Of their newest evaluation, Ark Make investments’s crypto specialists Julian Falcioni, David Puell, and Dan White, are presenting a evaluate of the Bitcoin market habits and prospects, delineating the interaction of varied financial, technical, and policy-driven components that would form the way forward for this pioneering digital foreign money.

Bitcoin Validates The Bullish Situation

Since early June, Bitcoin witnessed a big decline, dropping greater than -25%. Extra critically, on July 7, BTC fell beneath its 200-day transferring common—a key technical threshold. In line with Ark, the dip beneath the 200-day transferring common was “an important bearish sign that usually precedes additional declines except a powerful restoration ensues.” Finally, Bitcoin displayed important power in the previous few days and Ark was proper in that BTC staged a fast restoration above the 200-day EMA, invalidating the bearish prospects.

A shocking factor in June’s Bitcoin volatility was the aggressive sale of roughly 50,000 Bitcoins by the German authorities. These property had been seized from the unlawful streaming web site Movie2K and steadily transferred to varied exchanges on the market, beginning June 19. “The inflow of a giant quantity of bitcoins throughout a historically low liquidity interval, across the July 4th vacation, considerably pressured the worth downward,” the report notes. Notably, this promoting stress is now gone.

Associated Studying

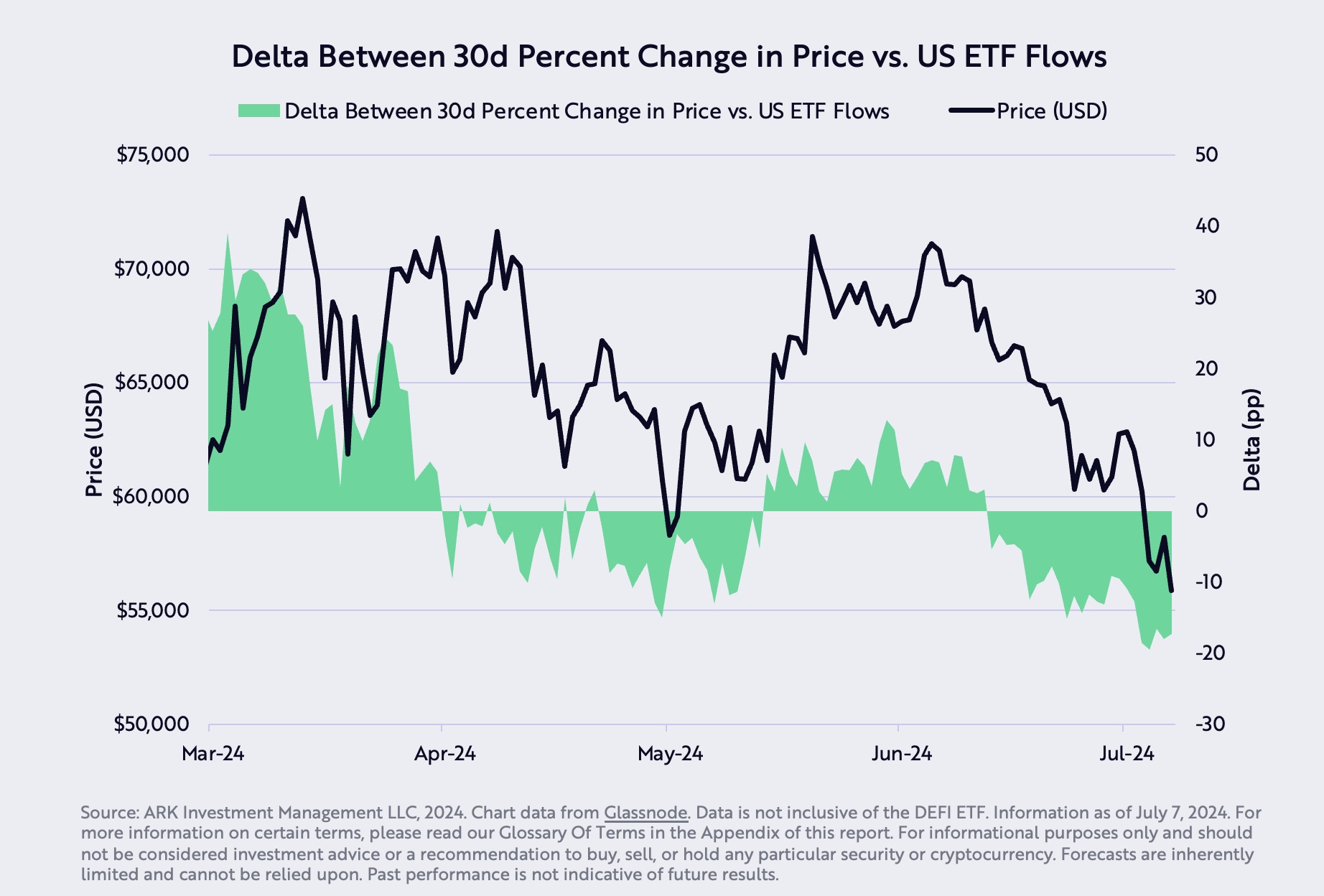

Regardless of these challenges, Bitcoin managed a formidable rally of greater than 17% in the previous few days. A number of indicators supported this reversal, in accordance with Ark. The discrepancy between the decline in Bitcoin’s worth and the lesser drop in US ETF balances—17.3 %—advised that Bitcoin was oversold. “This overselling is probably going pushed by exterior shocks relatively than intrinsic market actions, pointing in the direction of a mispricing that would appropriate within the medium time period,” the specialists clarify.

Brief-term holders, sometimes a extra speculative section, have been realizing losses as indicated by the sell-side threat ratio. This ratio, calculated by dividing the sum of short-term holder income and losses realized on-chain by their value bases, confirmed extra losses than income, which generally precedes a short-term market correction.

Associated Studying

June additionally noticed important exercise from Bitcoin miners. “Miner outflows, which regularly prelude market changes, mirrored patterns noticed round earlier Bitcoin halving occasions, when the reward for mining a block is halved,” says Ark. Such occasions traditionally result in a decreased provide and potential worth will increase as market dynamics alter to the brand new provide degree.

On the macroeconomic entrance, the report notes that the US financial knowledge have been persistently underperforming in opposition to expectations, with the Bloomberg US Financial Shock Index registering probably the most important unfavorable deviations in a decade. But, the Federal Reserve has maintained a surprisingly hawkish tone, which may affect investor sentiment and monetary market stability.

Company America isn’t insulated from these challenges. Revenue margins, which peaked in 2021, are on a downward trajectory as corporations lose pricing energy as Ark notes. This squeeze on income is prompting worth cuts throughout numerous sectors, additional dampening financial outlooks.

Relating to fairness markets, there was a notable enhance in market capitalization focus, reaching ranges unseen for the reason that Nice Despair. “This focus in bigger entities with important money reserves could possibly be an early indicator of a shifting financial panorama, which traditionally sees a breakout in favor of smaller cap shares,” the report says.

At press time, BTC traded at $63,131.

Featured picture created with DALL·E, chart from TradingView.com