The rave now could be all concerning the newly launched spot bitcoin ETFs in the USA, and different nations are racing to emulate this feat.

Spot Bitcoin ETFs, designed to straight monitor the value of Bitcoin, are a game-changer. They create the crypto sector to the normal monetary markets, making it simpler for even a ‘non-crypto individual’ to take part. These ETFs are traded on regulated inventory exchanges, a well-recognized floor for conventional traders, and may be purchased in customary brokerage accounts, guaranteeing a snug funding expertise.

Nevertheless, the U.S. is just not the primary market to embrace spot Bitcoin ETFs; another nations have provided these merchandise to traders for a number of years. On this article, we’ll discover the corners of the world the place you might put money into spot Bitcoin ETFs in 2024.

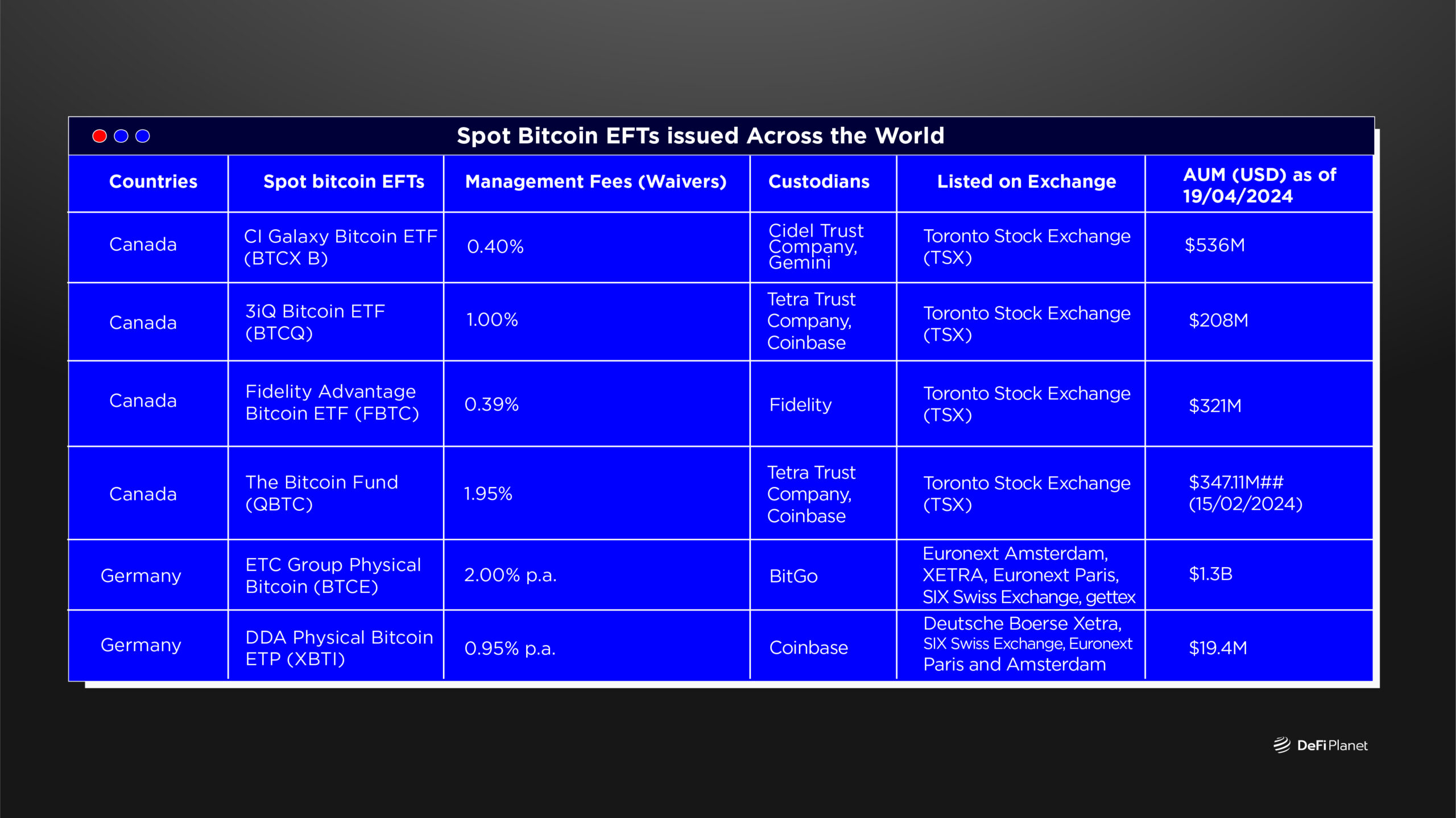

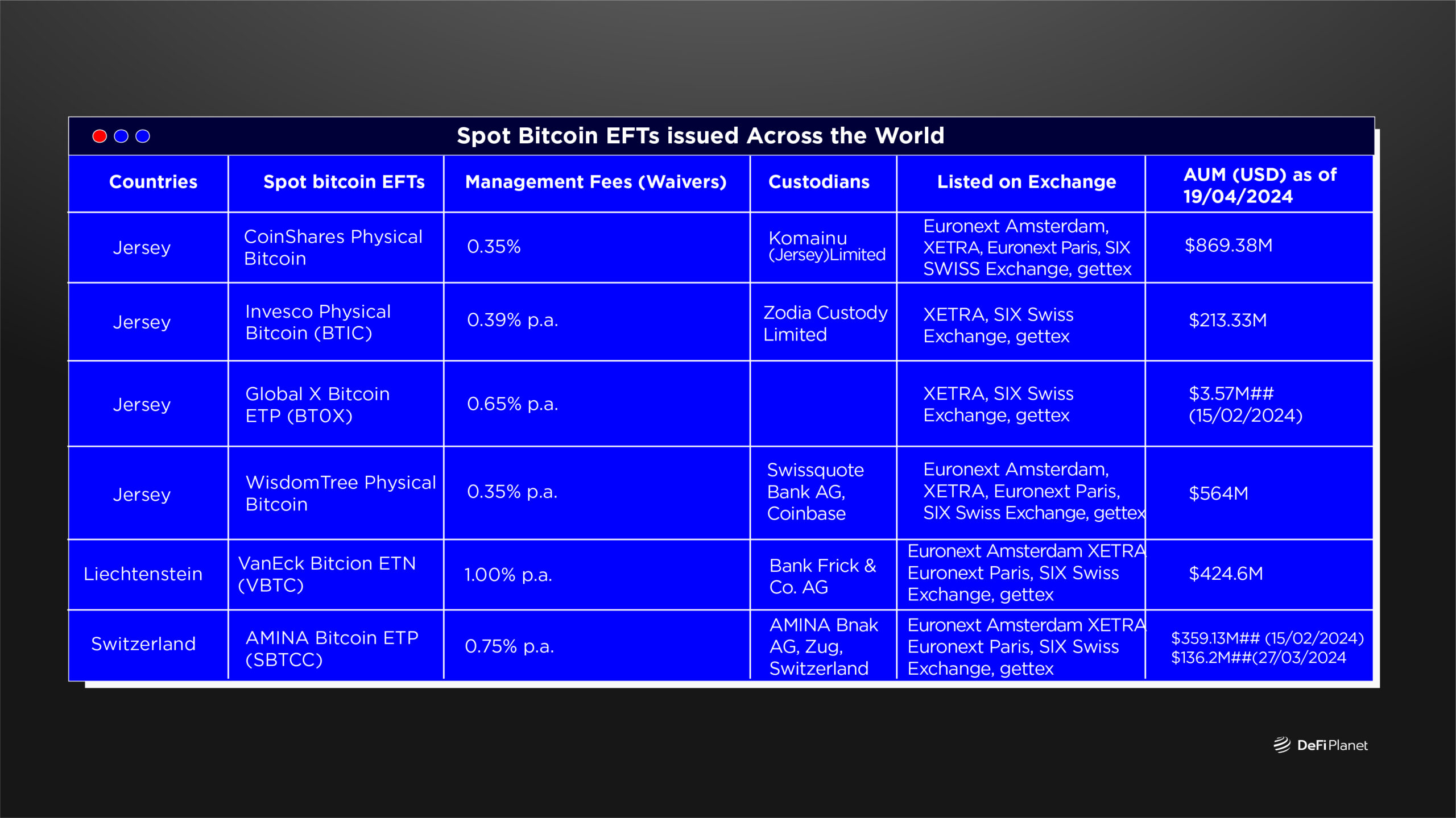

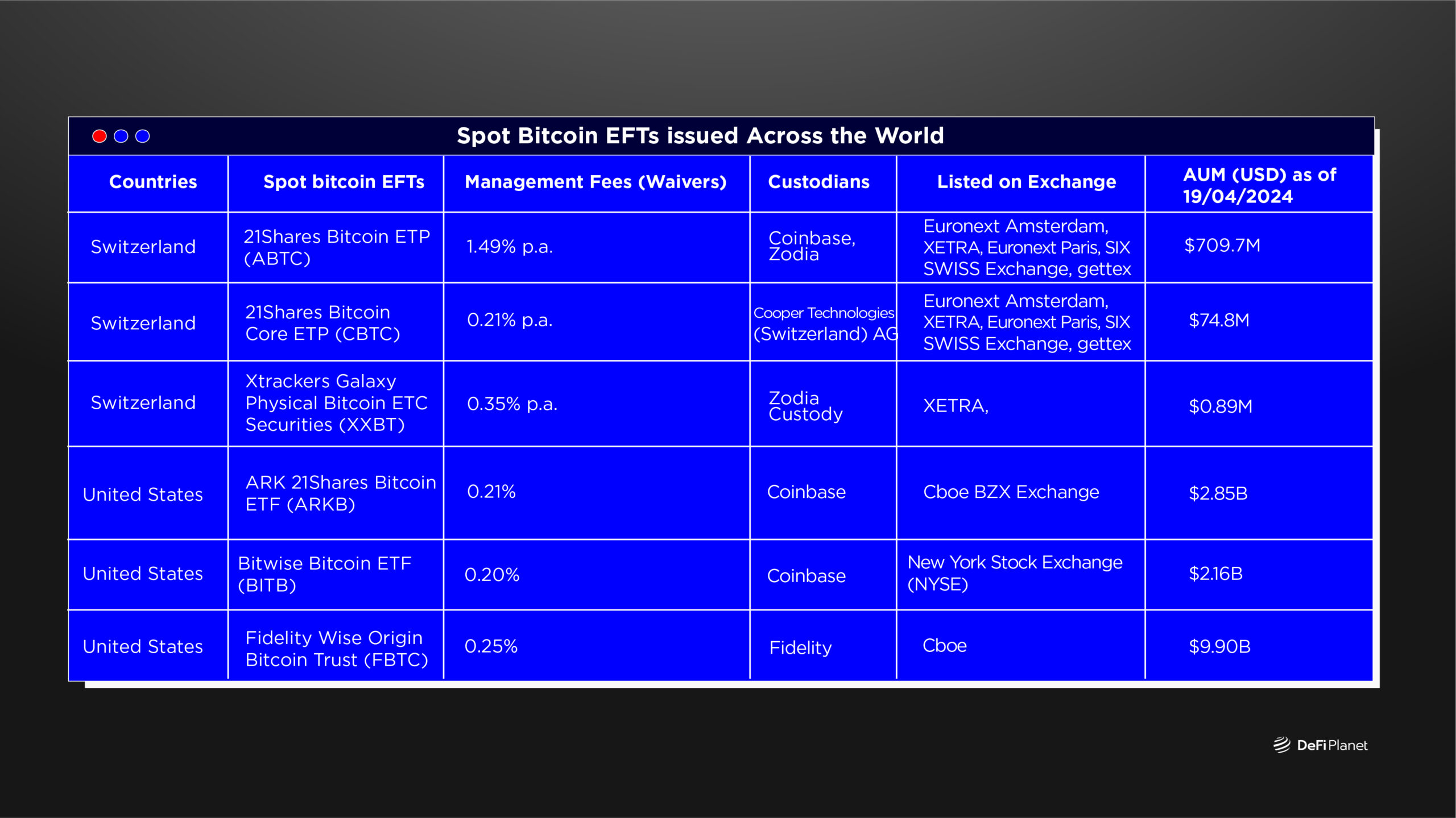

Nations The place Spot Bitcoin ETFs Are Issued Across the World

Only a heads up earlier than we start: there aren’t many nations which have authorised spot Bitcoin ETFs, however there are a few stunning names on the listing:

Australia (1 ETF)

Bermuda (1 ETF)

Brazil (2 ETFs)

Canada (6 ETFs)

Germany (3 ETFs)

Guernsey (3 ETF)

Jersey (5 ETFs)

Liechtenstein (1 ETF)

Switzerland (4 ETFs)

United States (11 ETFs)

Greater than 30 spot Bitcoin ETFs can be found globally and may be traded in 5 geographical areas. The U.S.’s addition of 11 funds made North America an even bigger hotspot, however Europe had all the time been a a lot larger market. The area collectively has 17 spot Bitcoin ETFs, with a mixed market measurement of over $3 billion.

