Bitcoin is struggling to shake off weak spot, judging by its efficiency in the previous few buying and selling days. After the dump on June 24, the general sentiment has been bearish, and sellers will doubtless double down, wiping good points posted within the final two days.

As issues stand, the sale of 4,000 BTC by the US authorities is a dent for consumers. It comes hours after the German authorities dumped 1000’s of BTC early this week, forcing costs to decrease.

Bitcoin Trending At Oversold Territory

One analyst is upbeat even amid this sense of unease throughout the crypto and Bitcoin markets. Citing formation within the RSI indicator, a instrument for gauging momentum, the analyst is satisfied costs might recuperate strongly going ahead.

Bitcoin is at its lowest overbought degree in over 300 days at spot charges. This formation echoes an analogous state of affairs in 2023 when costs have been caught beneath $30,000.

As soon as BTC swung to the oversold territory, costs rebounded strongly, breaking above $50,000 and reaching an all-time excessive within the coming months via March 2024.

Associated Studying

To date, Bitcoin finds itself within the oversold territory after consolidating for roughly three months after peaking in March 2024. Then costs shot to as excessive as $73,800 earlier than dumping sharply, reaching $56,500 by Might 2024. Although costs have recovered, discovering one other ceiling at $72,000, the trail of least resistance within the quick time period is bearish.

Bitcoin is testing its horizontal vary’s decrease boundary for the fifth time since March. For bulls to take cost, costs should maintain above the $56,500 and $60,000 zones for the bullish bias to stay.

Nonetheless, a confirmed breakdown beneath the vary low may see BTC crater dropping to as little as $50,000-$52.

Will BTC Bounce Greater? Capital Move To Spot ETFs

One other analyst additionally expects costs to recuperate, emphasizing the significance of the bull market assist band. Sharing on X, the analyst stated this assist band has served as a dependable loading zone up to now bull cycle.

Associated Studying

Its profitable protection in January 2024 gives a constructive precedent. With BTC on the similar degree, the chance of a refreshing bounce is excessive on the playing cards, offering a glimmer of hope.

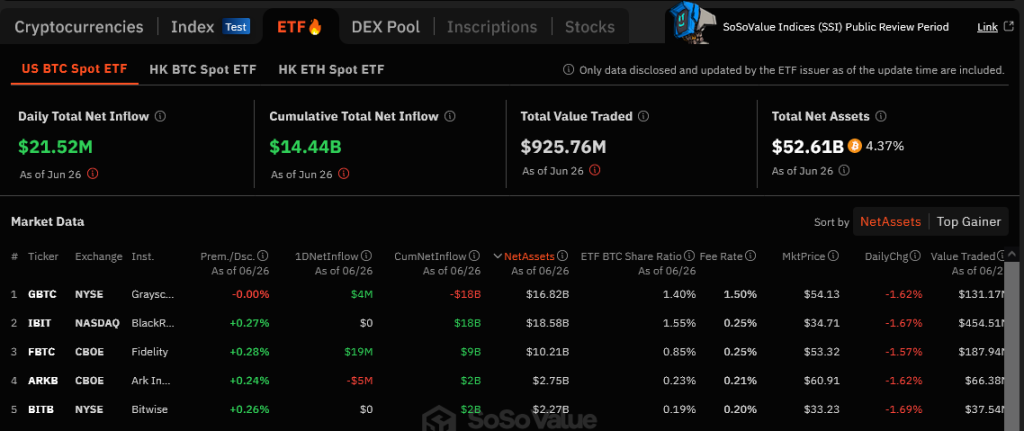

Regardless of the latest value decline and days, if not weeks, of outflows, curiosity in spot Bitcoin exchange-traded funds (ETFs) is rising.

On June 26, there was $21.5 million into these merchandise. Out of this, Constancy and Grayscale noticed inflows, based on SosoValue knowledge.

Function picture from DALLE, chart from TradingView