In a latest interview with CryptoSlate at BTC Prague 2024, Fred Thiel, CEO of Marathon Digital Holdings, shared his insights on a number of important facets of the Bitcoin panorama, specializing in transaction charges, hash fee resilience, and international enlargement initiatives.

Transaction Charges and Future Tendencies

Thiel highlighted the circumstances of Bitcoin transaction charges, noting that giant payloads requiring prioritization drive greater charges. He emphasised that transaction quantity within the mempool is the first driver, with numerous value-added companies constructed on prime of base transaction charges. Thiel likened it to a tiered system, the place first-class companies assure transaction finality and lower-tier companies function on a much less particular foundation. Thiel predicts that over time, transaction charges will surpass the block subsidy.

“transaction charges will surpass the block subsidy, particularly because the block subsidy continues to lower”.

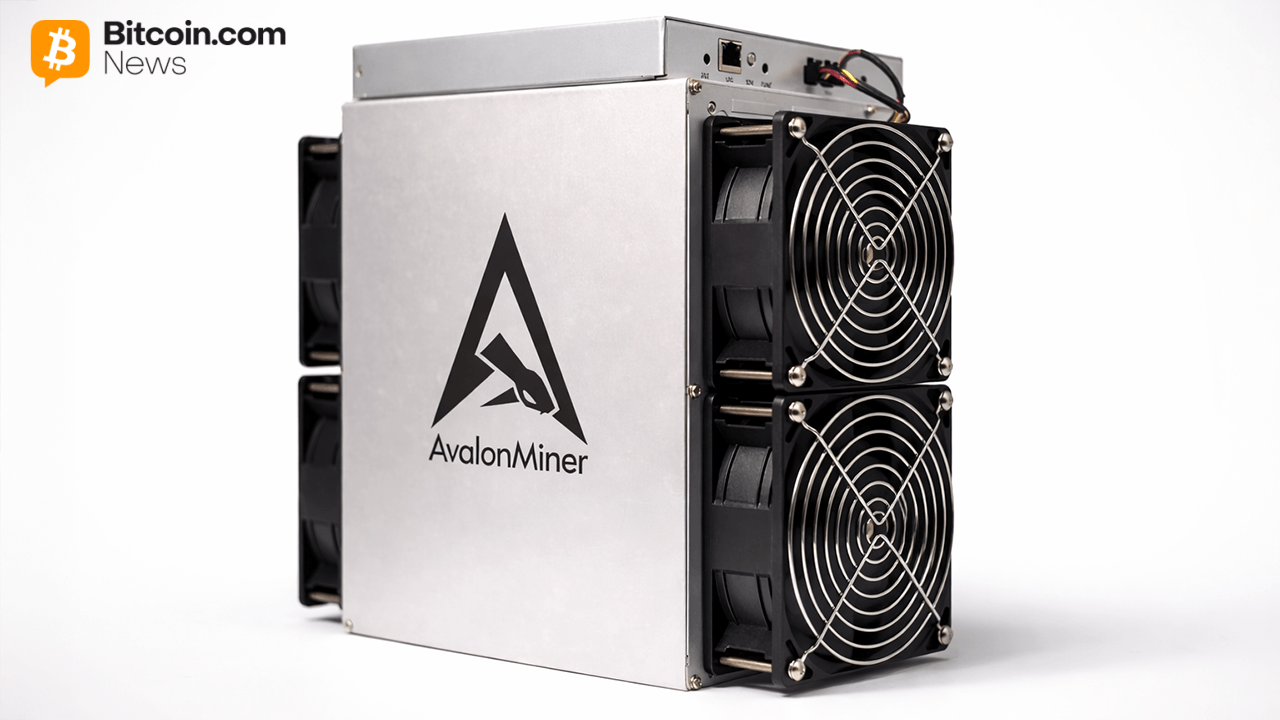

Addressing the resilience of the Bitcoin hash fee, Thiel identified that regardless of predictions of a major drop post-halving, the precise decline was much less extreme. He attributed this resilience to the expansion bulletins from each public and sovereign miners. Thiel expects public miners to consolidate and type a smaller proportion of the worldwide hash fee as a result of entry of latest sovereigns and different personal entities into the mining area, which might dilute the general share held by public miners.

International Enlargement Initiatives

Thiel additionally mentioned Marathon’s enlargement into Kenya and the UAE. He defined that these initiatives contain strategic partnerships on the sovereign stage, leveraging unused vitality assets to create international direct investments, job alternatives, and governmental revenues. Thiel highlighted the function of the US authorities, significantly Ambassador Meg Whitman, in facilitating these ventures. He underscored the collaboration with tech giants like Microsoft and Google to reinforce these tasks.

“It’s all actually one large initiative, which is to monetize unused vitality in Kenya,”

The interview additionally touched on Marathon’s latest inclusion within the S&P 600, noting a strong buying and selling quantity and elevated institutional funding, with entities like BlackRock buying vital stakes. Thiel talked about that whereas institutional curiosity is rising, the corporate additionally faces heightened quick curiosity as a result of its excessive liquidity.

Concerning the political local weather, Thiel noticed a bipartisan curiosity in supporting Bitcoin and Bitcoin mining in Congress, contrasting with the manager department’s stance. He emphasised Marathon’s assist for political candidates which might be favorable to the digital property trade.

Operational Updates

Lastly, Thiel addressed operational challenges, together with latest transformer points that affected their Ellendale web site. He said that the positioning is now 85% operational and will likely be solely on-line quickly.

Thiel’s insights mirror Marathon Digital Holdings’ strategic positioning and resilience within the evolving digital property market.

Talked about on this article