Decentralized finance, or DeFi, is undoubtedly probably the most modern functions of crypto and blockchain expertise. Along with bringing in new methods to make use of crypto belongings, it additionally creates many alternative profit-making alternatives. Certainly one of them is yield farming. However what’s yield farming, how does it work, and maybe most significantly, how are you going to get essentially the most out of it?

What Is Yield Farming? Definition

Yield farming is a method within the crypto markets the place token holders leverage their crypto belongings to earn rewards. It includes offering liquidity to decentralized finance (DeFi) platforms by lending or staking tokens in numerous lending protocols. This course of, generally known as liquidity mining, helps DeFi platforms keep liquidity and facilitate easy transactions whereas giving token holders alternatives to earn passive revenue via the native tokens they obtain as rewards.

Yield farming permits crypto buyers to maximise their returns by taking part within the decentralized finance ecosystem. By contributing to liquidity swimming pools on platforms like Uniswap or Compound, they not solely assist the community’s performance but in addition acquire entry to probably excessive yields.

How Does Yield Farming Work?

Yield farming operates utilizing good contract expertise, permitting buyers to earn passive revenue from their cryptocurrency funds. It includes placing tokens and cash into decentralized functions (dApps), resembling crypto wallets and decentralized exchanges (DEXs).

Yield optimization is a method utilized in yield farming to maximise returns by effectively managing and reallocating belongings throughout numerous platforms.

Buyers who deposit their funds and lock them up are referred to as liquidity suppliers. They’re incentivized via transaction charges, curiosity, or revenue in governance tokens. Potential returns are expressed within the Annual Share Yield (APY) metric.

Nevertheless, as extra liquidity suppliers contribute to the liquidity pool (the place belongings are locked), the rewards every investor receives lower.

Yield Farming vs. Staking

Please observe that yield farmers should deposit an equal quantity of each cash/tokens within the buying and selling pair they’re locking up.

Yield Farming Metrics

If you begin researching DeFi protocols, you may run into abbreviations that you just don’t acknowledge. Listed below are the 4 commonest ones.

Impermanent Loss

Impermanent loss is a key threat metric in yield farming. It happens when the worth of your belongings adjustments in comparison with whenever you deposited them. Since it may be decrease whenever you withdraw them, this could influence your total returns. Understanding impermanent loss is essential for anybody concerned in yield farming, because it instantly impacts the profitability of your investments.

Whole Worth Locked (TVL)

TVL, or the entire worth locked, is the entire quantity of cryptocurrency locked in a specific protocol. Often expressed in USD, it’s primarily the quantity of consumer funds at present deposited on the DeFi platform.

