Umoja, the world’s first sensible cash protocol, is taking a unique strategy to asset administration by introducing progressive instruments like Synths and smartcoins, providing retail traders enhanced returns and decreased dangers.

Umoja is an asset administration protocol that goals to interrupt down the boundaries that forestall retail traders from accessing top-tier funding alternatives sometimes reserved for institutional traders. By automating advanced monetary methods, Umoja allows anybody to take part in superior asset administration with out the necessity for intensive monetary data.

What are Synths?

Umoja’s core product is Synths, that are tokenized asset administration methods that additionally act as the muse for creating smartcoins. A Synth is basically a proprietary buying and selling algorithm that replicates the efficiency of conventional monetary devices like choices. Synths are backed by person collateral, which means traders are impacted solely by the efficiency of the Synths they make the most of, based mostly on the collateral they supply.

Do you know?

Wish to get smarter & wealthier with crypto?

Subscribe – We publish new crypto explainer movies each week!

Umoja provides two varieties of Synths – Synth Choices and Yield Synths.

Yield Synths, also called Yield-Producing Artificial {Dollars}, are designed to supply dollar-denominated, principal-protected returns in all market situations. They at all times goal to return the USD worth of the preliminary funding, no matter market volatility. Yield Synths present a aggressive edge over conventional artificial stablecoins by guaranteeing principal safety and yield technology, making them a sexy selection for risk-averse traders looking for regular returns.

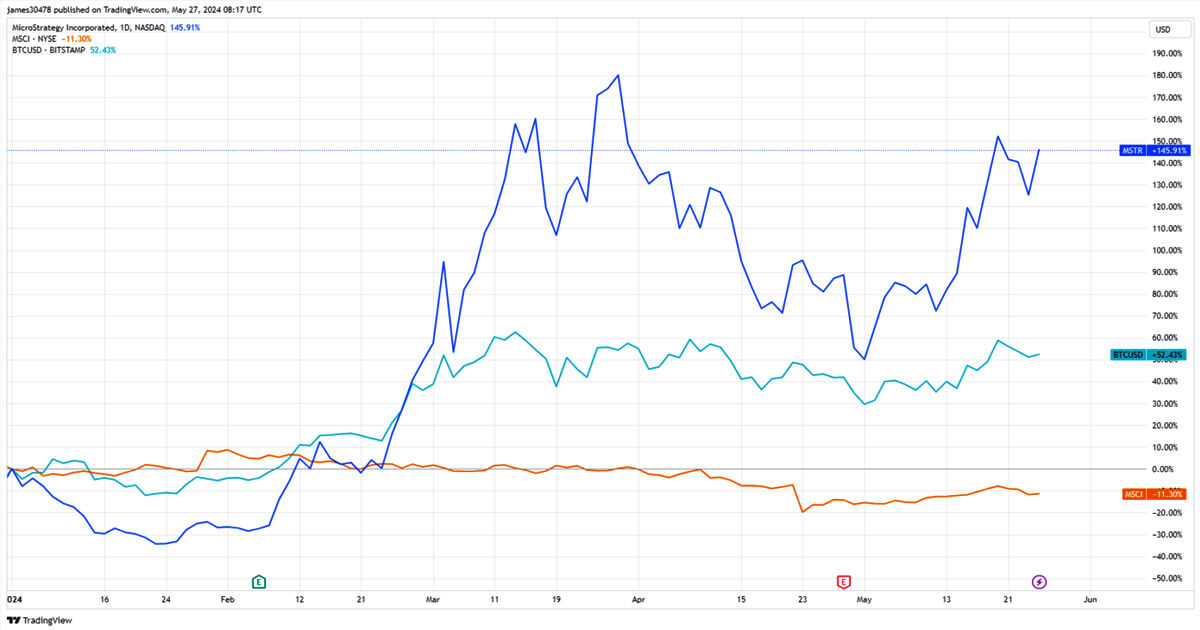

A Artificial Choice (Synth Choice), then again, is an algorithm that mimics the financial conduct of a conventional crypto choice. That is achieved by constantly adjusting positions in a portfolio of tokens and perpetual contracts based mostly on market actions. Umoja’s Synth Choices enable the automation of crypto buying and selling with 10x leverage and no liquidation danger.

