The under is an excerpt from a latest version of Bitcoin Journal Professional, Bitcoin Journal’s premium markets e-newsletter. To be among the many first to obtain these insights and different on-chain bitcoin market evaluation straight to your inbox, subscribe now.

In Nigeria, residence of the biggest digital asset economic system in Africa, a feud has been creating between the federal government and Binance—a feud that has culminated with one of many firm’s executives escaping home arrest and fleeing the nation.

Boasting the sixth-largest inhabitants in your complete world, the Federal Republic of Nigeria holds a big financial affect over the African continent and a decent sway within the higher world market. Though the doable future for Nigeria’s financial improvement has been a subject of nice curiosity for international monetary establishments, a selected focal point is the nation’s obvious affinity for Bitcoin; for instance, the nation is on the prime of countries by related Google searches equivalent to “spend money on crypto,” and so forth. Moreover, as a result of a few of the traditional causes like rampant inflation and declining native foreign money, Nigeria additionally accommodates the biggest buying and selling volumes in all of Africa. For these causes, the doable bitcoinization of Nigeria could be a major boon to Bitcoiners worldwide, and the nation could sooner or later be an actual hub for the trade.

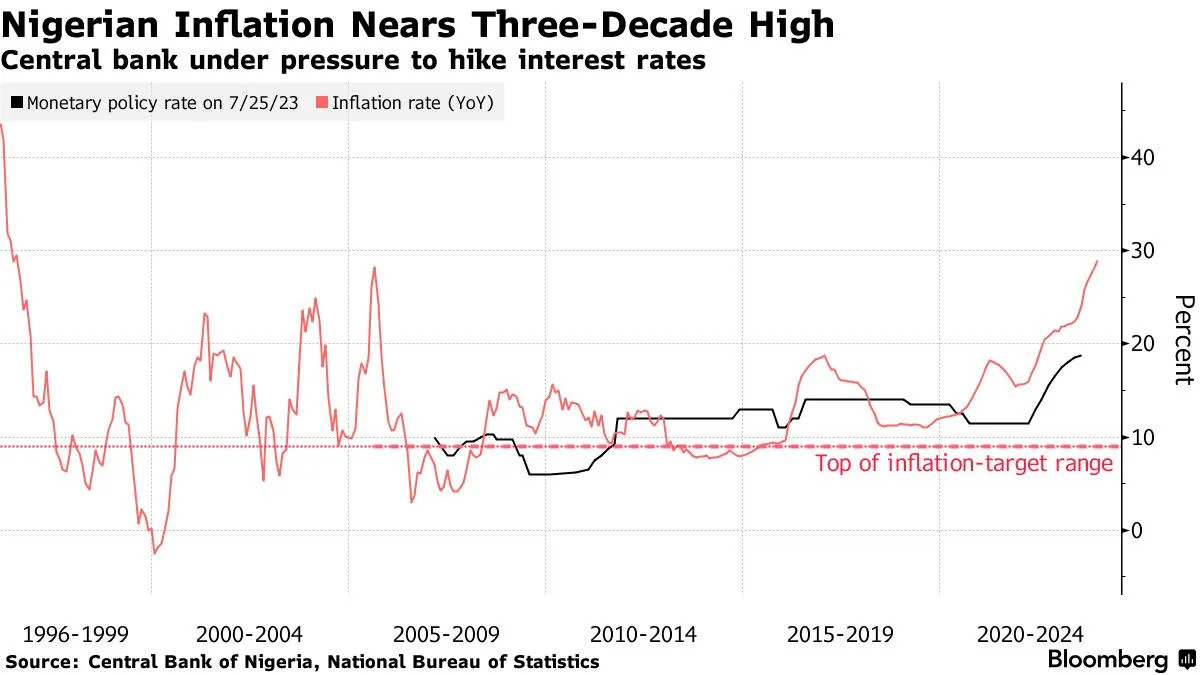

Due to this fact, Bitcoiners in the present day ought to actually have an interest within the creating feud concentrated between Binance and the Nigerian authorities, with particular consideration to the potential for a broader crackdown on the trade. The quarrel started in earnest in February 2024, when an alleged “glitch” in Binance’s peer-to-peer (P2P) transaction platform led to deflated costs for customers, as authorities officers formally accused the corporate of “blatantly setting a particular trade charge for Nigeria” and “making an attempt to control our foreign money to Floor Zero”. The Central Financial institution (CBN) thought-about the widespread utilization of P2P Bitcoin transactions as a doable contributor to the naira’s falling efficiency, and sought to take motion in opposition to Binance. Contemplating that inflation in Nigeria is climbing on the quickest charge in a long time, this downside appeared particularly regarding to authorities.

To this finish, a considerably complicated sequence of occasions unfolded: reviews circulated in February that the federal government was blocking providers from main exchanges like Binance, Coinbase, and Kraken. Coinbase, for its half, claimed that that they had skilled no such troubles with the Nigerian authorities on the time. The federal government went on to make clear its place when the CBN singled out Binance, asserting that some $26 billion in “untraceable” funds had apparently handed by the corporate’s operations in Nigeria. This amount of money would symbolize a major capital outflow for your complete economic system. Moreover, after all, such a big determine actually displays a comparatively excessive degree of curiosity and adoption within the broader inhabitants. After Binance refused to cooperate with allegations that it had enabled numerous monetary crimes on its platform, the federal government took the aggressive step of detaining two executives—a British and an American citizen.