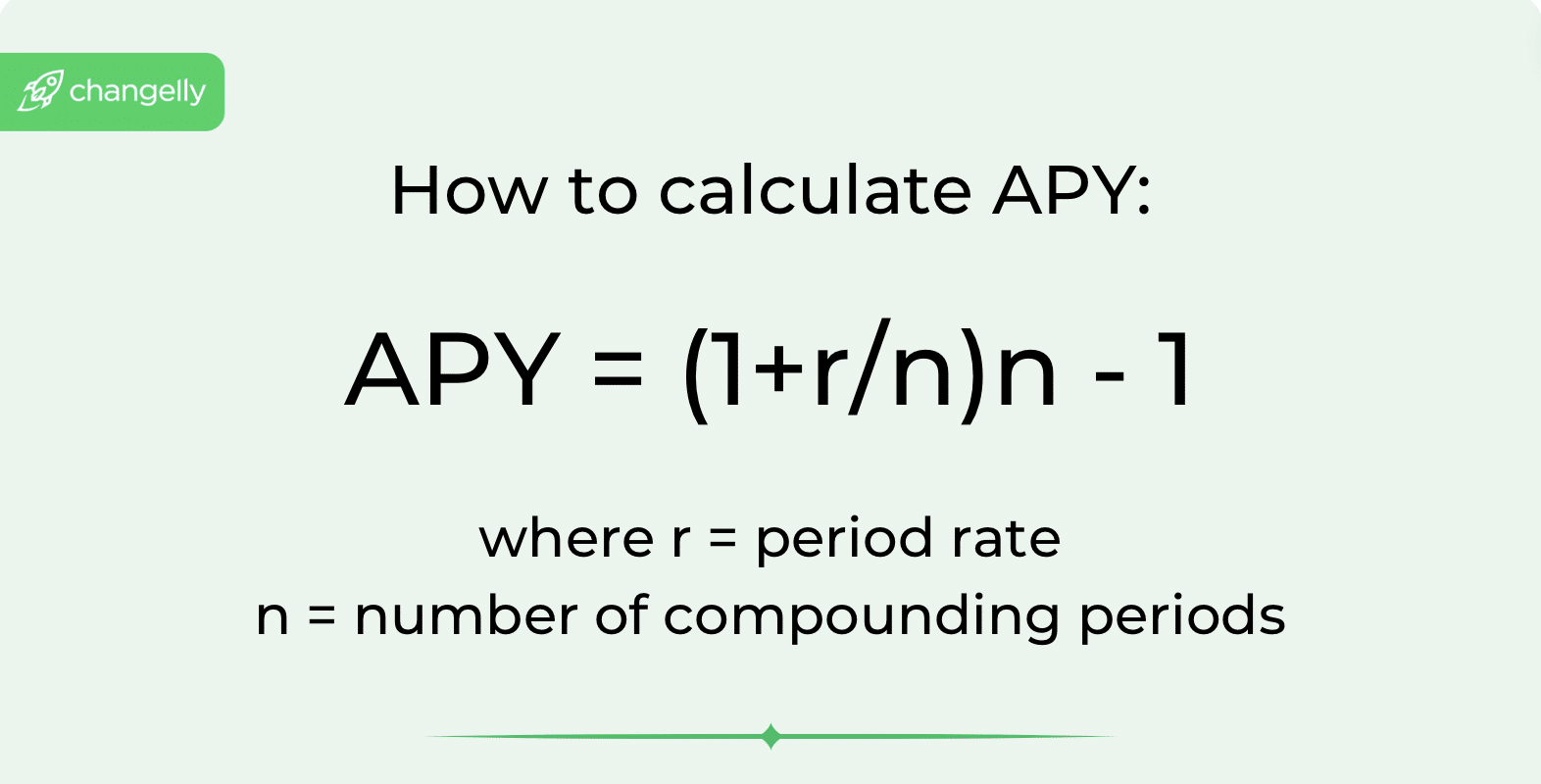

Annual Share Yield (APY)

APY, or the annual share yield, is the estimated price of return that may be gained over a interval of 1 12 months on a selected funding.

Annual Share Price (APR)

APR, or the annual share price, is the projected price of return on a specific funding over a interval of 1 12 months. In contrast to APY, it doesn’t embrace compound curiosity.

Compounding is the act of reinvesting your good points to get greater returns.

Forms of Yield Farming

There are a number of methods in which you’ll be able to have interaction in yield farming.

1. Liquidity supplier

Liquidity suppliers are customers that deposit two cryptocurrencies to a DEX to supply liquidity. At any time when someone exchanges these two tokens or cash on a decentralized alternate, the liquidity supplier will get a small minimize of the transaction payment.

2. Lending

Buyers can lend their tokens and cash to debtors by way of good contracts. This permits them to earn yield from the curiosity that debtors pay on their loans.

3. Borrowing

Buyers can lock up their funds as collateral and take a mortgage on one other token. This borrowed token can then be used to farm yield.

4. Staking

Staking in DeFi is available in two flavors: staking on proof-of-stake blockchains that we now have already talked about above and staking the tokens you earned by depositing funds to a liquidity pool. The latter permits buyers to earn yield twice.

Calculate Yield Farming Returns

The very first thing you want to find out about yield farming returns is that they’re often annualized: this implies they’re calculated for a one-year interval.

Yield returns are usually measured within the APR (annual share price) and the APY (annual share yield). Please observe that, in contrast to the latter, the previous doesn’t account for compound curiosity.

The APR formulation is pretty easy:

APR = (Annual Return / Funding) * 100%

The APY is a bit tougher to calculate. Initially, you will have to understand how usually your curiosity can be compounded and the way usually your returns can be reinvested into the liquidity pool. Compounding curiosity performs an important function in calculating APY, because it considers the impact of reinvesting earnings over a number of intervals.

Right here’s the formulation for it:

Please observe that, on the entire, you gained’t have to make use of the formulation your self as a result of most platforms these days robotically calculate projected returns for you.

The Greatest Yield Farming Protocols

Here’s a quick overview of a few of the largest yield farming platforms. This part focuses on liquidity mining platforms that supply one of the best alternatives for making excessive returns.

PancakeSwap

PancakeSwap is without doubt one of the largest decentralized exchanges, working on the Binance Sensible Chain (BSC). It facilitates the swapping of BEP-20 tokens utilizing the Automated Market Maker (AMM) mannequin. A big consumer base finds this platform enticing: it entices with decrease transaction charges in comparison with Ethereum-based counterparts.

