Undemonstrated Effectiveness and Effectivity

I am not conscious of any research establishing the effectiveness of KYC measures in combating cash laundering. And it is not for lack of looking.

Conversely, there are quite a few research tending to conclude the other. Ronald Pol, a researcher at La Trobe College in Melbourne, synthesized in a analysis paper printed in 2020, many works: Anand 2011; Brzoska 2016; Chaikin 2009; Ferwerda 2009; Findley, Nielson, and Sharman 2014; Harvey 2008; Levi 2002, 2012; Levi and Maguire 2004; Levi and Reuter 2006, 2009; Naylor 2005; Pol 2018b; Reuter and Truman 2004; Rider 2002a, 2002b, 2004; Sharman 2011; van Duyne 2003, 2011; Verhage 2017.

The primary discovering of this analysis paper is captured in a greater than eloquent title: “Cash Laundering Management: The Least Efficient Public Coverage within the World?”

What will we be taught?

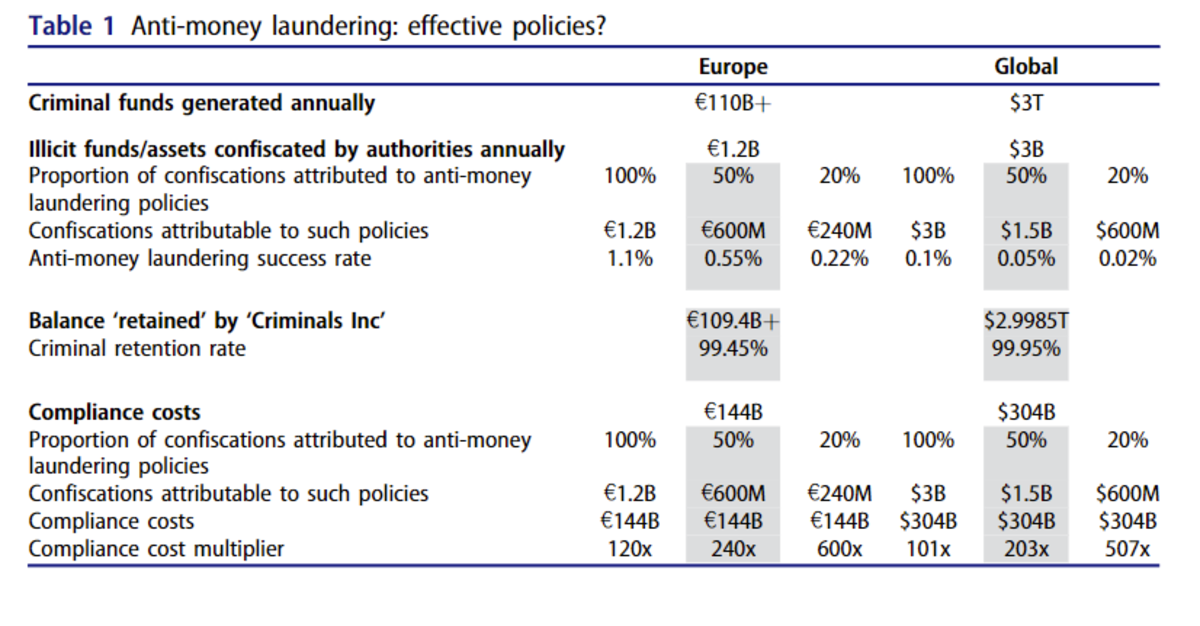

That KYC and AML procedures enable the restoration of roughly 0.05% of world legal cash, which means $1.5 billion out of the $3 trillion in crime cash circulating worldwide annually. And that is assuming that fifty% of the recovered cash is thru these procedures, whereas an empirical research in New Zealand confirmed a special actuality, the place 80% of seizures had been made by means of typical means, and solely 20% by means of KYC and AML procedures.