This step led to a flurry of actions because the state of affairs between Nigeria and the crypto economic system grew to become more and more muddied. Was the federal government concentrating on Binance as a result of its recalcitrant perspective, or is it solely step one in a deliberate crackdown on the broader world of Bitcoin? The federal government shuttered the biggest P2P trade within the nation, however is the apply of P2P Bitcoin buying and selling itself subsequent on the chopping block? Nigerian regulators printed an up to date listing of tips for overseas exchanges to observe, and the federal government moreover entered a brand new partnership to experiment with the feasibility of rolling out a CBDC, the eNaira. In the USA, the Chamber of Digital Commerce even pressured the White Home to intervene within the state of affairs, demanding that the American Binance official be launched from custody.

This tense and ambiguous state of affairs got here to a head in a really surprising manner when Nadeem Anjarwalla, a twin British-Kenyan nationwide and arrested Binance government, escaped Nigerian custody with a “smuggled passport” and fled the nation on March twenty fifth. Though his household claimed that Anjarwalla’s exit from the nation was solely authorized, Nigeria has requested INTERPOL to publish a world arrest warrant for him. Apparently, Anjarwalla’s guards allowed him to go away home arrest to go to a close-by mosque and attend worship providers, the place he disappeared. Not solely have the guards been arrested pending an investigation, however the authorities has additionally formally charged Binance with tax evasion. Anjarwalla’s American colleague, Tigran Gambaryan, stays in federal custody and has been named as a defendant within the accusations.

These actually appear to be grim portents for the Nigerian Bitcoin area, to make certain. Nonetheless, the chance stays that the federal government is merely making an attempt to strongarm Binance particularly, as the corporate has already been swamped with authorized issues. Along with the agency’s troubles in Africa, it has additionally suffered main setbacks on three separate continents. Probably the most well-known of those is the US Division of Justice’s wonderful: the corporate should pay $4.3 billion, and CEO Chengpeng Zhao was compelled to resign, prone to face jail time. Binance.US was spun off to raised accommodate American authorized necessities, however even this subsidiary is mired in a sequence of class-action fits and SEC battles that may most likely kill it. It will hardly be the primary time, as CommEX, Binance’s successor in Russia after an identical exodus, simply closed its doorways on March twenty fifth. The corporate was additionally blocked within the Philippines the identical day, after the federal government accused Binance of working and not using a license.

In different phrases, the Nigerian authorities could have merely picked now because the opportune time to strike at a beleaguered rival, one who has lengthy been a goal of securities watchdogs within the nation. To make certain, there are a number of worrying indicators of a doable Bitcoin crackdown, as a Nigerian court docket ordered Binance at hand over information on its largest merchants, accompanied by rumors that road crypto merchants have been being focused by police. The investigation into the eNaira, a doable CBDC to switch the demand for Bitcoin and different digital belongings, actually didn’t assist issues. Nonetheless, there are nonetheless loads of causes to see a path ahead.

For one factor, Paxful’s former CEO and NoOnes’ present CEO, Ray Youssef, was publicly smitten by his firm’s possibilities in Nigeria. Youssef prompt that Nigeria truly increase the registration charges for exchanges to function within the nation, calling the transfer an invite to the “large boys” equivalent to Coinbase or his personal firm working within the Nigerian market. Youssef went on to state that the federal government has an curiosity in proscribing these overseas conglomerates from performing as the primary venue for P2P gross sales for worry of capital flight, and exchanges with zero or restricted P2P performance needs to be welcome to function usually.

Nigerian customers have a excessive choice for P2P as the perfect methodology for purchasing and promoting Bitcoin, and the chance that $26 billion can circulation from Binance’s P2P market to unsure areas has shaken the federal government deeply. Nonetheless, the precise apply of P2P Bitcoin gross sales is alive and nicely within the Nigerian market with out Binance as an middleman; for instance, Worldwide Girls’s Day 2024 in Nigeria was marked by giant and well-attended seminars targeted on educating girls from all walks of life on Bitcoin. Centered on demystifying the world of decentralized finance and empowering girls, these seminars have been sponsored by all kinds of P2P channels, lovers, and companies within the Nigerian crypto scene.

From the place we’re standing, plainly the rumors of a broader crackdown on Bitcoin in Nigeria have been drastically exaggerated. Contemplating that the federal government’s feud with Binance is quickly escalating in direction of a world manhunt, it’s straightforward to think about that the federal government could be making related assaults on different exchanges like Coinbase and even the Bitcoin world altogether if it had any nice curiosity in doing so. Binance has been perceived as a scofflaw in direction of Nigerian laws for a while now, and plainly their simultaneous authorized battles in lots of jurisdictions have offered a chance for Nigeria to hitch in. The spirit of Bitcoin, nevertheless, is alive and nicely, and Binance’s opponents are greater than prepared to fill their area of interest available in the market. It’s anybody’s guess as to how strong the Bitcoin trade in Nigeria shall be 5 years from now, because the nation’s economic system as an entire continues to develop. One factor appears sure, nevertheless: It’ll take much more than one combat to maintain Bitcoin down.