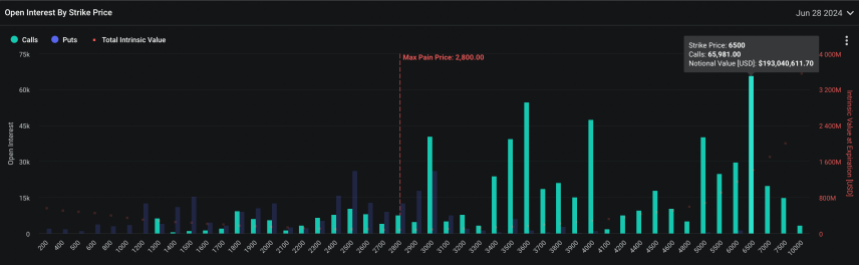

Ethereum (ETH) choices for June present a marked curiosity in greater strike costs, specializing in ranges exceeding $3,600.

Information from Deribit reveals a concentrated guess amongst merchants on calls surpassing this value, indicating a bullish sentiment towards Ethereum’s near-term trajectory. Probably the most favored strike value amongst these optimistic bets is an bold $6,500.

Associated Studying

Choices Market Bullish On Ethereum

Notably, choices are contracts that give merchants the proper, however not the duty, to purchase (within the case of calls) or promote (within the case of places) the underlying asset at a specified strike value by the expiry date.

A name choice is often bought by merchants who imagine the asset will improve in value, permitting them to purchase at a decrease price and doubtlessly promote at the next market value. Conversely, put choices are favored by these anticipating a decline within the asset’s value, aiming to promote on the present price and repurchase at a decrease worth.

At the moment, the Ethereum choices market is tilting closely in direction of calls, with the combination open curiosity—representing the entire variety of excellent contract choices—displaying a desire for greater strike costs.

This focus of calls, primarily above the $3,600 mark, suggests {that a} vital market section is positioning for Ethereum to ascend to greater ranges by the tip of June.

In keeping with Deribit information, roughly 622,636 Ethereum name contracts are set to run out by June’s finish, encapsulating a notional worth above $1.8 billion. Such substantial positioning underscores the market’s confidence in Ethereum’s potential uplift.

Information additional exhibits that essentially the most substantial open curiosity is clustered across the $6,500 strike value, with a notional worth of $193 million.

This focus displays dealer optimism and helps Ethereum’s market value, particularly if these choices are exercised because the asset value approaches or surpasses these strike ranges.

Regardless of the optimism embedded in these choices, Ethereum is at present navigating a slight downturn. It has dropped 5.4% over the previous week and a pair of.2% within the final 24 hours, positioning it under $2,900. This decline locations much more deal with upcoming market catalysts that would considerably sway ETH’s value.

Regulatory Choices And Technical Indicators: A Twin Affect on ETH’s Path

One vital upcoming occasion is the US Securities and Trade Fee’s (SEC) resolution on a number of purposes for Ethereum-based Trade-Traded Funds (ETFs), which is due by Could twenty fifth.

This resolution is pivotal as approval may usher in a wave of institutional investments into Ethereum, doubtlessly catapulting its value. Conversely, rejection may dampen the bullish sentiment and result in additional pullbacks.

From a technical evaluation standpoint, indicators are pointing to a doable rebound. The “Bullish Cypher Sample,” recognized by the analyst Titan Of Crypto, means that Ethereum might be at a turning level. At the moment, Ethereum is on the 38.2% Fibonacci retracement degree, a key assist zone in lots of bull markets.

Associated Studying

This degree has traditionally acted as a launchpad for upward value actions, hinting that Ethereum might be gearing up for a big rise.

#Altcoins #Ethereum Bounce incoming.

The Bullish Cypher Sample performed out completely and all of the targets obtained reached 🎯.#ETH is at present on the 38.2% Fibonacci retrace degree additionally referred to as “1st cease”. In a bull market this degree holds.

I anticipate a bounce from this degree. 🚀 pic.twitter.com/o9e6VLEREz

— Titan of Crypto (@Washigorira) Could 12, 2024

Featured picture from Unsplash, Chart from TradingView