Crypto analyst Rekt Capital has supplied insights into when the value of Bitcoin will attain its cycle highs. His evaluation has supplied reassurance that the flagship crypto continues to be removed from a market prime regardless of its current decline to new lows this week.

Associated Studying

When Will Bitcoin Peak In This Bull Run

Rekt Capital talked about in an X (previously Twitter) publish that Bitcoin may peak on this cycle someday in mid-September or mid-October 2025 if historical past have been to repeat itself. The analyst famous that Bitcoin peaked 518 days after the halving occasion in the course of the 2017 bull run and 546 days after the halving occasion in the course of the 2021 bull run.

Primarily based on this, the analyst predicts that Bitcoin’s market prime on this bull may happen between 518 and 546 days after the halving occasion, which occurred earlier in April. This timeline places the projected peak for Bitcoin someday in September or October subsequent 12 months. In the meantime, Rekt Capital once more alluded to the truth that Bitcoin was accelerating on this cycle by 260 days earlier this 12 months.

Nevertheless, that’s now not the case because of the over three-month consolidation interval the flagship crypto has skilled because the halving occasion. Rekt Capital claimed that the speed of acceleration has “drastically dropped and is now roughly 150 days.” He added that Bitcoin will probably resynchronize with the normal halving cycle the longer it consolidates.

The crypto analyst has additionally refused to be deterred by Bitcoin’s present worth motion, which some declare means that the bull run is over. Nevertheless, Rekt Capital has repeatedly acknowledged that Bitcoin will retrace deep sufficient to persuade anybody that the bull run is over, after which it would proceed its uptrend.

In one other X publish, Rekt Capital talked about that Bitcoin’s downtrend, which started final month, is one to observe for a significant pattern shift. The analyst remarked {that a} break of the “multi-week downtrend would consequence at first of at the very least a multi-week uptrend” for the flagship crypto.

Bitcoin is now buying and selling at $56,693. Chart: TradingView

‘This Is Not The Cycle Prime Vibes’

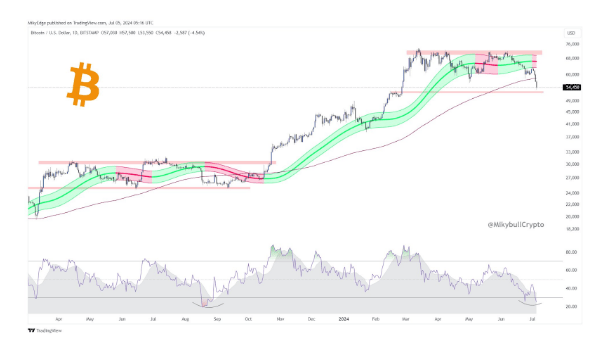

Crypto analyst Mikybull Crypto additionally believes that the cycle prime isn’t in but regardless of Bitcoin’s current decline, stating that this worth motion “will not be the cycle prime vibes.” The analyst additionally mentioned that Bitcoin’s present sell-off backside may be nearer than everybody thinks and famous that this situation performed out within the third quarter of 2023 when most individuals thought it was over.

Associated Studying

The analyst beforehand talked about that the cycle prime isn’t in but and easily categorised this market downtrend because the “last shakeout” earlier than Bitcoin reaches its peak on this bull run. Mikybull Crypto additionally claimed that Bitcoin has a cycle prime worth goal of $171,000, that means that the flagship crypto will nonetheless hit new all-time highs (ATHs) earlier than the bull run was thought of as being over.

Featured picture from Getty Photographs, chart from TradingView