In a latest submitting with the Securities and Change Fee (SEC), Wells Fargo, one of many largest banks in america, disclosed its publicity to identify Bitcoin Change-Traded Funds (ETFs).

JUST IN: 🇺🇸 Wells Fargo financial institution reveals it has spot #Bitcoin ETF publicity in new SEC submitting 👀 pic.twitter.com/H1iY9puKVb

— Bitcoin Journal (@BitcoinMagazine) Could 10, 2024

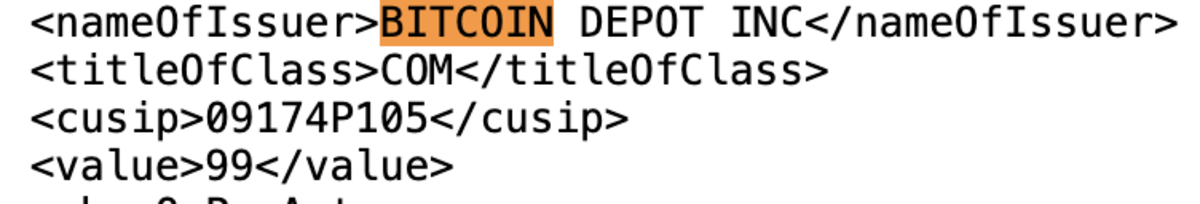

In line with the submitting, Wells Fargo holds positions in Grayscale’s spot Bitcoin ETF, ProShares Bitcoin Technique futures ETF, and shares in Bitcoin Depot Inc., marking a notable entry into the Bitcoin market. Spot Bitcoin ETFs allow buyers to achieve publicity to Bitcoin’s value actions with out instantly proudly owning the asset, making them a preferred alternative amongst institutional buyers searching for a extra regulated funding automobile for BTC.

The information of Wells Fargo’s spot Bitcoin ETF publicity comes amid a broader development of institutional adoption of Bitcoin, with a number of main banks and monetary establishments exploring methods to include BTC into their choices and get publicity to the asset.

Earlier this week, funding agency big Susquehanna Worldwide Group, LLP revealed in an SEC submitting that it holds $1.8 billion in spot Bitcoin and different Bitcoin ETFs, becoming a member of the wave of large monetary establishments disclosing their publicity to BTC.