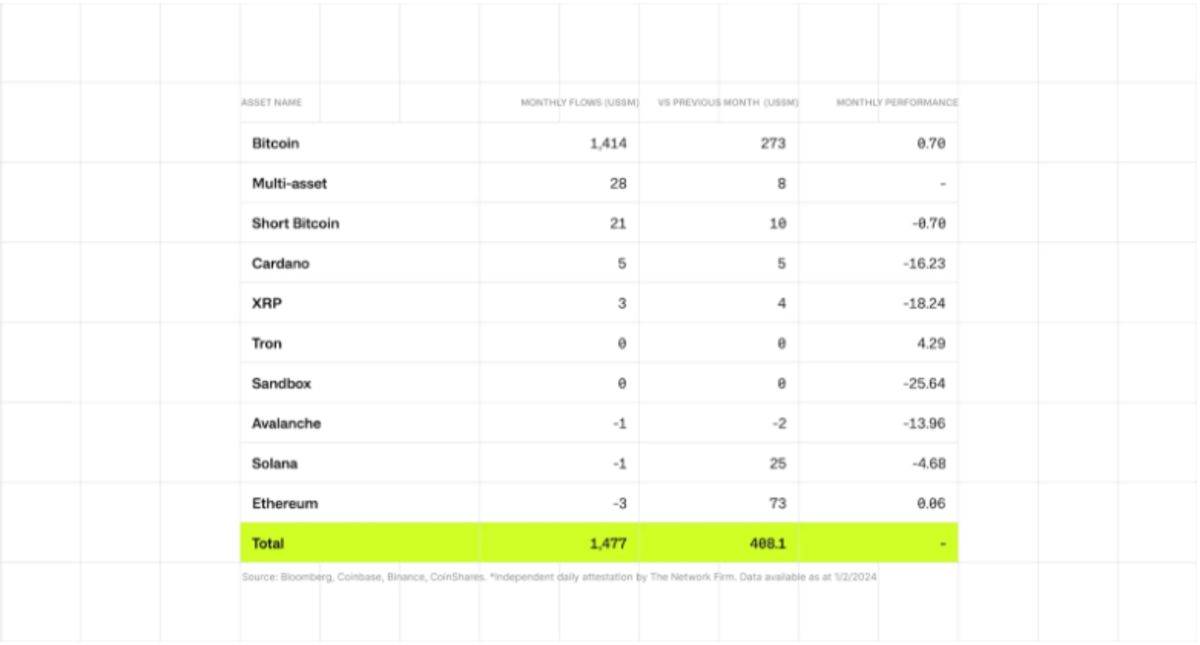

Greater buying and selling volumes generate increased liquidity, smoothing out value actions. That’s as a result of bigger volumes between each consumers and sellers take in momentary imbalances. Throughout January, CoinShares’ report confirmed $1.4 billion of Bitcoin inflows, along with $7.2 billion from newly issued US-based funds, towards the GBTC outflows of $5.6 billion.

Within the meantime, massive monetary establishments are setting new liquidity baselines. As of February sixth, Constancy Canada arrange 1% Bitcoin allocation inside its All-in-One Conservative ETF Fund. Given its “conservative” moniker, this indicators even larger share allocations in future non-conservative funds.

