Like Bitcoin and prime altcoins, together with Solana, Ethereum is holding regular. On the time of writing, it’s buying and selling above the native assist at $3,300 and floating increased, concentrating on $3,700.

Speculators Flowing To ETH As Bulls Set Sight On $3,700

The leg up is fueled by a number of market-related components, primarily the anticipated launch of spot Ethereum ETFs within the subsequent few days. As seen from the every day chart, information of the US Securities and Change Fee (SEC) fast-tracking the approval of 19b-4 types sparked a wave of demand from Might 20.

Nevertheless, speculators are permeating the scene whilst costs stay regular and uptrend. CryptoQuant knowledge reveals that the estimated leverage ratio has risen up to now few buying and selling days.

With this studying ticking increased, the ETH scene receives extra leveraged merchants eager extra on making the most of worth volatility somewhat than benefiting from what ETH as a digital asset presents.

In accordance with CryptoQuant, the estimated leverage ratio stood at 0.347 on July 16 earlier than rising to 0.354 on July 17. The enlargement means that merchants are more and more borrowing funds on perpetual buying and selling platforms like Binance and OKX, hoping to make a killing if ETH bulls push costs above $3,700.

As costs rally, the estimated leverage ratio will possible climb even increased. The native prime is at 0.358, as recorded on July 14. The all-time leverage ratio was at 0.392, registered in early July 2024.

Eyes On Spot Ethereum ETFs: Will It Be A Success?

Ethereum merchants are assured that costs will rise, even breaching all-time highs, as soon as spot ETH ETFs are launched. The most recent experiences present that the spinoff product will launch early subsequent week, permitting institutional traders to achieve publicity.

The USA SEC has given the inexperienced gentle to 3 issuers to launch. Nevertheless, it’s anticipated that every one spot Ethereum ETF candidates whose 19b-4 types have been permitted might be permitted to launch concurrently.

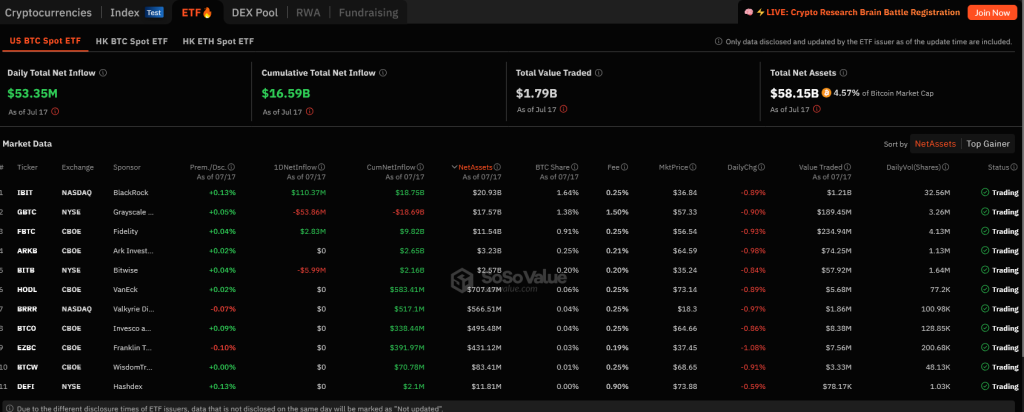

Confidence is excessive that spot Ethereum ETFs will observe the success of their spot Bitcoin ETFs. In accordance with SosoValue, all spot Bitcoin ETF issuers handle over $53 billion of BTC as of July 18.

Even so, although extremely anticipated and more likely to positively impression costs, the product will see a unique degree of demand than when spot Bitcoin ETFs launched.

Analysts pin this to Ethereum’s decrease market cap and the US SEC’s resolution to not enable spot ETF issuers to stake ETH. By staking, issuers would obtain rewards on behalf of their purchasers.

Function picture from Canva, chart from TradingView