The creator of the paper summarizes it as follows: “if the influence of three many years of cash laundering controls barely registers as a rounding error in legal accounts and “Criminals, Inc” hold as much as 99.95 % of the earnings from distress, and cheap prospects for higher outcomes stay persistently unexplored, the cruel actuality is that the present coverage prescription inadvertently protects, helps and permits a lot of the intense profit-motivated crime that it seeks to counter. In any occasion, the anti-money laundering experiment stays a viable candidate for the title of least efficient coverage initiative, ever, anyplace (Cassara 2017, 2).”

A Europol research in 201636 yields comparable figures: criminals would retain practically 99% of their income.

That is effectiveness lined.

What about effectivity, which means what sources are mobilized to realize this outcome?

The reply is as soon as once more complicated.

Research differ broadly in estimating the compliance prices imposed on companies, notably monetary ones, ranging in 2018 from $304 billion yearly in response to LexisNexis, to $1.28 trillion in response to Thomson Reuters37, with out even contemplating the prices imposed on states and public providers, in addition to oblique prices (productiveness losses, frictions, and so forth.).

Even by a low estimate, for each euro extracted from crime, 200€ had been spent. The state of affairs is so absurd in Europe that compliance prices (€144 billion) exceed the overall cash (€110 billion) generated by crime annually!

Confronted with such poor outcomes and the magnitude of their prices, any wise particular person or firm would take a while to replicate on the sustainability of such a system. However we’re coping with a faith right here, and asking for proof and reasoning could make one suspect of complicity with cash laundering and terrorism.

This business has additionally turn out to be extraordinarily profitable for a variety of actors who’ve developed a variety of providers: compliance-specialized legal professionals, consulting companies, in addition to startups providing devoted instruments, even named RegTech. Curiously sufficient, with practically $4.3 billion in penalties imposed on monetary establishments in 2018, and $8.1 billion in 2019, the enterprise additionally proves profitable for states, which earn extra in fines than they get better from criminals…

Totalitarian regimes dreamed of it, liberal democracies did it: monetary surveillance and its penalties

With the imposition of those procedures on the monetary system, new or current dangers tackle main proportions.

The primary is censorship, linked to the drastic discount of on-line anonymity. The second is arbitrariness within the software of choices and sanctions. The third is the theft of delicate info.

Monetary censorship as a political weapon for democratic asphyxiation

The danger of censorship is commonly perceived as a distant drawback in Western democracies. And but, residing in a democracy doesn’t forestall the temptation of censorship that prevails in human beings, and examples abound.

The Democracy Index printed by the British newspaper The Economist ranks Canada thirteenth, the UK 18th, South Korea twenty second. All are labeled as “full democracies,” forward of France (twenty third). India, the world’s largest democracy, ranks forty first, not removed from our Belgian (thirty sixth) or Italian (thirty fourth) neighbors.

And but, these nations have a narrative to inform about censorship associated to buyer information procedures and KYC.

In Canada, for instance, as not too long ago as 2022, as truckers’ protests intensified, the Ontario authorities after which the Canadian authorities declared a state of emergency and imposed monetary coercion measures on the protest motion, bypassing the standard democratic and authorized processes. It was the primary time in Canadian historical past that such a state of emergency was imposed.

Underneath the pretext of desirous to know the origin of the funds financing the crowdfunding campaigns supporting the motion, the monetary surveillance company (FINTRAC) was concerned. The 2 monetary platforms GoFundMe and GiveSendGo had been compelled to freeze the funds. Much more worrying, the Canadian authorities invoked its emergency powers to freeze the person accounts of practically 100 individuals concerned within the protests. An actual monetary suffocation below a political pretext.

Whether or not one agrees or disagrees with the explanations behind the protests is moreover the purpose. This state of emergency would later be deemed unconstitutional by the Federal Courtroom of Canada in January 202438. However the harm is finished: the protest has ceased, protesters have been financially choked, the rule of legislation and particular person freedoms have been diminished.