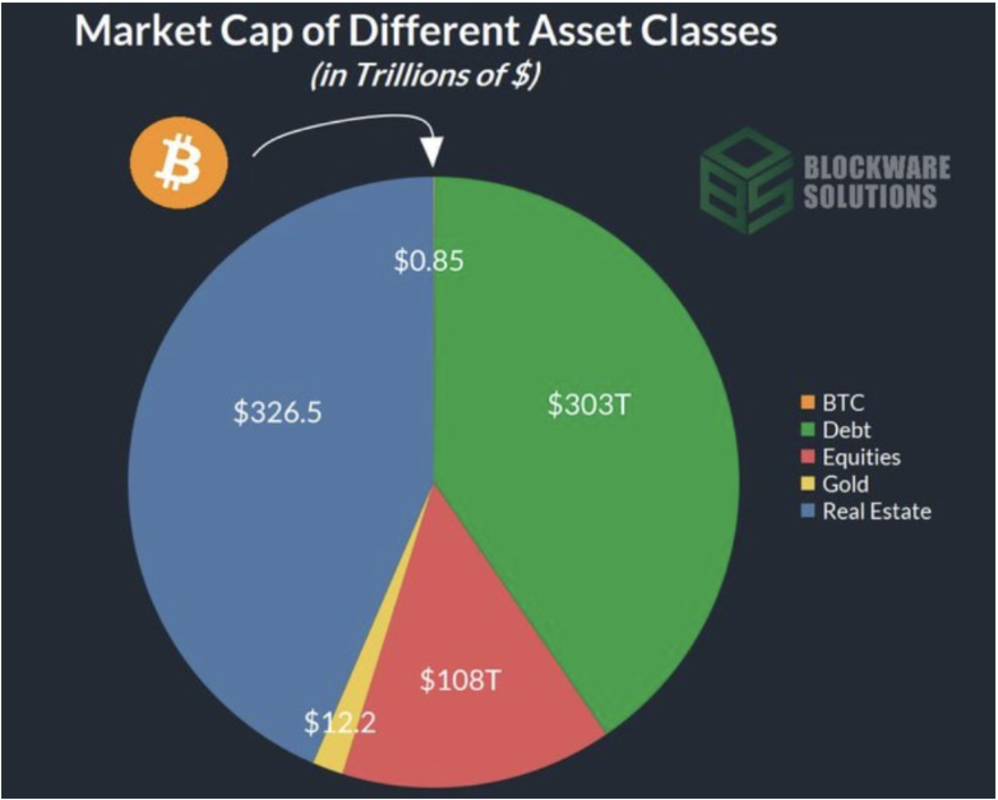

In the end, if Bitcoin faucets into 1% of the $749.2 trillion market pool of assorted asset courses, Bitcoin’s market cap might develop to $7.4 trillion, bringing Bitcoin value to $400k.

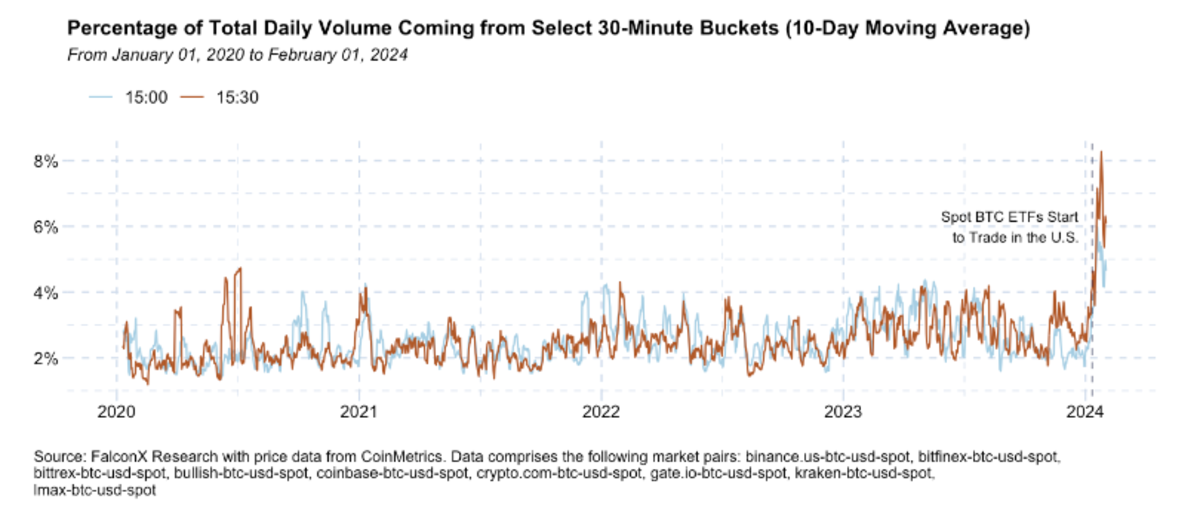

Provided that Bitcoin ETFs present a constant and clear market value reference level, massive aggregated trades scale back market influence on potential selloffs coming from miners. That is seen from FalconX Analysis, displaying an important uptick in each day mixture volumes, beforehand from common 5% heading into the ten – 13% vary.

In different phrases, the brand new Bitcoin ETF-induced market regime is decreasing total market volatility. Thus far, Bitcoin miners have been the primary price-suppressing driver on the opposite facet of the liquidity equation. In Bitfinex’s newest weekly on-chain report, miner wallets had been liable for 10,200 BTC in outflows.

This matches the aforementioned ~10,000 BTC inflows in Bitcoin ETFs, leading to comparatively secure value ranges. As miners reinvest and improve mining rigs forward of the 4th halving, one other stabilizing mechanism might come into play – choices.

Though the SEC is but to approve choices on spot-traded BTC ETFs, this improvement will additional develop ETF liquidity. In spite of everything, the larger spectrum of investing methods revolving round hedging will increase liquidity on each side of the commerce.

