Bitcoin’s 4th halving occasion is scheduled to happen on April twenty second, at occasion block peak 840,000. As every block, containing executed transactions, is mined, it’s stamped with a block peak, noting what number of blocks have been generated earlier than the newest one.

This fashion, block heights create a chronologically ordered digital ledger, granting Bitcoin its mantle of decentralized transparency and safety towards double-spending. This additionally makes it instrumental in imposing the embedded halving logic on all the Bitcoin community, occurring each 210,000 blocks.

Bitcoin halving is there as an algorithmic financial coverage. In contrast to the arbitrary central banking, halving predictably controls the influx (inflation) of latest bitcoins by reducing in half the miner BTC rewards. The very first Genesis block in 2009 delivered 50 BTC to miners. After the fourth halving, miners will obtain 3.125 BTC per block mined.

The stark distinction in these rewards interprets to Bitcoin’s inflation charge. From over 1,000% to current 1.7%, Bitcoin’s inflation charge will as soon as once more be lower in half. And as much less BTC is accessible within the provide, every Bitcoin turns into extra beneficial.

But, Bitcoin halvings are simply considered one of many elements impacting BTC worth. Probably the most extreme halving impacts revolves round Bitcoin mining profitability. If BTC rewards turn into so low, would this power BTC selloffs from struggling mining firms? And if that’s the case, wouldn’t the selloff stress suppress BTC worth?

Understanding the Halving and Its Impression on Miners

To grasp the significance of one thing, it’s best to think about its absence. Within the case of Bitcoin halving, its absence would imply that every one 21 million BTC would have been instantly out there upon the launch of the Bitcoin mainnet.

Conversely, that will enormously diminish BTC shortage, particularly given its preliminary unproven, novel proof of idea as a digital asset. After three halvings, Bitcoin shortage has confirmed a profitable foil towards fiat forex debasement, as central banks tamper with their respective cash provides. In different phrases, halvings paced out the Bitcoin provide and demand dynamic, permitting for adoption to unfold.

And as Bitcoin adoption elevated, the Bitcoin mining community grew to become safer. That’s as a result of extra Bitcoin miners elevate Bitcoin mining issue, which is auto-adjusted each two weeks. Following the reshuffling of the availability and demand dynamic, Bitcoin halvings sometimes end in a number of features pre and submit halvings.

Likewise, the very objective of Bitcoin mining issue is to manage the speed at which new transaction blocks are added to the community (~10 min), after each 2016 blocks. With out this mechanism, Bitcoin mainnet could be much less safe as a result of miners may very well be disincentivized from taking part.

With the Bitcoin mining issue, their profitability is auto-corrected. If too many miners unplug, the problem lowers, making it extra worthwhile to mine no matter lower rewards. If extra miners onboard the community, the problem elevates, making it much less worthwhile to safe the community (its computing energy expressed in hash charge).

Nevertheless, that is offset with BTC worth rising over time, owing to its provide shortage. When BTC mining rewards are lower in half, miners undergo a profitability hit. If the mining issue shouldn’t be lowered, they have to enhance their cost-efficiency by reinvesting in operations’ upgrades. Accordingly, these miner cycles are referred to as durations of accumulation and capitulation.

In the long run, Bitcoin miners should fastidiously suppose forward. With out overextending themselves within the enlargement/debt division, they depend on BTC worth enhance to hold them by means of the halvings.

