Joe McCann, the CEO and CIO of the crypto hedge fund Uneven, not too long ago made a daring assertion on X (previously Twitter), forecasting a $1 trillion market cap for Solana. McCann’s argument hinges on a number of key factors that element why he believes Solana has achieved product-market match (PMF) as “The Chain for Retail,” juxtaposing it towards Ethereum’s challenges and perceived shortcomings for retail customers.

Solana Beats Ethereum

McCann critiques Ethereum for not being designed with retail in thoughts, declaring its sluggish and costly Layer 1 (L1) transactions, alongside the consumer expertise (UX) nightmare posed by its quite a few Layer 2 (L2) options. He states, “Ethereum is just not a series designed for retail – the L1 is just too sluggish and costly and the L2s are (at present) a UX nightmare.”

The friction for brand spanking new customers, fragmented liquidity throughout over “40 L2s”, and the issues with bridging are highlighted as vital obstacles to Ethereum’s adoption by a broader retail viewers.

Turning his consideration to corporate-backed open-source tasks like Coinbase’s L2 answer, Base, McCann acknowledges their potential to unravel some UX points. Nevertheless, he additionally notes the inherent precedence of such tasks to serve company pursuits, typically on the expense of broader neighborhood wants.

Regardless of his critique, he admits, “Most company open supply in the end finally ends up serving company priorities…and it ought to!” This acknowledgment underscores the complexity of balancing company involvement in blockchain growth with the ecosystem’s decentralized ethos.

McCann attributes Solana’s rise to its means to serve the retail phase successfully, significantly by its affiliation with memecoins and speculative buying and selling. Describing Solana as initially being “Blockchain at Nasdaq velocity” for its excessive throughput and low latency, he notes a pivotal shift in its narrative in direction of retail.

He observes, “Not as soon as has the idea of being The Chain for Retail™️ ever surfaced. Till now.” This shift is basically credited to Solana’s embrace by the memecoin neighborhood and the speculative buying and selling that follows, marking a transparent PMF with retail customers.

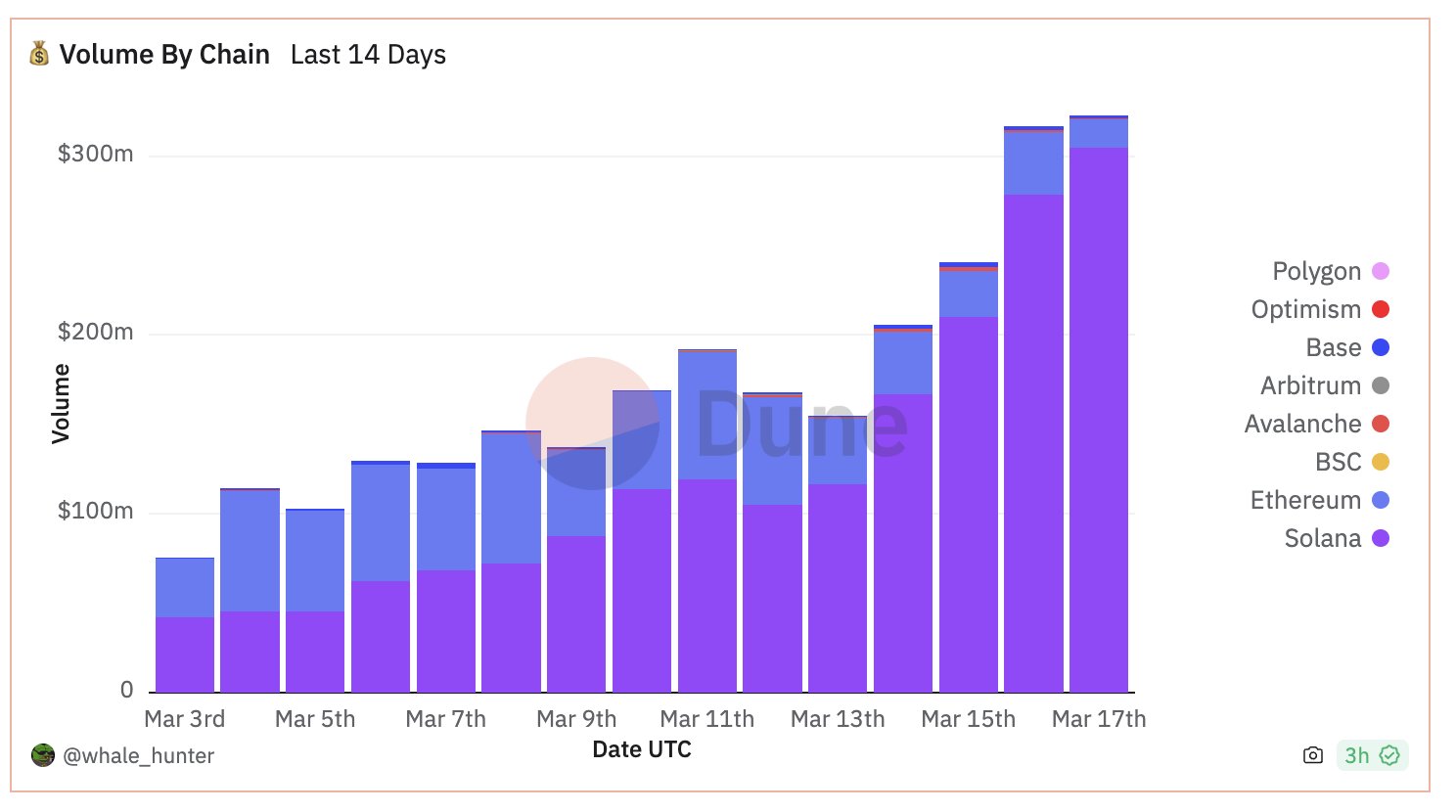

Highlighting the explosion of memecoin hypothesis on Solana, particularly post-NFL season, McCann factors out, “Because the NFL season ended, hypothesis on memecoins has exploded…BONK and WIF are on Solana. […] 1000’s of them are being created on a regular basis and buying and selling volumes are exploding.”

The intensive creation and buying and selling volumes of those cash on Solana are seen as a testomony to its enchantment and utility for retail speculators. Notably, the vast majority of memecoins is on Solana, not Ethereum.

”Buying and selling Bots aka the ‘Robinhood-ification of crypto’ has been driving the vast majority of the buying and selling as a consequence of its…nice UX. […] And the vast majority of these bots are buying and selling memecoins on Solana. Solana is now persistently flipping Ethereum in DEX volumes but for some purpose, SOL continues to be 1/4th the worth of Ethereum, it was 1/eighth only a few days in the past,” McCann famous.

He contrasts Solana’s market cap with Ethereum’s, utilizing their relative valuations to argue for Solana’s development potential. With Ethereum valued at slightly below $500 billion and Solana at about $115 billion, he means that Solana’s path to a $1 trillion market cap represents a virtually 10x development alternative, far outpacing the potential for Ethereum.

“ETH to $1T is a double. SOL to $1T is sort of a 10x. Which horse are you gonna wager on? The quickest one, clearly,” McCann concludes, encapsulating his bullish outlook for Solana based mostly on its retail-friendly ecosystem and the colourful exercise round memecoins.

At press time, Solana traded at $201.27.

Featured picture from Euronews, chart from TradingView.com

Disclaimer: The article is offered for academic functions solely. It doesn’t characterize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your personal analysis earlier than making any funding choices. Use info offered on this web site completely at your personal danger.