Key Takeaways

After its Season 1 airdrop ended, Renzo Protocol’s ezETH briefly depegged from Ethereum, dropping to $688 earlier than stabilizing;

The ezETH worth drop was attributed to a mass sell-off post-airdrop;

Dealer czsamsunsb.eth capitalized on the depeg, incomes 121.65 ETH ($380,000).

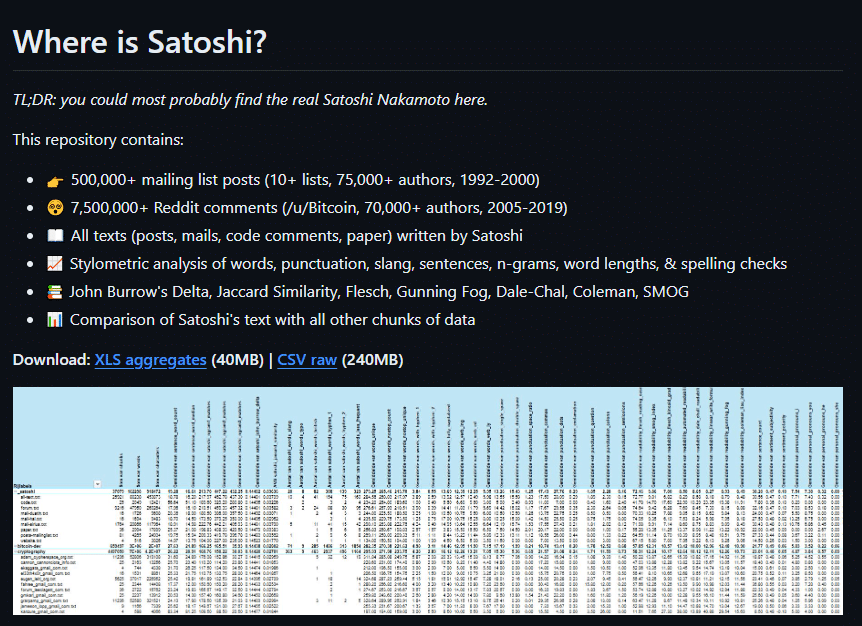

Following the top of its Season 1 airdrop, Renzo Protocol’s restaked Ether token (ezETH) briefly crashed from its 1:1 peg with Ethereum (ETH).

On April 24, the token’s worth fell to $688 on the Uniswap decentralized trade earlier than quickly regaining its worth parity with ETH.

Do you know?

Need to get smarter & wealthier with crypto?

Subscribe – We publish new crypto explainer movies each week!

Crypto analyst Tommy defined on X that this incident highlights a widespread concern inside liquid restaking tokens (LRTs), which, regardless of enabling withdrawals, can nonetheless expertise depegs as a consequence of short-term market imbalances.

He famous that the sudden worth drop was primarily as a consequence of a broad sell-off after Renzo Protocol’s airdrop:

Promote-off probably attributable to the conclusion of Season 1 Airdrop, customers need to get again $ETH to farm different LRT/protocols.

Tommy additional defined that the depeg triggered liquidations on leverage protocols like Gearbox and Morpho Labs, significantly impacting “loopers,” merchants who use LRTs as collateral to borrow ETH to create leverage.

As famous by Lookonchain, one crypto dealer, czsamsunsb.eth, profited from the depeg incident by 121.65 ETH, which, on the time of writing, equals round $380,000.

Renzo Protocol serves as an interface to the EigenLayer ecosystem and is the second-largest liquid restaking protocol, holding over $3.2 billion in complete worth locked (TVL)—an almost 100% enhance from the earlier month. It ranks second behind Ether.fi, which has a TVL of over $3.8 billion.

Whereas some merchants handle to revenue from market shifts, the broader crypto neighborhood continues to face challenges relating to funding stability and protocol reliability.

In different information, current assessments counsel that EigenLayer’s speedy development may steer it towards a yield disaster.

Having accomplished a Grasp’s diploma in Economics, Politics, and Cultures of the East Asia area, Aaron has written scientific papers analyzing the variations between Western and Collective types of capitalism within the post-World Warfare II period.With near a decade of expertise within the FinTech trade, Aaron understands the entire greatest points and struggles that crypto lovers face. He’s a passionate analyst who is worried with data-driven and fact-based content material, in addition to that which speaks to each Web3 natives and trade newcomers.Aaron is the go-to individual for the whole lot and something associated to digital currencies. With an enormous ardour for blockchain & Web3 training, Aaron strives to rework the house as we all know it, and make it extra approachable to finish novices.Aaron has been quoted by a number of established retailers, and is a printed writer himself. Even throughout his free time, he enjoys researching the market tendencies, and in search of the subsequent supernova.