Challenges for Bitcoin Miners Publish-2024 Halving

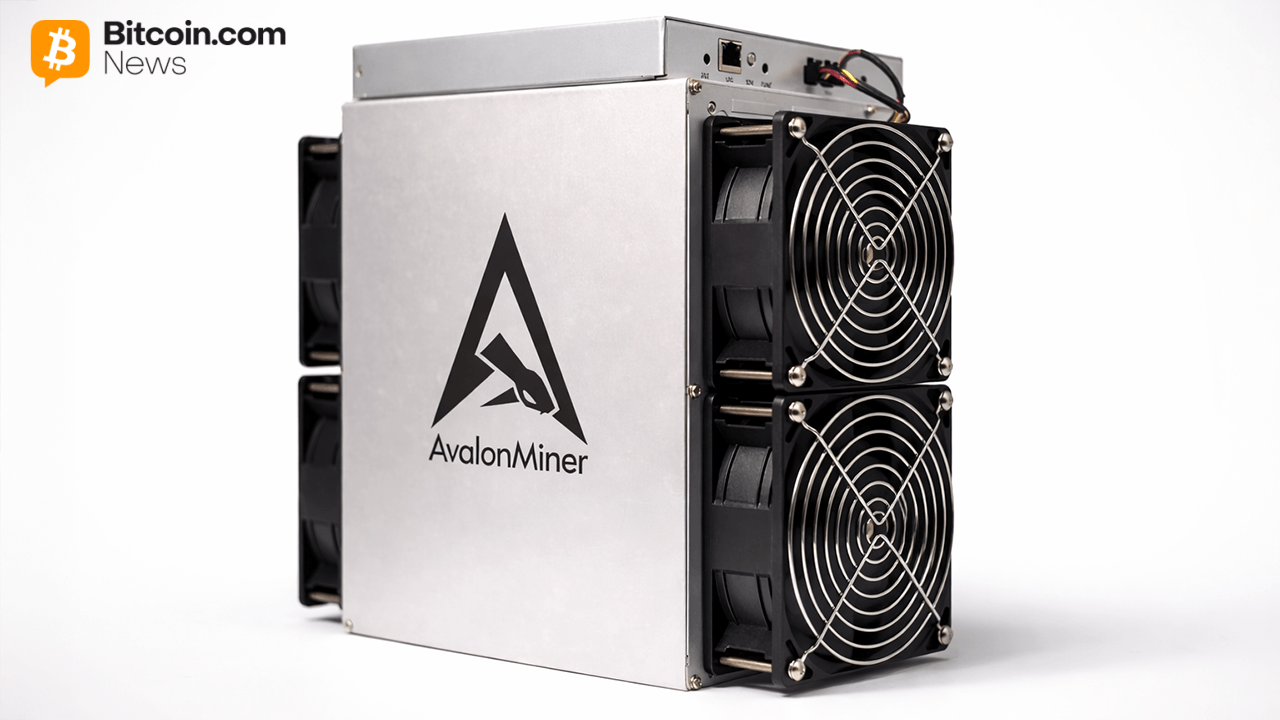

As of March twenty sixth, the overall hash charge of the Bitcoin community is 614.6 million TH/s, or 614.6 EH/s. Bitcoin miner income per TH/s is $0.10. To place this into context, Bitmain’s newest mining rig, Antminer S21 priced round $4,500, yields a hash charge of 188 TH/s whereas consuming 3500 Watts value of electrical energy.

Some machines are much more highly effective and costly, such because the Antminer S21 Hyd 335T. Towards the price of these machines, miners should account for electrical energy prices, cooling, upkeep, debt curiosity funds and the price of amenities themselves. These firms unable to carry out this balancing act will go bankrupt, because it occurred to Core Scientific in 2022.

For people utilizing bizarre PCs and laptops, Bitcoin mining lengthy ceased to be worthwhile. They must spend money on specialised ASIC machines to go towards the rising Bitcoin mining issue and subsequent enhance in power prices. The USG, reliant on central banking and forex debasement, is nicely conscious of this reality.

On the finish of January, the Power Info Administration (EIA) started to discover how you can cripple miners’ operations. By requesting obligatory survey knowledge on their power consumption, EIA would then relay findings to the Division of Power (DoE) to enact restrictive insurance policies.

Owing to the swift authorized motion of Texas Blockchain Council (TBC) and Riot, this motion has been halted as of March 2 submitting.

Technological Developments and Effectivity Enhancements

Bitcoin’s proof-of-work is the vital part of BTC worth. It makes it potential for a digital asset to be anchored into bodily actuality through power consumption and {hardware} belongings. In any other case, a large number of cryptocurrencies may very well be created at low-cost, introducing noise of their valuation.

