The beneath is an excerpt from a latest version of Bitcoin Journal Professional, Bitcoin Journal’s premium markets e-newsletter. To be among the many first to obtain these insights and different on-chain bitcoin market evaluation straight to your inbox, subscribe now.

Trendy Financial Concept (MMT) is again within the highlight, pushed by a brand new movie Discovering the Cash and a latest clip that went viral on Bitcoin Twitter and Fintwit. Within the clip, Jared Bernstein, Chair of the Council of Financial Advisors to the US President, is seen not with the ability to describe essentially the most primary ideas of presidency debt and cash printing. He claims MMT is right however among the language and ideas (essentially the most primary ones) are complicated to him. A fully stunning assertion given his position.

On this submit, I’ll define a number of main flaws in MMT that maybe you, expensive reader, will be capable of use to go forth and debunk MMT. The stakes are excessive, as a result of MMT cultists are gaining positions of energy in governments around the globe, as exemplified by Mr. Bernstein. It’s a very harmful proposition to place these individuals in energy, as a result of they’ll quickly destroy the foreign money and trigger financial armageddon. As bitcoiners, we imagine bitcoin will change the credit-based greenback, however we wish the transition to be pure and comparatively uneventful. A collapse of a serious foreign money with out bitcoin being able to take the reins, can be catastrophic for thus many.

Introduction to MMT

Trendy Financial Concept (MMT) is a post-Keynesian macroeconomic framework asserting that fiscal deficits are basically inconsequential, financial coverage must be subordinate to fiscal coverage, and financial authorities must situation base cash to finance huge authorities packages. MMT guarantees to eradicate involuntary unemployment and handle social points similar to poverty and local weather change. MMT is rooted within the perception that every one cash is a creation of the State, engineered via authorized frameworks to facilitate governmental management over financial actions.

In accordance with MMT, the federal government, which might situation its foreign money at will, can’t go bankrupt. Nevertheless, there are apparent limitations to this energy, like the lack to manage the foreign money’s worth. MMT additionally redefines the normal features of cash—medium of trade, retailer of worth, and unit of account—asserting that these features are mere byproducts of presidency coverage reasonably than intrinsic properties like shortage and divisibility. This concept results in the controversial notion {that a} authorities might dictate any merchandise as cash—be it acorns, IOUs, or Bitcoin—solely based mostly on authorized declarations, disregarding their properties, an idea starkly at odds with real-world financial dynamics.

No Coherent Concept of Worth

Probably the most vital shortcomings of Trendy Financial Concept is its method to the idea of worth. As a substitute of a subjective concept of worth, the place costs emerge via the preferences of particular person actors, like private spending or saving choices, MMT replaces this with a democratic or collective concept of worth.

In accordance with MMT, the worth of cash just isn’t derived from its utility in financial features—similar to a medium of trade, a retailer of worth, or a unit of account. As a substitute, in MMT cash’s worth originates from the collective acceptance and belief within the state that points it. This acceptance then supposedly confers worth onto the cash. In different phrases, MMT reverses the normal understanding: it’s not that one thing helpful turns into accepted as cash, however that one thing turns into helpful due to compelled acceptance as cash.

The worth of cash is reliant on the State being the financial calculator of types, as an alternative of the person market actors. The combination preferences of society together with central planning experience go into an equation and full-employment is the end result. This isn’t a joke. They do not have a concept of worth past what was simply defined.