What’s significantly fascinating is that the European market is just not dominated by the same old huge gamers. As an alternative, smaller nations, with their beneficial tax guidelines, have contributed the majority of the funds. In reality, 10 out of the 17 Funds within the European market are domiciled in Liechtenstein, Bermuda, and the British Crown Dependent Autonomous Territories of Jersey and Guernsey. This distinctive panorama hints on the potential for additional progress and diversification within the spot Bitcoin ETF market.

The South American market is far smaller, with Brazil being the most important absolutely energetic market. Notably, Brazil’s main inventory alternate, B3, hosts quite a lot of crypto-focused ETFs, with over 13 crypto ETFs and over $285 million in property beneath administration.

Regardless of the huge exercise in these areas’ crypto markets, the Asian and African markets have but to have a domestically issued spot Bitcoin ETF. The federal government and conventional monetary establishments in these locations haven’t but warmed as much as permitting cryptocurrencies in mainstream markets.

It’s some extent of pleasure that Canada was the frontrunner on this monetary product, with over six funds out there for buying and selling, even earlier than the U.S. entered the scene. The nation’s approval of the primary pure-play Bitcoin ETFs for buying and selling on the Toronto Inventory Trade (TSX) as early as February 2021 was a big milestone. What’s extra, Canadians had the distinctive alternative to put money into them through tax-sheltered accounts resembling tax-free financial savings accounts or registered retirement financial savings plans, additional demonstrating Canada’s progressive method to monetary innovation.