However simply as power consumption is Bitcoin’s power, it’s also its weak spot from a political standpoint. Working example, Elon Musk revoked Bitcoin fee from Tesla in Could 2021, triggering a significant crash. Since these days, Bitcoin mining has gone inexperienced, having drawn 54.5% of power from sustainable sources.

Along with utilizing regenerative hydropower, akin to Norwegian Kryptovault, Bitcoin miners can put extra warmth to good use. As an illustration, Kryptovault funnels this scorching air to dry out chopped logs for the lumber trade. Many smaller mining operations took this method to warmth their houses.

Heating a complete house with #bitcoin mining pic.twitter.com/470jJ7PSGW

— Documenting ₿itcoin 📄 (@DocumentingBTC) December 28, 2022

Different miners, akin to Crusoe Power Programs, hooked up their operations to grease and pure drill wells, utilizing the surplus fuel as a substitute of setting it wastefully on hearth. On a bigger scale, Bitcoin miners even assist to stability {the electrical} grid, as famous by now deceased ERCOT CEO Brad Jones.

The #bitcoin power debate is over.

Head of the Texas electrical grid, Brad Jones explains, “#Bitcoin mining helps stability our grid and is driving extra renewables into our system”pic.twitter.com/kGYwAkOVv8

— Documenting ₿itcoin 📄 (@DocumentingBTC) March 5, 2023

On the excessive finish, Bitcoin miners are turning to the densest and greenest type of power – nuclear. TeraWulf started its development of the Nautilus Cryptomine facility as the primary nuclear-power Bitcoin mining operation. At 2 cents per KW/h, TeraWulf is seeking to turn into probably the most cost-effective miner on the planet.

Throughout the subsequent halving cycle, a lot is predicted of hydrogen infrastructure as the following finest resolution to nuclear energy. Nevertheless, the commonest path to cost-effectiveness stays the pooling of assets in mining swimming pools.

What to Count on Within the Publish-Halving Panorama

Serving as a forex debasement foil, Bitcoin gives an out for miners as nicely. They purchase time with debt to improve, within the hopes of boosted BTC worth repaying that debt down the road. The issue is, solely the ready miners, with the up-to-date rigs and favorable power prices will survive.

In spite of everything, it’s they who will maintain the Bitcoin mining issue elevated. Those that can’t compete will go away the community, making the job simpler for opponents as community issue is auto-adjusted. In keeping with Luxor’s base case, within the situation of BTC worth remaining throughout the $66k – $66k vary, 3% Bitcoin miners may go away the community.

Moreover, Luxor tasks Bitcoin issue to succeed in 725 EH/s by the tip of the yr. This may stage the post-halving hashprice at $53/PH/day, aligning with the flat case hashprice projection.

Presently, the breakeven hashprice stands at $37.20/PH/day, with out accounting for firmware upgrades. Different firms, like Blockware Options, anticipate hashrate to succeed in ~670 EH/s by the tip of the yr, utilizing the 2020 halving as benchmark when the hashrate elevated by 30% by the tip of the yr.

Holding this in thoughts, Bitcoin miners ought to plan for long-term scalability, akin to TerraWulf’s funding in nuclear energy. Within the meantime, to hedge towards uncertainty, miners may benefit from Bitcoin derivatives merchandise.

Working example, a number of buying and selling platforms at present exist which give trade traded futures because the mechanism to promote ahead their mining productiveness. Simply as in conventional markets with commodities, miners may use this technique to safeguard towards BTC worth fluctuations.

And with recurrent income streams, the spike in operational prices may very well be lessened. Likewise, Bitcoin mining firms can diversify and supply cloud mining providers with enhanced cloud safety.

Conclusion

Taking all of its parts under consideration, Bitcoin is a marvel of each software program engineering and financial idea. It seems, it’s potential to enact financial coverage and incentives with out resorting to direct centralized tampering.

Bitcoin miners play a key position on this digital enactment. Though they need to resort to the Darwinian play of the survival of the fittest, the unknowns are much less prevalent. With three halvings behind, knowledge for projections is there to benefit from.

The one query stays, which Bitcoin miners aligned their monetary modeling with the worst bear case?