In the UK, one other case made headlines and triggered fairly a scandal: that of Nigel Farage. This Brexit supporter and chief, a consumer of the identical financial institution for 43 years, introduced in 2023 on Twitter39 that his accounts had been closed with out clarification. Two days later, because the scandal erupted within the UK, he introduced that his requests to open accounts had been rejected by 9 banks, below the pretext that he’s a “politically uncovered particular person,” a PEP, an acronym created by these buyer information rules. Nevertheless, different political decision-makers don’t face the identical issues in opening or sustaining financial institution accounts, elevating questions on differential remedy based mostly on political beliefs.

The incident triggered a stir within the UK, and the BBC confirmed that the account had been closed for political reasons40. Prime Minister Rishi Sunak needed to handle the issue41 and summoned the nation’s main banks to make sure their respect of freedom of expression.

Much more not too long ago in India, on the finish of March 2024, the affect of the banking sector on the funds of financial actors was materialized into the nation’s politics, enabling the ruling celebration to financially suffocate its rival, the Indian Nationwide Congress, the previous celebration of Gandhi.

Because the Human Rights Basis recollects in its seventeenth Monetary Freedom Report newsletter42, “The Indian authorities, led by Prime Minister Narendra Modi, froze the financial institution accounts of its largest political opposition celebration, the Indian Nationwide Congress (INC), citing allegations of tax evasion, simply weeks earlier than the upcoming election. In response to INC statements on X43, ‘all our financial institution accounts have been frozen. We can not perform our marketing campaign work. We can not assist our employees and candidates. Our leaders can not journey throughout the nation.’ A couple of days later, the Indian company for combating monetary crime additionally arrested opposition chief Arvind Kejriwal44 in what’s seen as a broader transfer to get rid of competitors within the upcoming elections. These occasions spotlight the rising want for a impartial and apolitical forex as a device of democratic activism and for political campaigns.”

It’s tempting to suppose that such issues “don’t occur right here.” However the examples I’ve intentionally cited are democracies, most of that are higher ranked on this regard than France.

And France has already shifted on comparable points.

An unfair system : selective enforcement of measures

Id assortment and counter-terrorism efforts in areas exterior of finance have additionally proven that they are often broadly diverted from their unique objective. One notable instance is South Korea, the primary nation to try to fight anonymity on the web, enacting a legislation in 2008 requiring id assortment by social networks to fight hate speech and misinformation.

In 2012, the Constitutional Courtroom of South Korea abolished the law45, deeming it unconstitutional. It regretfully famous quite a few pitfalls: the selective and arbitrary software of this legislation as a result of its overly imprecise standards, the dearth of proof exhibiting that the legislation’s enforcement had diminished the amount of unlawful content material posted on-line, and the stifling of native financial actors, who needed to adjust to pricey requirements, to the good thing about international actors who continued to function within the nation, attracting South Korean web customers involved with their means to specific themselves freely.

