Pendle (PENDLE), a cryptocurrency powering a decentralized finance (DeFi) protocol, has skilled a value surge in latest days. This rally comes amidst constructive developments throughout the Pendle ecosystem and a high-profile funding from business veteran Arthur Hayes. Nonetheless, considerations concerning token distribution threaten to forged a shadow over Pendle’s long-term prospects.

Associated Studying

Hayes Fuels The Fireplace: Crypto Whale Ignites Investor Confidence

The latest value surge may be partly attributed to a strategic transfer by Hayes, co-founder of BitMEX and a outstanding determine within the crypto house.

Pendle tallied a 25% enhance from its lowest level this week to an intraday peak of $6.21, after Hayes publicly introduced his acquisition of Pendle tokens, a transfer interpreted by many as an indication of confidence within the venture.

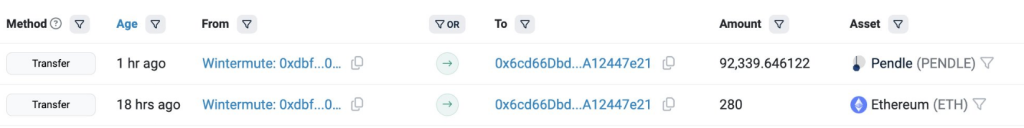

After Arthur Hayes(@CryptoHayes) tweeted that he’s including $PENDLE and $DOGE to his baggage, one in every of his wallets purchased 92,339.6 $PENDLE($554K) by way of #Wintermute.

He transferred 2.05M $USDC to #Wintermute, then obtained 280 $ETH($1M) and 92,339.6 $PENDLE($554K).… pic.twitter.com/wo2Sl4245B

— Lookonchain (@lookonchain) June 20, 2024

This endorsement from a seasoned investor with a profitable observe document, like Hayes’ involvement with the fast-growing USDe stablecoin, has undoubtedly bolstered investor sentiment in the direction of Pendle.

Pendle’s Ecosystem Takes Flight: TVL Skyrockets, Consumer Base Expands

Past Hayes’ affect, Pendle’s personal inner developments are driving the present momentum. The venture’s complete worth locked (TVL), a key metric reflecting the full worth of crypto belongings deposited throughout the protocol, has witnessed a big uptick.

The surge in TVL means that increasingly more individuals are utilizing Pendle’s DeFi options. These options let customers earn spectacular yields on their crypto holdings, with some reaching as excessive as 25%.

That’s considerably higher than what most customers get from conventional investments like short-term US Treasuries. On prime of that, the variety of Pendle token holders retains climbing, which exhibits a rising and lively person base for the protocol.

Complete crypto market cap at $2.28 trillion on the 24-hour chart: TradingView.com

A Cloud On The Horizon: Token Distribution Raises Issues

Whereas the present outlook for Pendle seems promising, a possible hurdle lies within the venture’s tokenomics: a small variety of addresses management a considerable portion of Pendle’s circulating provide.

This concentrated possession construction may result in market manipulation sooner or later. Moreover, the deliberate launch of extra tokens into circulation raises considerations about potential dilution of present token worth.

Associated Studying

Balancing Progress With Sustainability

Pendle’s latest value surge and constructive ecosystem developments paint a rosy image, however the token distribution mannequin presents a big problem. Shifting ahead, the token’s success will hinge on its capacity to foster sustainable progress whereas addressing considerations concerning tokenomics.

Increasing the person base and diversifying token possession can be essential steps in securing Pendle’s long-term future.

Featured picture from The Economist, chart from TradingView