There are two varieties of Synth Choices provided by Umoja – Synth Put Choices and Synth Name Choices. Synth Put Choices enable traders to hedge towards potential losses by betting on the long run lower within the value of an asset. Synth Name Choices, then again, let traders take leveraged positions on the long run enhance in an asset’s value.

Easy methods to Use Synth Places and Calls?

Synths might be immediately used by Umoja’s dApp. Traders can choose from a wide range of Synth methods relying on their market outlook and danger tolerance. Right here’s a step-by-step information on methods to use Synth Put and Name Choices:

Choose the Synth Choice sort (Put or Name) on the high of the Synth creation kind.

Choose the token you wish to shield or wager on from the checklist and enter the quantity you want to use.

Select the length on your Synth Put or Name. The tip date is when your Synth will expire, particularly at 11:59:59 PM on the chosen date.

Select the strike value, which is the value at which your safety begins (if it’s a Synth Put) or the value above which a Synth is activated (if it’s a Synth Name). When you try this, a notification will seem about collateral upkeep (click on “Study extra” when you want extra details about it).

Click on on “Particulars” to assessment the Synth you might be creating and the full down fee quantity. Then, proceed by clicking “Join your pockets” or “Place Synth” (when you’ve already linked your pockets).

Click on “Verify Synth” to pay for the transaction. As soon as accredited by your crypto pockets, you’ll be redirected to the Synth particulars web page in your Dashboard.

You could find visible tutorials on methods to use Synth Put and Name Choices on the Umoja web site.

What are Smartcoins?

Now, one other product of Umoja I’ve talked about earlier than is smartcoins, that are self-trading digital belongings constructed utilizing Synths. They’re designed to autonomously commerce their underlying worth, making them a brand new class of belongings often known as sensible belongings.

The method of making a smartcoin entails two key elements: a base asset and a Synth technique. The bottom asset gives the inherent worth, whereas the Synth technique governs the buying and selling conduct.

This mix permits smartcoins to keep up and optimize their worth independently, providing a hands-off funding strategy for customers. Some smartcoins that will likely be accessible on Umoja embrace yBTC, USDb, bstETH, and bstBTC.

The UMJA Token

The final vital a part of the Umoja ecosystem is the UMJA token, which has not been launched but. Nonetheless, the UMJA token technology occasion (TGE) is deliberate for August 2024. The utmost provide of UMJA will likely be 1 billion tokens, of which a major quantity will likely be devoted to public airdrops and staking rewards.

UMJA will serve a number of functions, together with governance, protocol charge reductions, and insurance coverage.

By staking UMJA tokens, customers will be capable to take part within the governance of the protocol, influencing vital selections and developments. In addition to governance capabilities, although, tokens staked within the Governance Pool may even present further yield rewards.

Furthermore, holding UMJA tokens entitles customers to reductions on protocol charges, lowering their total prices. The token additionally acts as a safeguard, with staked USDC within the Insurance coverage Pool defending the protocol from unexpected occasions. Nonetheless, staking tokens within the Insurance coverage Pool not solely helps shield the protocol from capital shortfalls but in addition earns rewards.

It is also price noting that Umoja plans to implement a system the place charges collected from Synth utilization and asset minting are partially used to purchase again UMJA tokens on decentralized exchanges, supporting the token’s worth.

General, Umoja seeks to remodel asset administration by making refined monetary methods accessible to retail traders. By using Synths, smartcoins, and the UMJA token, Umoja provides a singular mixture of automated danger administration and yield optimization.

Ain is the Lead Content material Researcher. Her huge expertise with crypto and blockchain tech-related content material permits her to determine the important thing items of data that needs to be offered to the learner, and make sure the validity of the gathered information.With a level in New Media research, she has developed an in depth checklist of strategies to coach folks through new, research-proven examine fashions based mostly on deduction and long-term human reminiscence.Ain approaches all the pieces with unequivocal consideration to element. Her most important objectives are to erase the anomaly surrounding many Web3 ideas, and to information content material writers in presenting troublesome crypto-related ideas in an easy-to-understand method.Regardless that content material technique is her most important ardour, Ain additionally enjoys studying high-fantasy books and watching superhero films.