Japanese Institutional Crypto Funding Traits

Japan’s largest funding financial institution, Nomura Holdings (TYO:8604), and its crypto subsidiary, Laser Digital, launched findings from a current survey on Monday. The survey focused over 500 funding managers in Japan, revealing that 54% plan to allocate funds to crypto property inside the subsequent three years.

Motivations and Limitations for Japanese Institutional Crypto Funding

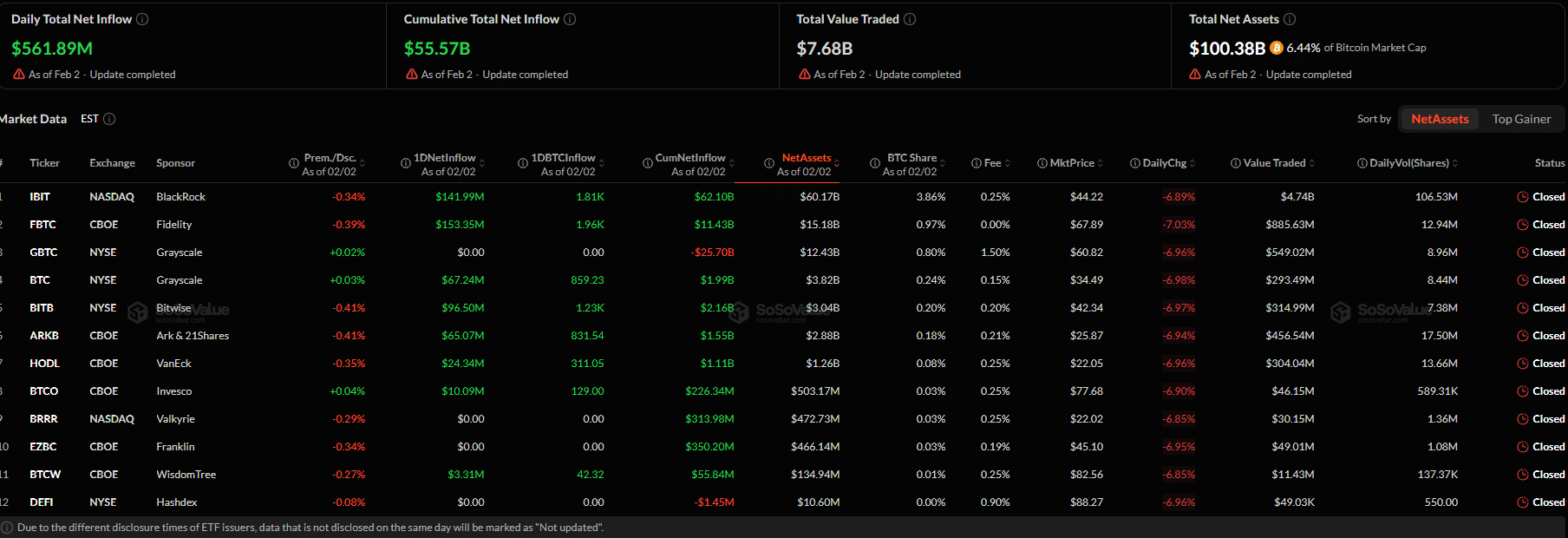

Greater than half of the respondents indicated a future curiosity in digital property, motivated by current developments such because the launch of crypto merchandise like exchange-traded funds (ETFs), funding trusts, staking, and lending. These components, together with the growing mainstream adoption of cryptocurrencies, are seen as important drivers within the progress and growth of cryptocurrencies.

Nonetheless, some establishments at the moment hesitant to put money into crypto property cited counterparty dangers, excessive volatility, regulatory necessities, and considerations about safety as important limitations to entry.

Optimistic Sentiment In the direction of Japanese Institutional Crypto Funding

Moreover, 25% of survey respondents have a constructive impression of the asset class, and 62% view cryptos as a possibility for funding diversification. The survey indicated that when investing in crypto property, the popular allocation is 2-5% of property beneath administration (AUM).

Curiosity in Web3 and Enterprise Capital Investments

Respondents additionally expressed curiosity in investing in Web3 initiatives, both immediately or by enterprise capital (VC) funds. This curiosity displays a broader pattern in direction of integrating superior blockchain applied sciences and decentralized purposes into conventional funding methods.

Japan’s Crypto Coverage Developments

Japan is quickly creating an financial reform invoice with notable implications for Japanese institutional crypto funding. Early this 12 months, the federal government printed a legislative proposal permitting enterprise capital corporations and different funding funds to carry digital property immediately. This inclusion of digital property within the authorized framework not solely legitimizes their use in institutional investments but additionally positions Japan as a crypto-friendly jurisdiction globally.

Unbiased finance information outlet FinanceFeeds launched a report in February, highlighting that Japan is a world chief in compliant crypto funds. In March, Japan’s $1.5 trillion pension fund was actively exploring the potential addition of Bitcoin to its funding portfolio.

Stablecoin Regulation in Japan

Japan has additionally closely regulated stablecoins, noting that solely banks, cash transmission providers, and belief corporations can situation stablecoins. Moreover, all reserves underpinning the worth of those tokens should be held in Japanese trusts and invested solely in home financial institution accounts, guaranteeing the best ranges of safety and compliance.

This stringent regulation goals to guard traders and keep the soundness of the monetary system. Moreover, these measures assist to stop fraudulent actions and improve the general trustworthiness of the cryptocurrency market in Japan, making it a safer setting for each institutional and particular person traders.

Conclusion

The findings from Nomura Holdings’ survey point out a rising curiosity and potential for important Japanese institutional crypto funding. With progressive regulatory frameworks and an growing variety of funding managers exhibiting curiosity in digital property, Japan is poised to grow to be a key participant within the world crypto market.

As conventional monetary establishments acknowledge the advantages of digital property, the combination of those property into funding portfolios is anticipated to speed up. This shift not solely enhances portfolio diversification but additionally opens up new avenues for progress and innovation within the monetary sector. Japan’s proactive stance on crypto regulation performs an important function in fostering a safe and steady setting for digital asset investments.

By implementing stringent rules on stablecoins and guaranteeing that reserves are held in home banks, Japan is setting a excessive commonplace for different nations to observe. This method not solely protects traders but additionally enhances the credibility and legitimacy of the crypto market. In abstract, the growing Japanese institutional crypto funding underscores Japan’s potential as a number one participant within the world crypto business.

As extra establishments allocate funds to crypto property, the Japanese market is prone to see substantial progress, innovation, and diversification within the coming years. This pattern not solely advantages the establishments themselves but additionally contributes to the general development and maturity of the worldwide crypto market.

Featured Picture: Freepik © ojosujono96

Please see disclaimer