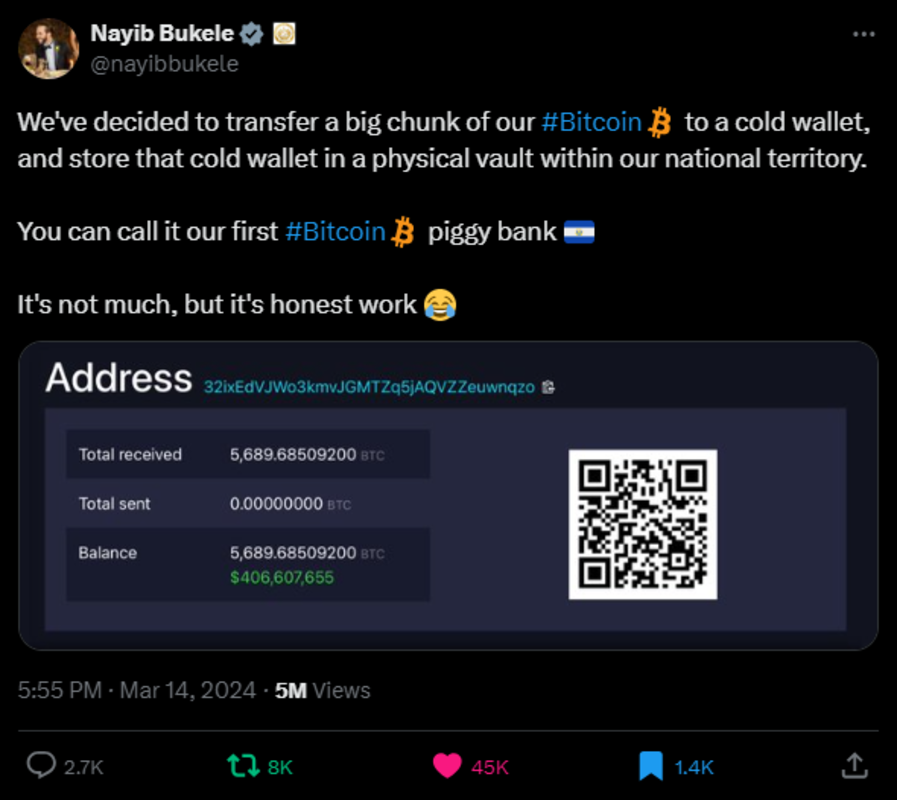

On March 14, 2024, El Salvador’s president-elect, Nayib Bukele, unveiled a historic daring maneuver that echoed throughout the Bitcoin world: El Salvador confirmed the switch of a considerable portion of its Bitcoin holdings into chilly storage, securely saved inside a vault in its nationwide borders. This strategic resolution marks a pivotal juncture in El Salvador’s Bitcoin journey because the introduction of the Bitcoin Regulation, which has drawn each admiration and skepticism worldwide.

Amidst a cacophony of critiques starting from allegations of human rights violations to insufficient fashionable infrastructure, El Salvador has stood dedicated, weathering storms of disapproval from conventional finance stalwarts and even fervent Bitcoin maximalists on Twitter (X) Areas. The veil of ambiguity surrounding the scale of El Salvador’s Bitcoin reserves, a degree of competition and criticism for a lot of, has now been decisively lifted, ushering in a brand new period of transparency and confidence within the nation’s dedication to fostering a thriving Bitcoin-friendly ecosystem.

With this groundbreaking transfer, Salvadorans and Bitcoin fans worldwide have the flexibility to audit El Salvador’s Bitcoin reserves and might see all inbound and outbound transactions. This audacious step wasn’t mandated however was taken willingly, embodying El Salvador’s dedication to its residents’ belief and the worldwide Bitcoin neighborhood’s ethos of openness. Unsurprisingly, shortly after Bukele introduced El Salvador’s Bitcoin handle, Bitcoiners started to ship donations to the pockets, with practically 6 Million Sats in transactions as of this writing. Thus far, plebs can monitor El Salvador’s each day 1 bitcoin DCA purchases. On this historic second, El Salvador not solely charts a brand new course in monetary governance but in addition silences its critics by setting a precedent of main by instance in responsibly disclosing and managing its modest however fashionable sovereign Bitcoin wealth reserves.

With 5,689 Bitcoins—valued at $385,111,456 USD as of this writing—El Salvador has secured its digital wealth and aptly navigated the treacherous waters of worldwide politics. The choice to shift its Bitcoin holdings from Bitgo, an American custodian, to a vault inside its sovereign borders wasn’t only a public relations masterstroke; it was a strategic crucial. Given the strained relations between the American authorities and El Salvador over the Bitcoin Regulation, the mounting holdings below Bitgo’s custody risked turning into entangled in potential sanctions and regulatory quagmires. This decisive motion safeguards El Salvador’s monetary autonomy and showcases a shrewd understanding of the intricacies of the American regulatory panorama.

Whereas the disclosure of the reserves has garnered widespread approval, there might have been compelling and strategic causes behind the nation’s preliminary reluctance to reveal its full holdings. Nayib Bukele’s affirmation that solely a “massive chunk” of the overall Bitcoin reserves has been transferred to chilly storage underscores a nuanced understanding of the nation’s strategic monetary administration. Within the advanced realm of nation-states navigating the uncharted waters of a Bitcoin Commonplace, sustaining a level of opacity is usually a prudent technique. El Salvador, in its quest to carve a definite path on the planet, has tactically saved some playing cards near its chest, ready for the opportune second to unveil its Bitcoin wealth in a calculated transfer. This sensible method displays a cautious balancing act between transparency and strategic benefit within the dynamic panorama of geopolitics.

Bukele make clear El Salvador’s Bitcoin holdings in earlier tweets, surpassing their earlier acquisition methods and dollar-cost averaging efforts. Opposite to speculations circulating on social media, Bukele revealed a multifaceted method that had propelled the nation’s Bitcoin reserves. Past mere purchases, El Salvador’s progressive visa program, income from Bitcoin-to-dollar exchanges held in escrow, income from authorities companies, and mining endeavors have collectively contributed to a good-looking Bitcoin treasury. This revelation additional dispels misconceptions propagated by armchair quarterbacks and highlights El Salvador’s progressive braveness in leveraging numerous avenues to bolster its rising Bitcoin wealth.

Disclosing El Salvador’s Bitcoin reserves represents a major stride towards transparency and accountability for its residents. But, it is essential to acknowledge that there’ll all the time be a section of critics who demand extra and complain about each element in an try to seek out fault. Nevertheless, it is important to do not forget that these measures are usually not solely geared toward appeasing detractors. As an alternative, they function a foundational step in making a optimistic enterprise atmosphere the place Bitcoiners can confidently set up their ventures, figuring out that the nation is devoted to their success.

The last word purpose for Bukele and El Salvador extends past merely silencing critics; it is about remodeling the nation right into a affluent hub of alternative for Salvadorans. In a stroke of genius, El Salvador has constructed its personal digital Fort Knox, with the distinctive characteristic that residents can confirm the existence of the funds. The Salvadoran authorities goals to nurture a tradition of belief and funding within the nation’s future by rewarding proof-of-work and low-time desire. This imaginative and prescient encompasses constructing a brand new El Salvador the place residents can thrive, seize alternatives at residence, and contribute to the nation’s development, fairly than in search of elusive guarantees overseas. As El Salvador continues its journey towards financial empowerment and progress, these strategic strikes function foundational pillars for a brighter and extra affluent future.

This can be a visitor put up by Jaime Garcia. Opinions expressed are completely their very own and don’t essentially mirror these of BTC Inc or Bitcoin Journal.