An Ethereum whale has prompted panic amongst group members following a current transaction suggesting they is likely to be seeking to offload their holdings. This comes amid a current prediction by analysis agency Matrixport that Ethereum’s worth might considerably rebound from its present worth degree.

Ethereum Whales Transfers 11,215 ETH

Onchain knowledge reveals that the Ethereum whale transferred 11,215 ETH ($34.3 million) to the crypto alternate Coinbase. A dealer often makes such a transfer when promoting these tokens, and contemplating the quantity of tokens concerned, such a sale might considerably influence ETH’s worth. Nonetheless, knowledge from the market intelligence platform IntoTheBlock reveals that there is likely to be a requirement for these tokens if, certainly, this whale is seeking to offload their tokens.

Associated Studying

There was a rise of 132% within the massive holders’ netflow to alternate netflow ratio within the final seven days, which means that Ethereum whales are actively accumulating extra ETH. The move metrics additionally paint an accumulation development amongst Ethereum holders, with influx quantity into exchanges down by over 11% within the final seven days.

Throughout this era, the outflow quantity from these exchanges has elevated by 3%, additional confirming that Ethereum traders need to maintain their positions and accumulate extra ETH at this level. That is undoubtedly a optimistic improvement for Ethereum’s worth, which might witness a big rebound because of this wave of accumulation.

Analysis agency Matrixport additionally predicted that ETH’s worth would rebound from its present worth degree because of the Spot Ethereum ETFs, which they claimed might launch as early as this week.

Whereas that is still unsure, market consultants like Bloomberg analyst James Seyffart have steered that it shouldn’t be lengthy earlier than these Spot Ethereum ETFs start buying and selling. It is because fund issuers have carried out a lot of the feedback that the Securities and Alternate Fee (SEC) had on their S-1 filings.

ETH Is Primed For A Rally

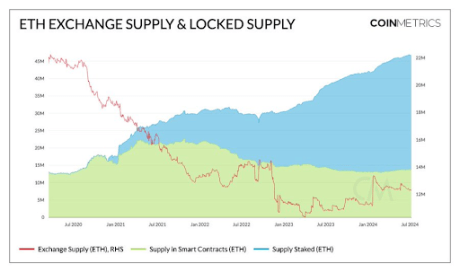

Crypto analyst Leon Waidmann talked about in an X (previously Twitter) put up that Ethereum is primed for a rally. He made this assertion primarily based on Ethereum’s dwindling provide. He famous that 40% of Ethereum’s provide is locked up, with 28% staked and the opposite 12% in sensible contracts and bridges.

Moreover, Waidmann expects this provide to proceed to cut back as soon as the Spot Ethereum ETFs start buying and selling, with institutional traders taking an enormous chunk of the provision off exchanges. Primarily based on this, Ethereum might rally on the again of the provision and demand dynamics since demand is sure to outpace provide sooner or later.

Associated Studying

Crypto analyst Follis talked about that Ethereum’s chart appears an identical to Bitcoin’s simply earlier than it pumped over 200% final 12 months. He steered that the Spot Ethereum ETFs might be the catalyst that sparks the same rally for ETH.

Featured picture created with Dall.E, chart from Tradingview.com