Aave

Aave is an open-source, non-custodial lending and borrowing protocol constructed on the Ethereum blockchain. It gives algorithmically adjusted yields primarily based on provide and demand for numerous crypto belongings provided to the platform. Aave helps modern options like “flash loans,” permitting borrowing and repaying inside a single transaction block. The protocol additionally has a governance token, AAVE, which provides a layer of community-driven governance and incentives.

Uniswap

Uniswap is without doubt one of the most famous decentralized exchanges and AMMs, recognized for its iconic unicorn mascot and reliability in buying and selling ERC-20 tokens and Ethereum. On Uniswap, customers can create liquidity swimming pools for buying and selling pairs of ETH and ERC-20 tokens. The fixed product market maker mechanism adjusts the alternate price primarily based on liquidity adjustments, producing quite a few buying and selling alternatives.

Yearn Finance

Yearn Finance robotically strikes consumer funds between numerous lending protocols to maximise returns. Constructed on Ethereum, Yearn Finance boasts a set of merchandise like vaults, lending, and insurance coverage — it is just pure buyers take into account it a flexible platform. The protocol’s governance token, YFI, has additionally gained vital traction.

Balancer

Balancer is an automatic portfolio supervisor and liquidity supplier that enables customers to create or be part of liquidity swimming pools with a number of tokens. Flexibility and probably greater yields go hand in hand with its dynamic charges and the flexibility to carry a number of tokens in customizable ratios.

Yield Farming Dangers

Yield farming, whereas probably extremely worthwhile, is extraordinarily dangerous. Aside from cryptocurrency worth volatility, there are a number of different dangers of yield farming buyers must be cautious of, together with complexity and a excessive entry barrier by way of information and understanding of platforms. Newbies have to be well-prepared and knowledgeable earlier than diving in.

Rug Pulls

A rug pull happens when a challenge’s builders abandon it and take away liquidity, leaving buyers unable to promote their tokens. To keep away from this, scrutinize the challenge’s group, repute, tokenomics, and roadmap. All the time conduct thorough analysis (DYOR) earlier than investing.

Regardless of their reliability, good contracts can nonetheless be hacked, posing dangers to yield farmers’ investments. One particular threat issue is wise contract vulnerabilities, which will be exploited by malicious actors. Though this threat can’t be completely prevented, researching platforms and studying opinions can assist mitigate potential theft.

Regulatory Danger

The crypto trade and DeFi exist in a regulatory grey zone, with governments contemplating methods to control the market. Nevertheless, DeFi’s design goals to withstand regulatory pressures, suggesting restricted influence from new legal guidelines.

FAQ

What are some widespread yield farming methods?

Frequent yield farming methods embrace offering liquidity to high-yield swimming pools, staking tokens in decentralized finance (DeFi) platforms, and taking part in liquidity mining applications. Every technique has its personal threat and reward profile, so it’s vital to decide on one which aligns together with your funding targets.

The place can I yield farm crypto?

The most well-liked yield farming platforms embrace PancakeSwap, Uniswap, Curve Finance, Maker DAO, and extra.

Is yield farming nonetheless worthwhile?

It will possibly nonetheless be worthwhile so long as you handle your investments and dangers effectively.

What are the advantages of yield farming?

Yield farming gives the potential to generate yields that may exceed conventional monetary devices, scoring enticing returns on digital belongings. Moreover, it rewards members with additional tokens, enhancing total profitability inside the DeFi ecosystem.

Who’re yield farmers?

Yield farmers are people or entities that take part within the yield farming course of by contributing liquidity to decentralized exchanges or different DeFi protocols. They purpose to generate yields and earn extra rewards from their investments within the DeFi ecosystem and by benefitting from market volatility.

What’s a liquidity pool?

A liquidity pool is a group of digital belongings locked in a wise contract on a decentralized alternate to facilitate buying and selling and lending. Liquidity swimming pools infuse crucial liquidity to allow easy transactions and market operations. No shock they’re important to the yield farming course of.

Who’re liquidity suppliers?

Liquidity suppliers are people or entities that offer digital belongings to liquidity swimming pools on decentralized exchanges. By contributing liquidity, they assist keep market stability and are rewarded with yield farming rewards, incomes extra returns for his or her participation within the DeFi yield farming ecosystem.

Disclaimer: Please observe that the contents of this text usually are not monetary or investing recommendation. The data offered on this article is the creator’s opinion solely and shouldn’t be thought-about as providing buying and selling or investing suggestions. We don’t make any warranties concerning the completeness, reliability and accuracy of this info. The cryptocurrency market suffers from excessive volatility and occasional arbitrary actions. Any investor, dealer, or common crypto customers ought to analysis a number of viewpoints and be aware of all native laws earlier than committing to an funding.