The latest approval of the Ethereum ETF functions by the US Securities and Change Fee (SEC) on Thursday has sparked hypothesis on the subsequent worth actions for the market’s second-largest cryptocurrency because the buying and selling launch date approaches.

Nevertheless, important transfers of Ethereum (ETH) to cryptocurrency exchanges have raised considerations about profit-taking, portfolio rebalancing, and potential market hypothesis.

Promote-Off Amidst Ethereum ETF Greenlight?

In accordance to crypto analyst Ali Martinez, these developments coincide with Ethereum founder Jeffrey Wilke transferring 10,000 ETH, valued at roughly $37.38 million, to the cryptocurrency trade Kraken.

Moreover, the surge in Ethereum balances on cryptocurrency exchanges signifies a notable enhance in tokens accessible on the market.

Associated Studying

The chart beneath exhibits that greater than 242,000 ETH have been transferred to cryptocurrency trade wallets over the previous two weeks, signaling elevated buying and selling exercise that may contribute to cost volatility.

This development, coupled with Wilke’s switch, suggests the opportunity of a sell-off or a rise in profit-taking amongst market members.

Whereas business consultants like Anthony Pompliano view the Ethereum ETF approval as a constructive signal for your complete business, merchants are suggested to train warning. For Martinez, the rising variety of ETH deposits to trade wallets implies a possible market response characterised by profit-taking or promoting strain.

Moreover, the analyst notes that the Tom DeMark (TD) Sequential indicator has introduced a promote sign on Ethereum’s each day chart, indicating the potential for a retracement or a brand new downward countdown section earlier than the upward development resumes.

Ethereum’s Value Outlook In Focus

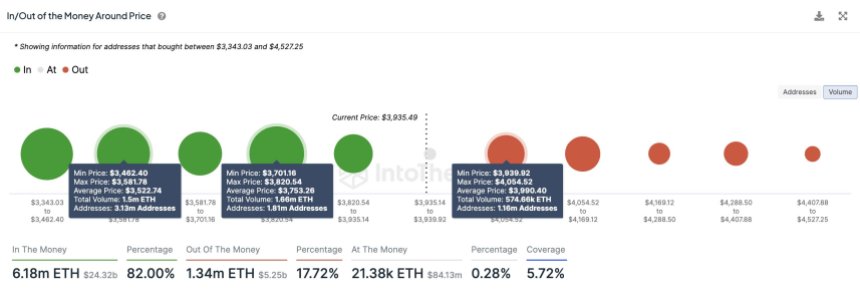

Diving into the value evaluation, contemplating the IOMAP (Enter-Output Mannequin and Profitability) information, Martinez highlights that Ethereum has a robust demand zone between $3,820 and $3,700, the place over 1.81 million addresses purchased roughly 1.66 million ETH.

This vary might present help amid growing promoting strain. Nevertheless, if this zone fails to carry, the subsequent key space of help lies between $3,580 and $3,462, the place 3.13 million addresses acquired over 1.50 million ETH.

Associated Studying

On the upside, Ethereum’s most vital resistance barrier is between $3,940 and $4,054, with over 1.16 million addresses buying round 574,660 ETH.

Martinez suggests {that a} each day candlestick shut above $4,170 would invalidate the bearish outlook and doubtlessly set off a brand new upward countdown section, with a goal in direction of $5,000.

As of this writing, ETH’s worth is $3,719, reflecting a 2.5% retracement over the previous 24 hours. Nevertheless, in accordance with the analyst’s evaluation, Ethereum stays inside an important demand zone.

Because the market approaches the launch and graduation of buying and selling for all eight spot Ethereum ETF functions by the world’s largest asset managers, the precise affect on worth motion is but to be totally realized.

Featured picture from Shutterstock, chart from TradingView.com