The cryptocurrency market has just lately exhibited distinct divergences within the conduct of its two main belongings, Bitcoin and Ethereum. Whereas Bitcoin seems to be stepping right into a part of relative stability, Ethereum’s journey paints a contrasting image of sustained uncertainty, notably in its choices market.

This divergence is highlighted by the sustained excessive ranges of implied volatility related to Ethereum choices, signaling a cautious outlook amongst buyers relating to its future value actions.

Ethereum Persisting Volatility: A Comparative Evaluation

Implied volatility (IV) serves as a vital indicator within the choices market, offering insights into the anticipated value fluctuations of an asset over a selected interval. It displays the market’s temperature, gauging the depth of potential value actions merchants anticipate.

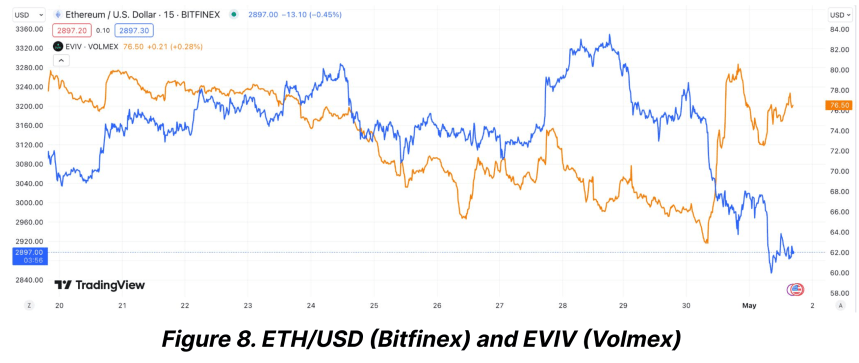

Current analyses recommend that whereas Bitcoin’s implied volatility has settled down considerably post-halving, Ethereum’s has not adopted swimsuit. As Bitcoin’s IV dipped to a multi-month low, indicating a relaxing market, Ethereum’s IV stays stubbornly excessive.

Opposite to the calming waves within the Bitcoin market, Ethereum wrestles with heightened volatility. Based on information from Bitfinex Alpha Report, Bitcoin’s volatility index sharply declined from 72% on the time of its newest halving occasion to about 55%.

Then again, Ethereum noticed a extra modest discount in its volatility index, dropping from 76% to 65% in the identical interval. This persistent volatility in Ethereum’s market is primarily fueled by uncertainties surrounding vital upcoming regulatory choices and broader market implications.

The Ethereum market is especially jittery in anticipation of the US Securities and Trade Fee’s (SEC) impending resolution on two spot Ethereum ETFs, slated for late Might 2024.

This upcoming regulatory milestone is taken into account a crucial occasion that might both catalyze a serious market transfer or exacerbate the present volatility.

The Bitfinex Alpha report underscores that regulatory uncertainty is a main driver behind Ethereum’s much less vital drop in its Volatility Danger Premium (VRP) in comparison with Bitcoin’s.

ETH And BTC Present Indicators of Restoration Amid Volatility

Ethereum and Bitcoin have proven indicators of restoration over the previous week when it comes to buying and selling efficiency. Bitcoin has seen a 4.1% enhance, whereas Ethereum reported a extra modest achieve of two.4%.

Nonetheless, the final 24 hours have been much less favorable for Ethereum, with a slight dip of 0.7%, underscoring the continued volatility and investor warning.

Furthermore, Ethereum’s community dynamics additionally replicate a subdued exercise with a marked lower in ETH burn fee attributed to diminished transaction charges.

This technical facet additional enhances a cautious Ethereum market narrative, poised on the point of probably vital shifts relying on exterior regulatory actions.

Regardless of all these, analysts like Ashcrypto recommend that the present volatility might set the stage for a powerful rebound within the 12 months’s third quarter. Drawing on historic patterns, Ethereum’s speculative forecast is probably reaching the $4,000 mark, offered market situations align favorably.

Featured picture from Unsplash, Chart from TradingView

Disclaimer: The article is offered for instructional functions solely. It doesn’t signify the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You might be suggested to conduct your personal analysis earlier than making any funding choices. Use data offered on this web site solely at your personal danger.