As a forward-looking metric, implied volatility in choices buying and selling gauges market sentiment. However the larger market maturity that we are going to inevitably see following the introduction of BTC ETFs, we’re extra more likely to see a extra stabilized pricing of choices and spinoff contracts typically.

Analyzing Inflows and Market Sentiment

As of February ninth, Grayscale Bitcoin Belief ETF (GBTC) holds 468,786 BTC. During the last week, the BTC value went up 8.6% to $46.2k. Concurrent with the earlier forecast, which means that BTC dumping is more likely to unfold out over a number of rallies forward of the 4th halving and past.

By newest numbers offered by Farside Traders, as of February eighth, Bitcoin ETFs have racked up $403 million inflows, totaling to $2.1 billion. GBTC outflows totaled $6.3 billion.

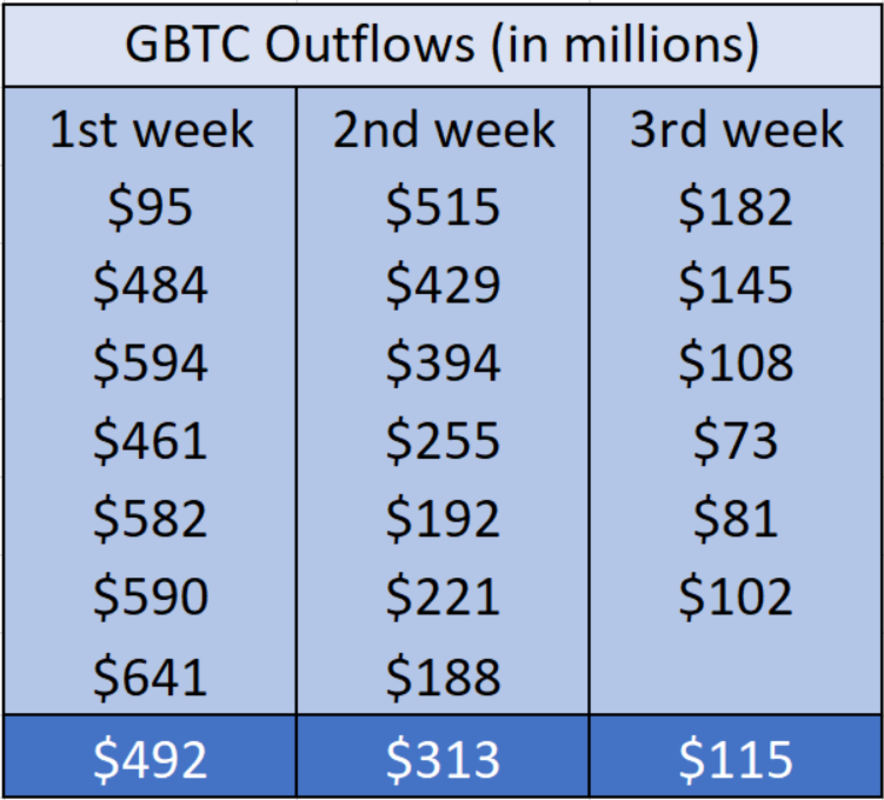

From January eleventh to February eighth, GBTC outflows have steadily decreased. Throughout the first week, they averaged $492 million. Within the second week, GBTC outflows averaged $313 million, ending in $115 million on common in the course of the third week.

On a weekly foundation, this represents a 36% discount on promote stress from week one to 2, and 63% discount from week two to a few.

As GBTC FUD unfolded as much as February ninth, crypto worry & greed index elevated to “greed” at 72 factors. This represents a revisit to January twelfth, at 71 factors, just some days after Bitcoin ETF approvals.