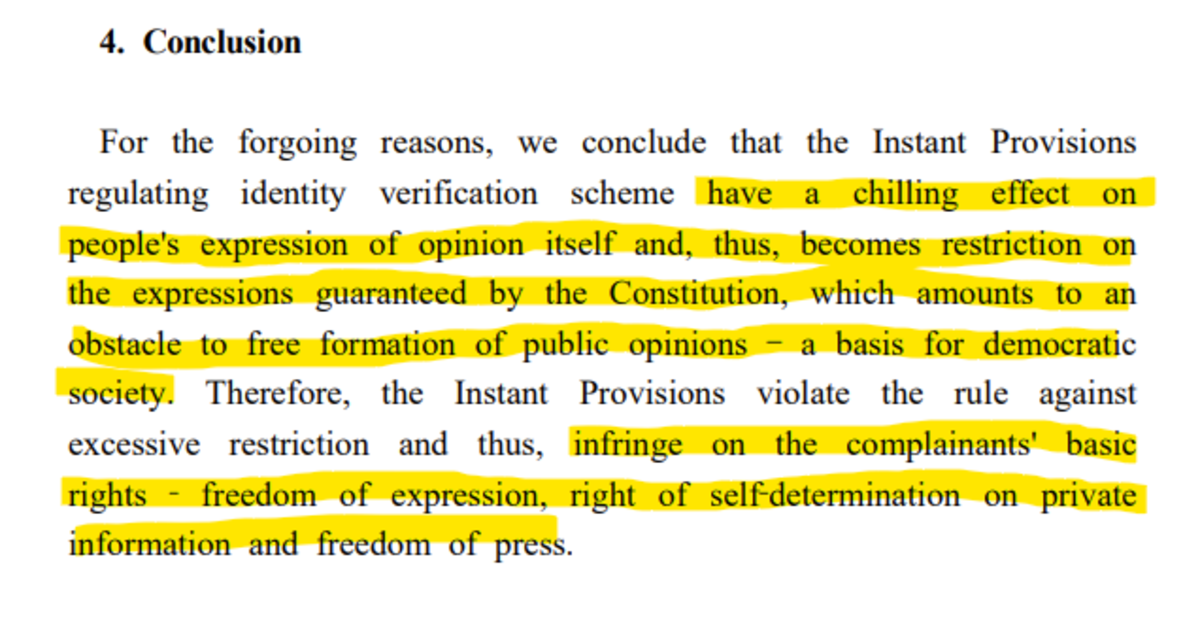

The Courtroom concluded by affirming that id assortment had “a chilling impact on individuals’s expression of opinion itself,” which constitutes “an impediment to the free formation of public opinions — a foundation for democratic society.”

One would not must go to Asia to see the hazard posed by this censorship and legal guidelines geared toward combating terrorism.

In France, sure political teams, particularly on the left, had a impolite awakening when, after supporting varied legal guidelines geared toward limiting hate speech and the glorification of terrorism, they’re now focused for “eco-terrorism” or “promotion of terrorism.” The battle in opposition to terrorism typically serves as a handy pretext to limit the expression of reliable political opposition, which is severe and damaging in a democracy, wherein the power to disagree with the bulk opinion should completely be preserved.

On this regard, the parallel with the id assortment by monetary establishments is hanging: no proof of their effectiveness, drastic financial requirements resulting in sector focus and benefiting international actors, and selective enforcement by authorities of the prosecutions to be initiated, amongst different issues.

How else can we clarify, as we noticed within the introduction, that builders of a Bitcoin pockets are already in pretrial detention and resist 25 years’ imprisonment for wrongdoings attributed to them in a fallacious method, whereas sure monetary establishments, crypto or in any other case, frequently keep away from jail sentences for far more important and severe offenses, generally dedicated consciously?

In 2012, HSBC was accused by the US authorities of cash laundering for Mexican drug cartels and violating sanctions in opposition to nations like Iran. The laundered quantities would method a billion dollars46. HSBC agreed to pay a document superb of $1.9 billion to US authorities.

However no jail sentences had been imposed.

Once more in 2012, UBS was convicted by US authorities for aiding US residents in evading taxes by hiding undeclared property overseas, totaling $20 billion47. UBS paid a superb of $780 million and had to supply the names of hundreds of American shoppers.

However no jail sentences had been imposed.

Higher-known in France, in 2014, BNP Paribas pleaded responsible to violating US sanctions in opposition to nations similar to Sudan and Iran, in addition to expenses of cash laundering, totaling $30 billion48. The financial institution agreed to pay a document superb of $8.9 billion and was briefly banned from sure greenback transactions.

However no jail sentences had been imposed.

In 2019, Danske Financial institution was fined €150 million by Danish authorities for facilitating large-scale cash laundering, involving $227 billion49 primarily from Russia.

However no jail sentences had been imposed.

In 2012, Normal Chartered was accused by US authorities of cash laundering for Iranian shoppers, bypassing US sanctions, totaling $250 billion50. The financial institution agreed to pay a superb of $667 million.

However no jail sentences had been imposed.

$250 billion is greater than the overall market capitalization of Bitcoin in 2020. That is the magnitude we’re speaking about.

The most important financial institution in the US, JP Morgan, has been convicted 27751 occasions by the courts since 2000, for a complete of practically $40 billion in fines. That is roughly a conviction of practically $150 million each month for twenty-four years, for offenses starting from shopper safety violations to mortgage abuses, clearly together with deficiencies in anti-money laundering efforts. The latter represents $2 billion out of the $40 billion in fines.