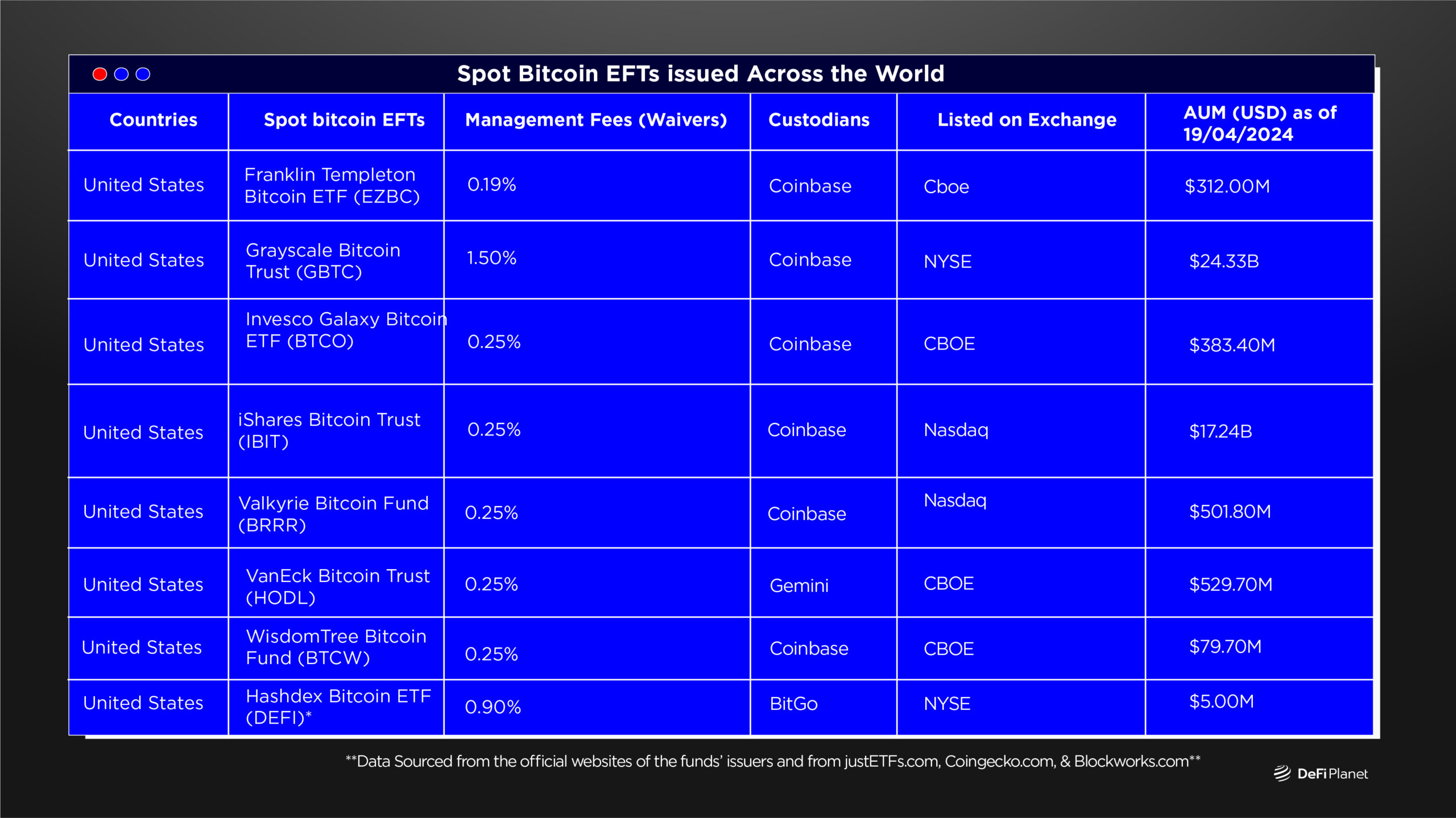

Determine 1: Spot Bitcoin ETFs issued Throughout the World

Buying and selling and Issuing ETFs: What’s the Distinction?

Issuing spot Bitcoin ETFs entails creating and launching a brand new ETF that holds Bitcoin. This requires acquiring regulatory approvals, establishing custody options for securely holding the Bitcoin property, and guaranteeing compliance with numerous necessities.

Then again, buying and selling spot Bitcoin ETFs is a simple course of. It merely entails the shopping for and promoting of shares of those ETFs. These shares are generally traded on inventory exchanges, offering traders with a readily accessible avenue by way of brokerage accounts or specialised funding automobiles like retirement accounts.

Naturally, residents of any nation the place a spot Bitcoin ETF is issued can commerce the fund. However generally, one may nonetheless have the ability to commerce a fund legally though it’s not issued in a single’s nation of residence. As an example, along with a domestically issued spot Bitcoin ETF, Brazilians can commerce BlackRock’s $iBIT, issued within the U.S.

Different Locations The place You Can Commerce Spot Bitcoin ETFs

Other than the nations the place spot Bitcoin ETFs are issued, there are a number of different jurisdictions the place traders can commerce these ETFs, both by way of native exchanges or abroad platforms. Notable ones embrace:

1. Chile

Traders can commerce the Function Bitcoin ETF from Canadian issuer Function Investments on the Santiago Inventory Trade. Moreover, they’ve the choice to commerce Brazil’s HASH11, although not as an ETF however as an funding fund which makes use of the ETF shares because the underlying asset.

2. India

In contrast to Chileans, Indians, particularly the rich ones, commerce spot Bitcoin ETFs on abroad platforms, not native exchanges. Native platforms like Vested Finance and Mudrex allow them to purchase models of U.S. spot bitcoin ETFs through a particular avenue that enables them to maximise the 30% capital tax on crypto investments required by Indian legal guidelines.

3. Thailand

Following the approval of spot Bitcoin ETFs within the U.S., Thailand’s monetary regulator has up to date laws to permit native skilled traders to commerce these funds. Retail traders can put money into funds arrange by these professionals to realize publicity to the ETFs.

4. United Arab Emirates (Dubai)

A yr after Canada’s 3iQ debuted its ETF within the Canadian market, it expanded to Dubai. The agency’s The Bitcoin Fund ETF grew to become the primary listed digital asset-based fund within the Center East and North Africa area. The fund was listed on Nasdaq Dubai, and permits native traders to buy shares.

To Sum Up

The introduction of spot Bitcoin ETFs to the U.S. markets definitely elevated the recognition of this “area of interest” monetary market and, by extension, the crypto sector. With the present local weather within the monetary sector, it’s sure that many extra territories will be a part of the pack quickly.

This enhance in adoption and regulatory alignment of cryptocurrencies provide thrilling alternatives for each seasoned cryptocurrency traders and people new to the area. Crypto ETFs are bridging the hole between conventional finance and crypto, which have been lengthy seen as two opposing forces. This was certain to occur, in the end in any case.

Then again, navigating the crypto market requires a balanced method—enthusiasm for innovation coupled with a eager consciousness of its complexities. Thus, as with all monetary instrument, traders ought to conduct thorough analysis on every ETF and consider the way it aligns with their particular person funding aims and threat tolerance earlier than making selections.

Disclaimer: This text is meant solely for informational functions and shouldn’t be thought of buying and selling or funding recommendation. Nothing herein ought to be construed as monetary, authorized, or tax recommendation. Buying and selling or investing in cryptocurrencies carries a substantial threat of economic loss. All the time conduct due diligence.

If you need to learn extra articles (information reviews, market analyses) like this, go to DeFi Planet and comply with us on Twitter, LinkedIn, Fb, Instagram, and CoinMarketCap Neighborhood.

“Take management of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics instruments.”