Discussions round when the Spot Ethereum ETFs will doubtless start buying and selling have continued to warmth up. This time, Bloomberg analyst Eric Balchunas and fellow Bloomberg analyst James Seyffart have shared an replace on once they count on these funds to start buying and selling.

Spot Ethereum ETFs To Start Buying and selling By July 2

Balchunas said in an X (previously Twitter) submit that they’re transferring their “over/beneath date” for the launch of the Spot Ethereum ETFs to July 2. He revealed that they had heard that the Securities and Trade Fee (SEC) despatched fund issuers feedback on their respective S-1 filings. These feedback are stated to be “fairly gentle” and nothing main, with fund issuers set to file their amended registration statements inside every week.

Associated Studying

The Bloomberg analyst claimed that there’s a first rate probability that the SEC will declare these S-1 filings efficient the subsequent week and that the Fee will work in direction of approving them earlier than the vacation weekend. He added that something is feasible however that’s the timeline they’re working with for now.

These Bloomberg analysts had beforehand put July 4th as their over/beneath date for the launch of the Spot Ethereum ETFs. Balchunas acknowledged that the current shift from July 4th to 2nd wasn’t a significant one however was nonetheless important, contemplating it was starting to really feel prefer it might take longer earlier than the Spot Ethereum ETFs launch.

He additionally clarified that they selected July 2nd because the over/beneath date as a result of that is once they stay undecided about whether or not to go decrease or larger. Their newest projection can also be excellent news, contemplating that SEC Chair Gary Gensler had thrown the crypto neighborhood right into a little bit of limbo together with his newest remark.

Whereas addressing the Senate Banking Committee on June 13, Gensler informed Senator Invoice Hagerty that the S-1 filings for the Spot Ethereum ETFs will doubtless be accredited “over the course of this summer time.” This assertion raised the potential for these funds not being accredited till the top of the summer time, which will likely be someday in September.

Spot ETFs To Propel ETH To $10,000

The Spot Ethereum ETFs are anticipated to have a huge effect on Ethereum’s worth as soon as they start buying and selling. Crypto skilled Ash Crypto just lately talked about that Ethereum reaching $10,000 is only a “matter of time,” with these funds set to start out buying and selling quickly. Crypto analyst Eljaboom additionally alluded to the Spot Ethereum ETFs when he said that $10,000 is “programmed” for Ethereum on this cycle.

Associated Studying

Crypto analyst CrediBULL Crypto said that $10,000 is his minimal goal for Ethereum on this bull run and added that the second-largest crypto token might even rise to $20,000 as a result of it matches Bitcoin’s high within the 2017 bull run.

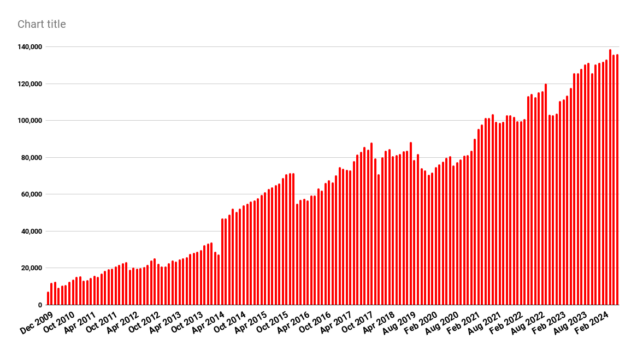

Featured picture created with Dall.E, chart from Tradingview.com