I could not discover a single particular person in conventional finance, because the 2008 disaster, who has gone to jail on expenses associated to anti-money laundering or terrorism financing.

In distinction, between Pertsev, the developer of Twister Money, who spent 9 months in jail with out trial and has simply been sentenced to five years, and the builders of Samouraï Pockets, who spent a while in jail, once more with out trial, and one among whom was launched on bail, evidently we’re proper within the midst of what the Constitutional Courtroom of Korea known as “selective enforcement by authorities of the prosecutions to be initiated.”

Not So Private Information

The third extraordinarily harmful level raised by these practices of amassing buyer knowledge and combating cash laundering and terrorism financing is, clearly, the theft of this knowledge.

You do not have to go too far again in time to search out examples of information breaches exploited by cybercriminals. In France, should you’ve been unemployed even as soon as prior to now 20 years, your knowledge is now not private, after a hack occurred on the Nationwide Company for unemployment, France Travail. Your identify, surname, date of beginning, social safety quantity (and due to this fact gender, county, and metropolis of beginning), e mail handle, postal handle, and telephone quantity: all of that is now within the wild, within the palms of cybercriminals, who’ve already began utilizing it for his or her deeds.

In fact, what occurred to France Travail additionally occurs on the earth of finance.

Among the many greatest knowledge breaches lately, we will point out Equifax in 2017, an American credit standing company, affecting the non-public knowledge of over 150 million individuals 52 53, or JP Morgan in 2014, with 76 million households and seven million businesses54, or Capital One in 2019, with over 100 million affected clients, among the many largest lately. Europe just isn’t spared both: HSBC has skilled a number of knowledge breaches over the previous ten years55 56, however fintech firms like Revolut57 are additionally not immune.

In brief, as soon as your private knowledge is collected, the query is now not “if” however “when” it will likely be accessible to hackers.

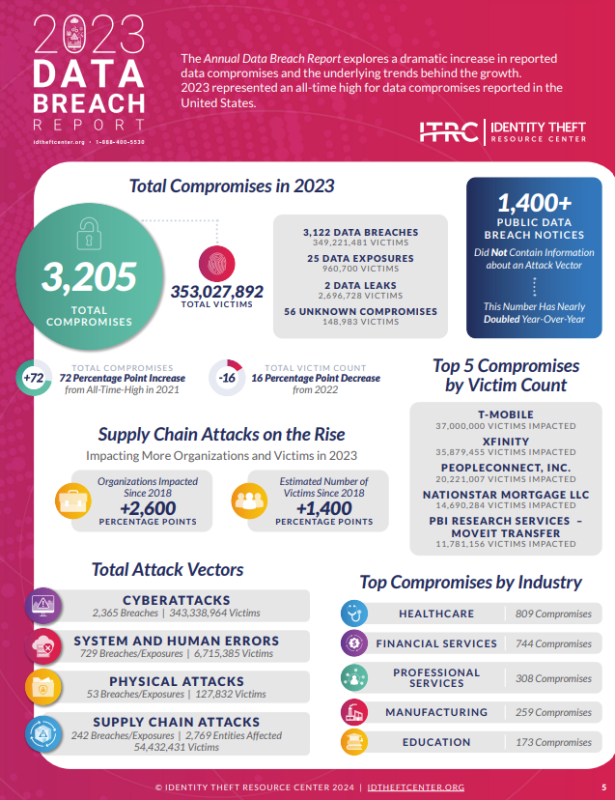

In response to the Id Theft Useful resource Middle (ITRC), an American NGO devoted since 1999 to evaluating id theft crimes in the US, there have been over 3,200 knowledge breaches or hacking occasions in 2023 in the US, affecting over 350 million victims. That is greater than the complete inhabitants of the nation. The monetary business emerges as the primary sufferer, simply behind the medical business and its useful well being data58.

