Onchain Highlights

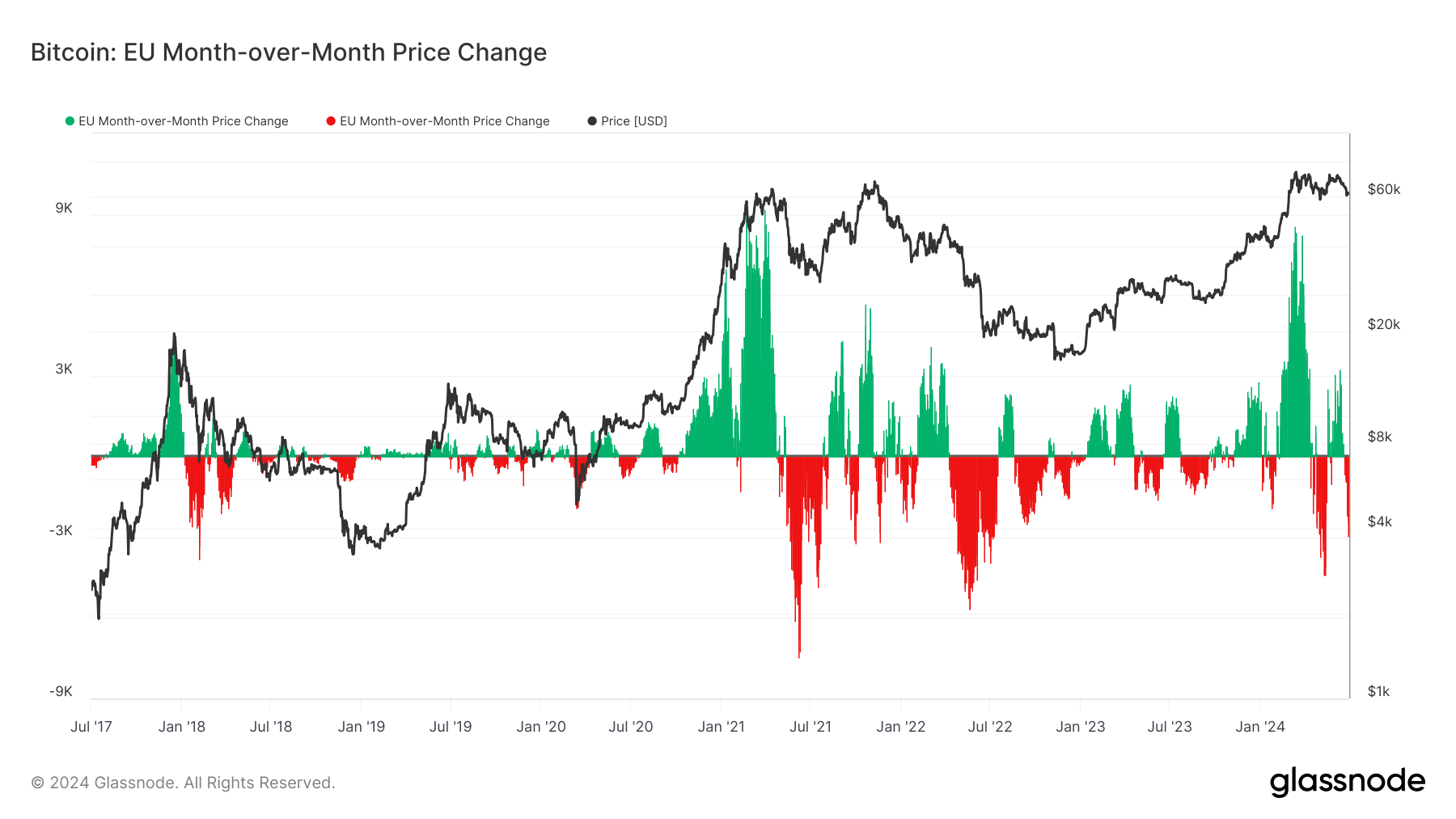

DEFINITION: This metric exhibits the 30-day change within the regional value set throughout EU working hours, i.e., between 8 A.M. and eight P.M. Central European Time (07:00-19:00 UTC), respectively, and Central European Summer season Time (06:00-18:00 UTC).

Bitcoin’s month-over-month value change within the EU area exhibits vital fluctuations over current months. Analyzing the primary half of 2024, the information reveals a marked improve in volatility post-halving in April.

From early January to mid-March, Bitcoin’s value throughout EU buying and selling hours was in a noticeable uptrend, with a number of durations of constructive momentum. Nevertheless, following the halving occasion, the pattern shifted dramatically. The charts illustrate a pointy decline in Could, reflecting elevated promoting stress and a sustained downward motion with a quick respite in early June.

Historic knowledge provides further context, highlighting comparable volatility patterns following main occasions. As an illustration, the 2017 and 2021 bull markets noticed vital month-over-month value swings, notably throughout key regulatory developments and market corrections. The present pattern aligns with these historic patterns, suggesting that post-halving market situations proceed influencing Bitcoin’s value motion throughout the EU buying and selling window.