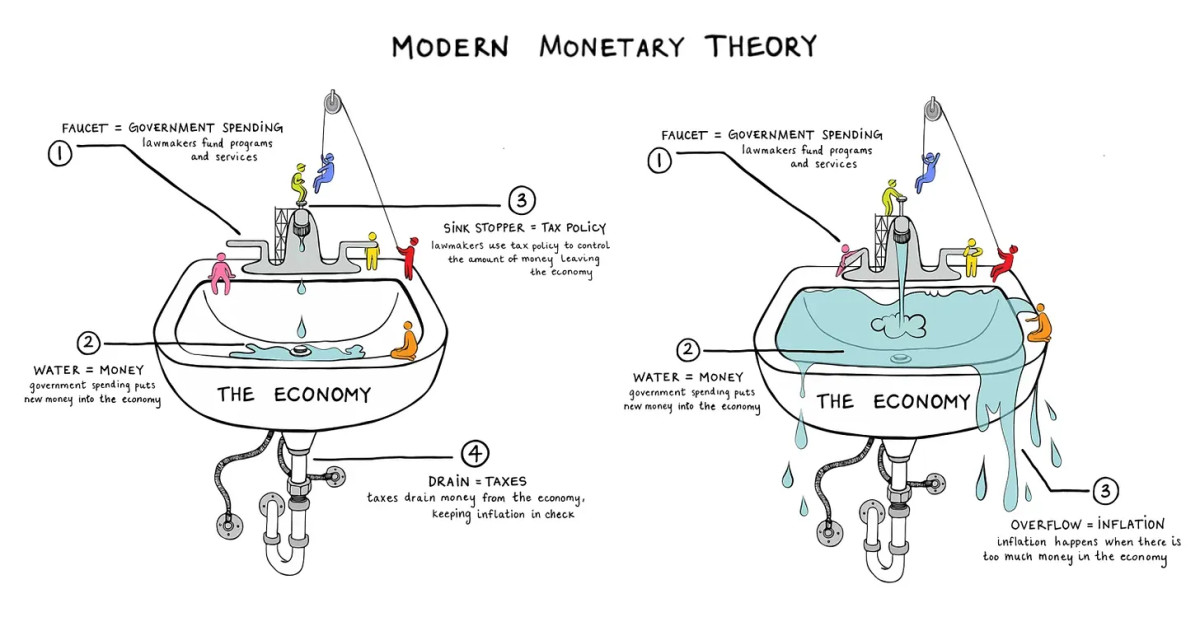

The Mechanics of MMT: Taxes and Fiscal Coverage

Trendy Financial Concept presents a skewed understanding of fiscal coverage and taxation, proposing that taxes function the bottom load of demand for state-issued cash. With out taxes, MMT adherents argue, authorities spending would result in devaluation. This level reveals a notable contradiction: whereas MMT devotees fervently deny that deficits matter in any respect, they concurrently argue that taxes are important to counteract deficits’ adversarial results.

Moreover, MMT believers overlook broader dynamics in foreign money markets. Taxes alone don’t essentially promote demand to carry a foreign money. People could select to attenuate their holdings because of fears of depreciation, solely changing different property into money when crucial to meet tax obligations. For instance, an individual would possibly primarily function utilizing another foreign money and solely purchase the home foreign money in quantities wanted to pay taxes.

When it comes to fiscal coverage, MMT contends the first constraints on cash printing are inflation, which in flip is because of the availability of actual sources, similar to labor and capital. Of their faculty of thought, in the event that they print cash the result’s financial development till labor and capital are absolutely employed. Elevating taxes is the mechanism to battle inflation by taking cash out of the financial system.

One other vital flaw in MMT is its required perception that the State can exactly handle fiscal coverage outcomes. MMT overlooks the inherent limitations of central planning, significantly the round reasoning that the knowledge guiding fiscal coverage is merely a mirrored image of earlier authorities actions, assuming good coverage transmission, with out appreciation for actual market knowledge or exterior market dynamics. Are MMT planners in management or not? In that case, it’s round. If not, it’s incorrect.

MMT doesn’t acknowledge the existence of unintended penalties that necessitate frequent coverage changes and undermine demand for the foreign money, as a result of that might imply they aren’t in management. Furthermore, market rates of interest additional complicate issues for MMT devotees. Micromanaging the financial system would lead to drastic declines in financial exercise, decrease demand for the foreign money and better rates of interest. Consequently, whereas MMT claims that the State can mandate using its foreign money, it doesn’t have the facility to manage how the market values or trusts that foreign money.

MMT and Useful resource Allocation

MMT’s method to useful resource allocation emphasizes attaining “full employment” via top-down fiscal insurance policies with out addressing the effectivity of labor and capital use. Proponents of MMT argue that with the correct fiscal insurance policies, full employment of labor, capital, and sources might be assured. Nevertheless, they battle to justify, utilizing MMT ideas, why seemingly unproductive actions like digging holes after which filling them again in are much less helpful than market derived employment of labor and capital. This typically results in ambiguous explanations concerning the variations in output, with out a clear, constant customary of worth.

In accordance with MMT, all financial actions that eat equal sources have to be perceived as equally helpful, blurring the strains between productive investments and wasteful expenditures. As an illustration, there isn’t any elementary distinction made between utilizing sources to construct important infrastructure or to assemble “bridges to nowhere.” This lack of an understanding of worth results in insurance policies the place the first objective is employment reasonably than the worth created by employment. The result’s huge misallocation of labor and capital.

Conclusion and Implications

Trendy Financial Concept’s foundational ideas and coverage implications include vital flaws. These vary from its incoherent concept of worth and reliance on round fiscal coverage logic, to its failure in aggressive worldwide foreign money markets and unworkable useful resource allocation methods. Every of those dangers might have profound penalties if MMT have been broadly applied.

For these paying consideration within the Bitcoin house, the similarities between MMT and Central Financial institution Digital Currencies (CBDCs) are significantly hanging. CBDCs symbolize a shift from our present credit-based financial system to a brand new type of fiat that may be tightly managed via programmable insurance policies—mirroring MMT’s advocacy for pure fiat cash managed by detailed fiscal insurance policies. This alignment means that areas like Europe and China, that are advancing in CBDC implementation, could naturally gravitate in direction of MMT ideas.

These transitions are monumental. A significant financial system can’t instantaneously change to a brand new type of fiat cash, regardless of what the MMT cultists would really like you to suppose. The transition will span years, throughout which we’ll possible witness the decline of conventional currencies. As MMT and these governments inadvertently champion Bitcoin, the selection for people, capital, and innovators will turn into clear. If persons are compelled to undertake an entire new type of cash anyway, will probably be a easy alternative for capital, financial exercise, and innovation to flee into Bitcoin.