In response to the US Federal Commerce Fee, bank card frauds between 2019 and 2023 elevated by over 50%, from about 280,000 shopper complaints to over 425,00059. Amongst these frauds, about 90% resulted from id theft that allowed the opening of a brand new account within the identify of an individual who had their private info stolen, and solely 10% resulted from fraud on an current card.

In response to Transunion, an organization that collects, displays, and protects banking knowledge, using private knowledge to forge new false identities reached new information in 2023, leading to a lack of $3 billion within the United States60.

Particularly with the event of AI, which reaches horrifying ranges of sophistication when it comes to id theft (voice, video, and so forth.), it turns into obligatory for this “free-for-all” private knowledge to cease as quickly as doable. Defending private knowledge is due to this fact additionally an ethical obligation in direction of others as a result of defending oneself is defending others from scams and breaches of belief.

It’s due to this fact a matter of bodily and digital security for everybody. That is notably the battle that has been launched in Switzerland, the place the canton of Geneva has already voted 94% in favor of amending the structure in favor of making a proper to digital integrity61.

Conclusion: An extreme, Unjustified, and Counterproductive Lockdown that Tramples Basic Rights

The practices and devices of monetary regulation impose excessive limitations on the train of a number of basic rights and freedoms. Particularly, they disproportionately scale back each financial confidentiality and the liberty to dispose of 1’s personal funds, whereas resulting in the prohibition, authorized or sensible, of applied sciences and instruments no matter their use, in addition to variations in remedy, for a given conduct, relying on the actor concerned. By extension, this offers a deadly blow to innovation in Europe.

Nevertheless, these practices and rules haven’t been justified, as their effectiveness in combating cash laundering and terrorism financing has not been “convincingly demonstrated”62, which is an obligation for the State in any endeavor to restrict freedoms.

Conversely, they pose better dangers, for people and society, than these they declare to fight, notably when it comes to the safety of private knowledge (the truth that people can not escape a serious threat regarding very delicate knowledge additionally constitutes an infringement of their dignity).

Lastly, their value to the financial system – and thus the liberty of enterprise – alone surpasses the proceeds of the crimes they declare to focus on.

In these circumstances, the infringements on the aforementioned basic rights are arbitrary and unacceptable in a democratic society.

Extra particularly, firstly, the rights to dignity, self-determination, and resistance to oppression are trampled upon. A considerable a part of the precise to property is nothing greater than a chimera in a Europe the place people should search permission earlier than spending their very own cash, with out being sure that it’ll not be blocked the following day for a purpose that has no authorized foundation and in opposition to which there isn’t a efficient treatment. The liberty of commerce and business is curtailed by the shortcoming to develop progressive instruments.

The appropriate to privateness, extra typically, can also be violated to the purpose of annihilating its very essence: when nameless cryptos are banned, and transfers with out KYC are blocked, earlier than any suspicion of wrongdoing and due to this fact no matter their illicit use or not, it’s privateness itself that’s focused, although it constitutes the traditional train of privateness.

But, the precise to privateness safety is a pillar of democracy: described as “essentially basic” in that it “preconditions the enjoyment of most different rights and freedoms”63, it’s supposed “to make sure the event, with out exterior interference, of the persona of every particular person in relations with others,” to make use of the phrases of the European Courtroom of Human Rights (ECHR)64. This capability for private growth, related to the liberty to make selections in full confidentiality, ensures the “democratic functioning of society”65.

To impose limitations on any of those basic freedoms, a transparent and exact authorized foundation, motivated by a demonstrated necessity, strictly proportionate, with ensures to attest to it’s rightly anticipated.

However none of that is complied with because it stands. It’s the introduction of a presumption of guilt that paves the way in which for the selective software of disproportionate legal guidelines, by governments, but in addition by monetary actors. The hypertrophy of the banking sector is certainly largely the kid of those rules, imposing staggering prices and consequently focus, protected by big entry limitations, main de facto to recurring abuses of dominant place.

Preventive management of everybody, on a regular basis, earlier than the slightest suspicion of committing an offense, turns into the norm. Though the European Courtroom of Human Rights and the Courtroom of Justice of the European Union prohibit it. For firms topic to those rules, the absence of management turns into an offense, in violation of main legislation.