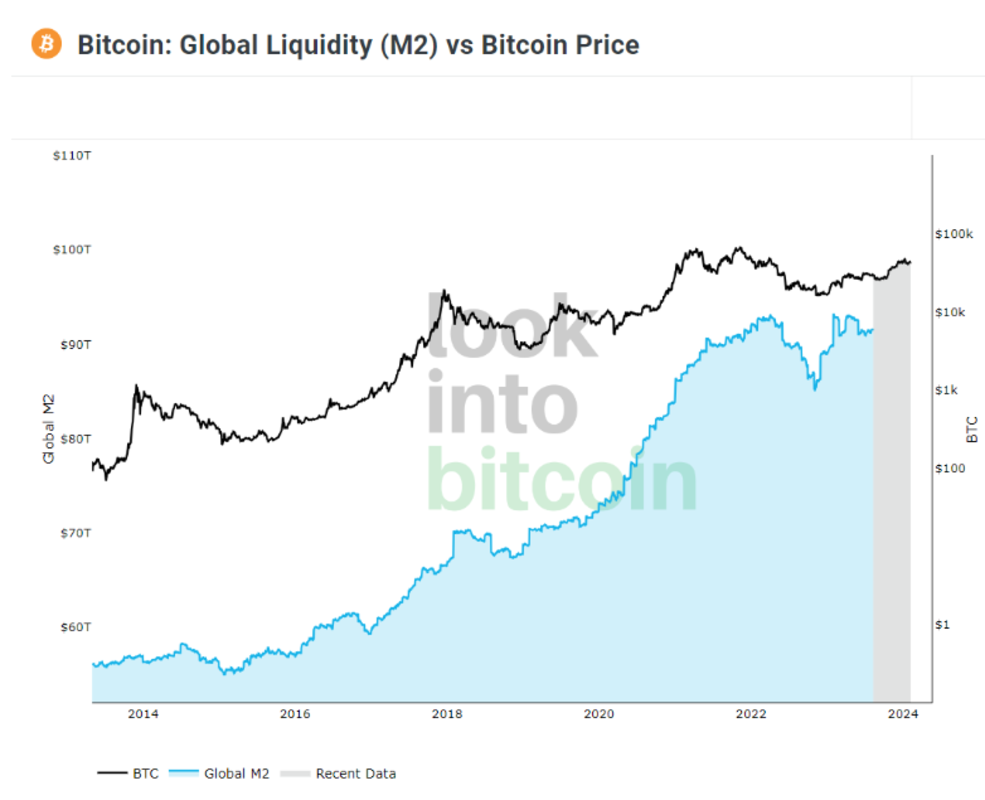

Wanting forward, it bears noticing that Bitcoin value is reliant on world liquidity. In spite of everything, it was the Fed’s rate of interest mountaineering cycle in March 2022 that triggered the avalanche of crypto bankruptcies, culminating within the FTX collapse. Present fed fund futures mission the top of that cycle both in Might or in June.

Furthermore, this can be very unlikely that the Federal Reserve will veer off the cash printing course. And at such events, Bitcoin value adopted go well with.

Contemplating the insurmountable nationwide debt of $34 trillion, whereas the federal spending retains outpacing income, Bitcoin is positioning itself as a protected haven asset. One which waits for capital inflows into its restricted 21 million coin provide.

Historic Context and Future Implications

As an analogous protected haven asset, Gold Bullion Securities (GBS) launched as the primary gold ETF in March 2003 on the Australian Securities Alternate (ASX). Subsequent 12 months, SPDR Gold Shares (GLD) launched on the New York Inventory Alternate (NYSE).

Inside every week from November 18th, 2004, GLD’s complete web property rose up from $114,920,000 to $1,456,602,906. By the top of December, this decreased to $1,327,960,347. To succeed in BlackRock’s IBIT market worth of $3.5 billion, it took GLD as much as November twenty second 2005.

Though not inflation-adjusted, this means Bitcoin’s superior market sentiment in comparison with gold. Bitcoin is digital, but it’s grounded in a proof-of-work mining community spanning the globe. Its digital nature interprets to portability which can’t be stated of gold.

The USG showcased this level when President Roosevelt issued Government Order 6102 in 1933 for residents to promote their gold bullions. Likewise, new gold veins are steadily found which dampens its restricted provide standing in distinction to Bitcoin.

Along with these fundamentals, Bitcoin ETF choices are but to materialize. Nonetheless, Customary Chartered analysts mission $50 to $100 billion in Bitcoin ETFs by the top of 2024. Furthermore, massive corporations are but to comply with MicroStrategy’s lead by successfully changing shares gross sales right into a depreciating asset.

Even 1% BTC allocations throughout mutual funds are poised to skyrocket BTC value. Living proof, Advisors Most popular Belief arrange a 15% vary allocation into oblique Bitcoin publicity by way of futures contracts and BTC ETFs.

Conclusion

After 15 years of doubt and aspersions, Bitcoin has reached the apex of credibility. The primary wave of believers in sound cash ensured that the blockchain model of it isn’t misplaced within the bin of coding historical past.

On the again of their confidence, up till now, Bitcoin traders constituted the second wave. The Bitcoin ETF milestone represents the third wave publicity milestone. Central banks around the globe proceed to erode confidence in cash, as governments can’t assist themselves however to bask in spending.

With a lot noise launched into the change of worth, Bitcoin represents a return to the sound cash root. Its saving grace is digital, but additionally bodily proof-of-work as power. Barring excessive USG motion to sabotage institutional publicity, Bitcoin might even overtake gold as a conventional protected haven asset.

It is a visitor put up by Shane Neagle. Opinions expressed are fully their very own and don’t essentially mirror these of BTC Inc or Bitcoin Journal.