After a 71-day streak of steady inflows, BlackRock’s Bitcoin ETF, IBIT, has skilled a sudden cease with no new inflows. This sudden halt has raised considerations amongst buyers, particularly as Bitcoin consolidates across the $64,000 degree. Many analysts view this as a bearish indicator for Bitcoin’s worth, suggesting that the cessation of inflows from a number one Bitcoin ETF issuer might plunge shopping for demand. This decline in demand might make it difficult for Bitcoin to carry its restoration rally following the current halving occasion.

Blackrock ETF Sees No Shopping for Demand

BlackRock’s spot Bitcoin ETF had maintained a exceptional streak of web inflows since its launch on January eleventh. Nonetheless, in keeping with knowledge from Farside Buyers, this streak of 71 consecutive buying and selling days with web inflows has now come to an finish.

On Wednesday, the iShares Bitcoin Belief (IBIT) recorded zero web flows, breaking a file for a newly launched ETF. Whereas IBIT’s efficiency was historic for a newly established fund, Bloomberg Intelligence analyst Eric Balchunas famous that different ETFs had longer streaks after establishing themselves over months and years available in the market.

IBIT’s streak of inflows reached 71 days on Tuesday, making it the tenth longest streak of all time, as reported in an X publish by Balchunas. Nonetheless, in keeping with knowledge from Farside Buyers, web inflows into IBIT got here to a halt on Wednesday. On 25 April, IBIT once more witnessed zero influx quantity, in keeping with knowledge from The Block.

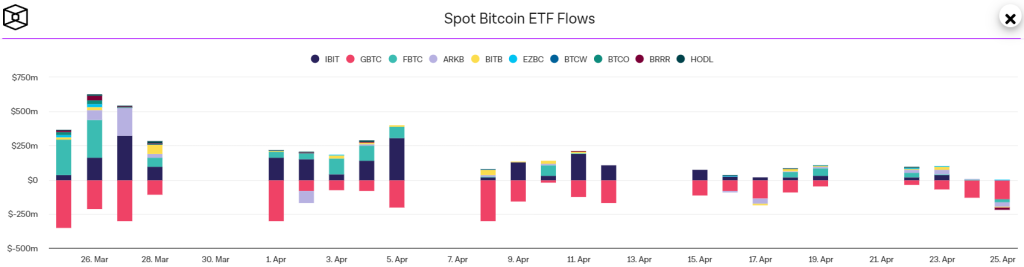

On the identical day, solely the Constancy Clever Origin Bitcoin Fund (FBTC) and the Ark 21Shares Bitcoin ETF (ARKB) skilled minor inflows, whereas the Grayscale Bitcoin Belief ETF (GBTC) recorded web outflows amounting to $130 million.

The conclusion of IBIT’s streak follows two consecutive weeks of web outflows for the 11-fund section. Nonetheless, its current zero influx quantity won’t have a big effect on Bitcoin because the sentiment is supported by a number of different bullish metrics together with the current halving.

Influx Quantity Would possibly Rebound In The Coming Weeks

The movement of funds into US spot Bitcoin ETFs has skilled a major decline within the second quarter. Throughout the first quarter, the height inflows have been noticed in February, totaling $6 billion, adopted by March with $4.6 billion. January noticed $1.5 billion because the market acquainted itself with the brand new merchandise.

Nonetheless, ETF inflows for April in Q2 solely amounted to $170 million. This raises the query: is the demand for BTC ETFs declining?

Bitwise CIO Matt Hougan disagrees. In a weekly memo addressed to funding professionals, Hougan asserted that the potential for extra inflows stays excessive within the coming months.

Yesterday marked the primary time since its inception that FBTC skilled outflows, amounting to $22.6 million. Concurrently, different funds reminiscent of Ark Make investments’s ARKB, Bitwise’s BITB, and Valkyrie’s BRRR additionally noticed outflows of $31.3 million, $6 million, and $20.2 million, respectively.

Moreover, Grayscale’s GBTC, which has been on a 73-day streak of outflows since its conversion from a Bitcoin Belief, witnessed withdrawals totaling $139.4 million. The only real ETF to see inflows was managed by asset supervisor Franklin Templeton, receiving investments of $1.9 million.