This case ought to frighten any citizen needing to stay in a liberal democracy.

Because of Estelle De Marco, Physician of Personal Regulation and Legal Sciences, professional with the Council of Europe specializing within the safety of basic rights, for her contribution on authorized developments.

[36] World Financial institution Group, What Does Digital Cash Imply for Rising Market and Creating Economies?, 2022, https://documents1.worldbank.org/curated/en/099736004212241389/pdf/P17300602cf6160aa094db0c3b4f5b072fc.pdf

[37] Anti-Cash Laundering Regulation EU, 2024, https://www.europarl.europa.eu/doceo/doc/TA-9-2024-0365_EN.pdf

[38] Cour EDH, Podchasov v. Russia, https://hudoc.echr.coe.int/?i=001-230854.

[39] Does crime nonetheless pay? Legal Asset Restoration within the EU, Survey of Statistical Data 2010–2014, 2016, https://www.europol.europa.eu/cms/websites/default/recordsdata/paperwork/criminal_asset_recovery_in_the_eu_web_version.pdf

[40] Voir les références dans le papier de Ronald Pol.

[41] Paul Vieira, Canada’s Use of Emergency Powers to Finish Trucker Protests Was Unconstitutional, Decide Guidelines, 2024, https://www.wsj.com/world/americas/canadas-use-of-emergency-powers-to-end-trucker-protests-was-unconstitutional-judge-rules-6a537434

[42] https://twitter.com/Nigel_Farage/standing/1674357026921623552

[43] Ben Quinn, Jim Waterson, BBC writes to Farage to apologise over Coutts checking account report, 2023, https://www.theguardian.com/politics/2023/jul/24/bbc-writes-to-farage-to-apologise-over-coutts-bank-account-report

[44] https://twitter.com/DavidDavisMP/standing/1681656257600532481

[45] Human Rights Basis, The Monetary Freedom Report #17, 2024, https://mailchi.mp/hrf.org/hrfs-weekly-financial-freedom-report-290691

[46] https://twitter.com/incindia/standing/1770707793730838967?mc_eid=332f07f5f9

[47] Predominant Modi opponent Kejriwal challenges arrest forward of India election, 2024, https://www.france24.com/en/asia-pacific/20240322-modi-s-main-opponent-kejriwal-held-in-graft-probe-ahead-of-indian-elections

[48] https://english.ccourt.go.kr/ “Id Verification System on Web”, 23 Août 2012

[49] Marc L. Ross, HSBC’s Cash Laundering Scandal, 2023, https://www.investopedia.com/stock-analysis/2013/investing-news-for-jan-29-hsbcs-money-laundering-scandal-hbc-scbff-ing-cs-rbs0129.aspx#:~:textual content=HSBCpercent20Bankpercent20USApercent20launderedpercent20percent24881,topercent20resultpercent20frompercent20systematicpercent20failures.

[50] Trial Begins for Ex-UBS Banker Accused of Hiding $20 Billion in US Belongings, 2014, https://www.occrp.org/en/each day/2675-trial-begins-for-ex-ubs-banker-accused-of-hiding-20-billion-in-us-assets

[51] BNP Paribas accepte de payer une amende document aux Etats-Unis, 2014, https://www.leparisien.fr/economie/bnp-paribas-le-montant-de-l-amende-fixe-ce-lundi-soir-30-06-2014-3964657.php

[52] Teis Jensen, Danske Financial institution’s 200 billion euro cash laundering scandal, 2018, https://www.reuters.com/article/idUSKCN1NO10D/

[53] Dominic Rushe, Jill Treanor, Normal Chartered financial institution accused of scheming with Iran to cover transactions, 2012, https://www.theguardian.com/enterprise/2012/aug/06/standard-chartered-iran-transactions#:~:textual content=Normalpercent20Charteredpercent20bankpercent20ranpercent20a,ofpercent20thepercent20UKpercent2Dbasedpercent20bank.

