Information exhibits that Bitcoin sentiment has cooled off to impartial from greed following the asset’s newest plunge to the $57,000 stage.

Bitcoin Concern & Greed Index Has Returned To Impartial Ranges

The “Concern & Greed Index” is an indicator created by Various that exhibits the typical sentiment amongst traders within the Bitcoin and wider cryptocurrency market.

This index estimates sentiment by contemplating 5 elements: volatility, buying and selling quantity, social media information, market cap dominance, and Google Tendencies.

The metric makes use of a scale that runs from zero to 100 to characterize this common sentiment. All values beneath 46 recommend that traders are fearful, whereas these above 54 suggest a grasping market. The zone between these two cutoffs naturally corresponds to the territory of impartial mentality.

Now, here’s what the Bitcoin sentiment appears to be like like proper now, in accordance with the Concern & Greed Index:

The worth of the metric seems to be 54 in the intervening time | Supply: Various

As displayed above, the Bitcoin Concern & Greed Index is at a worth of 54, implying that traders share a impartial sentiment at present. Nevertheless, the neutrality is just simply, because the metric is true on the boundary of the greed area.

This can be a important departure from yesterday’s sentiment: 67. The chart under exhibits how the indicator’s worth has modified just lately.

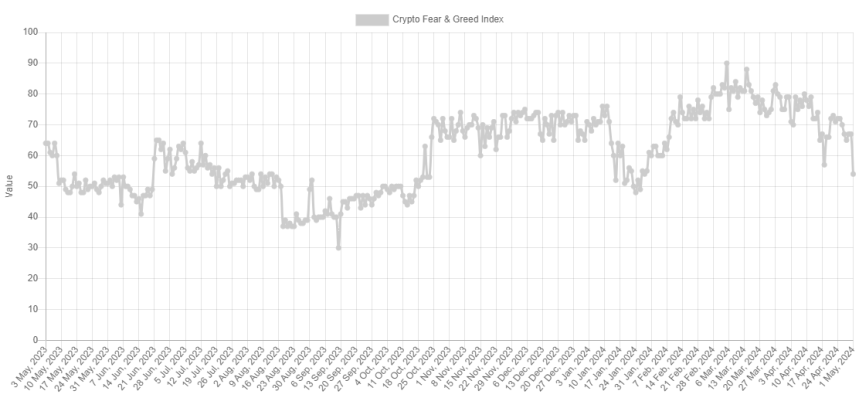

The development within the Concern & Greed Index over the previous 12 months | Supply: Various

Because the graph exhibits, the Bitcoin Concern & Greed Index has been declining just lately. For many of February and March, in addition to the primary half of April, the indicator was in or close to a particular zone referred to as excessive greed.

The market assumes this sentiment at values above 75. Because the asset worth struggled just lately, the mentality cooled off from this excessive zone and entered the traditional greed area. With the newest crash in BTC, the index has seen a pointy plunge, now exiting out of greed altogether.

Traditionally, cryptocurrency has tended to maneuver in opposition to the bulk’s expectations. The stronger this expectation, the upper the chance of such a opposite transfer.

This expectation is taken into account the strongest in excessive sentiment zones, in addition to excessive concern and greed. As such, main bottoms and tops have typically occurred in these territories.

The all-time excessive (ATH) worth final month, which continues to be the highest of the rally up to now, additionally occurred alongside excessive values of the Bitcoin Concern & Greed Index.

With the sentiment now cooled to impartial, some traders could also be looking ahead to a fall into concern. That is pure as a result of a rebound would change into extra possible the more severe the sentiment will get now.

BTC Value

Throughout Bitcoin’s newest plunge, its worth briefly slipped under $57,000 earlier than surging again to $57,300.

Seems like the worth of the asset has registered a pointy drop over the previous two days | Supply: BTCUSD on TradingView

Featured picture from Kanchanara on Unsplash.com, Various.me, chart from TradingView.com

Disclaimer: The article is supplied for academic functions solely. It doesn’t characterize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your individual analysis earlier than making any funding choices. Use data supplied on this web site completely at your individual threat.