[54] Violation Tracker, Mum or dad Firm JP Morgan Chase https://violationtracker.goodjobsfirst.org/?guardian=jpmorgan-chase

[55] Todd Haselton, Credit score reporting agency Equifax says knowledge breach may probably have an effect on 143 million US customers, 2017, https://www.cnbc.com/2017/09/07/credit-reporting-firm-equifax-says-cybersecurity-incident-could-potentially-affect-143-million-us-consumers.html

[56] FCA, Last Discover to Equifax Limitless, 2023, https://www.fca.org.uk/publication/final-notices/equifax-limited-2023.pdf

[57] Tara Siegel Bernard, Methods to Shield Your self After the JPMorgan Hacking, 2014, https://www.nytimes.com/2014/10/04/your-money/jpmorgan-chase-hack-ways-to-protect-yourself.html

[58] Scott Ferguson, HSBC Information Breach Exhibits Failure to Shield Passwords & Entry Controls, 2018, https://www.darkreading.com/cyber-risk/hsbc-data-breach-shows-failure-to-protect-passwords-access-controls

[59] Elise Viebeck, HSBC Finance alerts clients to knowledge breach, 2015, https://thehill.com/coverage/cybersecurity/239408-hsbc-finance-alerts-customers-to-data-breach/

[60] Carly Web page, Revolut confirms cyberattack uncovered private knowledge of tens of hundreds of customers, 2022 https://techcrunch.com/2022/09/20/revolut-cyb erattack-thousands-exposed/

[61] 2023 Information Breach Report, Id Theft Useful resource Middle, 2024, https://www.idtheftcenter.org/wp-content/uploads/2024/01/ITRC_2023-Annual-Information-Breach-Report.pdf

[62] Federal Commerce Fee, Id Theft Reviews, 25 avril 2024 (données du 31 mars 2024), https://public.tableau.com/app/profile/federal.commerce.fee/viz/IdentityTheftReports/TheftTypesOverTime

[63] TransUnion, TransUnion Evaluation Finds Artificial Id Fraud Rising to File Ranges, 24 août 2023, https://newsroom.transunion.com/transunion-analysis-finds-synthetic-identity-fraud-growing-to-record-levels/

[64] Yannick Chavanne, Genève fait determine de pionnier en introduisant l’intégrité numérique dans sa Structure, 2023, https://www.ictjournal.ch/information/2023-06-19/geneve-fait-figure-de-pionnier-en-introduisant-lintegrite-numerique-dans-sa

[65] Cour EDH, ch., 25 février 1993, Crémieux c. France, req. n°11471/85, § 38, https://hudoc.echr.coe.int/fre?i=001-62362.

[66] Antoinette Rouvroy et Yves Poullet, ‘The appropriate to Informational Self-Willpower and the Worth of Self-Improvement: Reassessing the Significance of Privateness for Democracy’, in Serge Gutwirth et al., Reinventing Information Safety?, janvier 2009, p. 45–76, https://www.researchgate.web/publication/225248944_The_Right_to_Informational_Self-Determination_and_the_Value_of_Self-Development_Reassessing_the_Importance_of_Privacy_for_Democracy , p. 16. See additionally Fabrice Rochelandet, ‘II. Quelles justifications à la vie privée ?’, in Économie des données personnelles et de la vie privée (2010), p. 21–37, https://www.cairn.information/Economie-des-donnees-personnelles-et-de-la-vie-pri–9782707157652-page-21.htm?contenu=resume. Voir aussi Antoine Buyse, ‘The Function of Human Dignity in ECHR Case-Regulation’, 21 octobre 2016, https://www.echrblog.com/2016/10/the-role-of-human-dignity-in-echr-case.html .

[67] CEDH, Botta v. Italie, 1998, §32, https://hudoc.echr.coe.int/eng?i=001-62701.

[68] Antoinette Rouvroy et Yves Poullet, précités, p. 13.

It is a visitor publish by Alexandre Stachtchenko. Opinions expressed are solely their very own and don’t essentially replicate these of BTC Inc or Bitcoin Journal.