Bitcoin miner Riot Platforms reported a internet lack of $84.4 million for the second quarter, in comparison with a internet lack of $27.4 million throughout the identical interval final 12 months.

Regardless of the monetary setback, the corporate reported $70.0 million in income for the quarter, down barely from $76.7 million within the prior 12 months. The outcomes mirror a difficult atmosphere following the Bitcoin community’s current ‘halving’ occasion.

Riot Platforms’ loss per share for the three months ending June 30 stood at $0.32.

Q2 outcomes

The agency’s internet loss was pushed by a $76.4 million lower within the truthful worth of Bitcoin, a non-cash stock-based compensation expense of $32.1 million, and depreciation and amortization of $37.3 million.

The miner additionally reported a 52% decline in Bitcoin manufacturing, which dropped to 844 Bitcoin from 1,775 within the second quarter of 2023. Nonetheless, Riot Platforms managed to take care of sturdy gross margins regardless of the decline with income on par with the earlier 12 months.

The ‘halving’ occasion and elevated community issue contributed to the next common direct price to mine Bitcoin, which rose to $25,327 from $5,734 per Bitcoin within the second quarter of 2023.

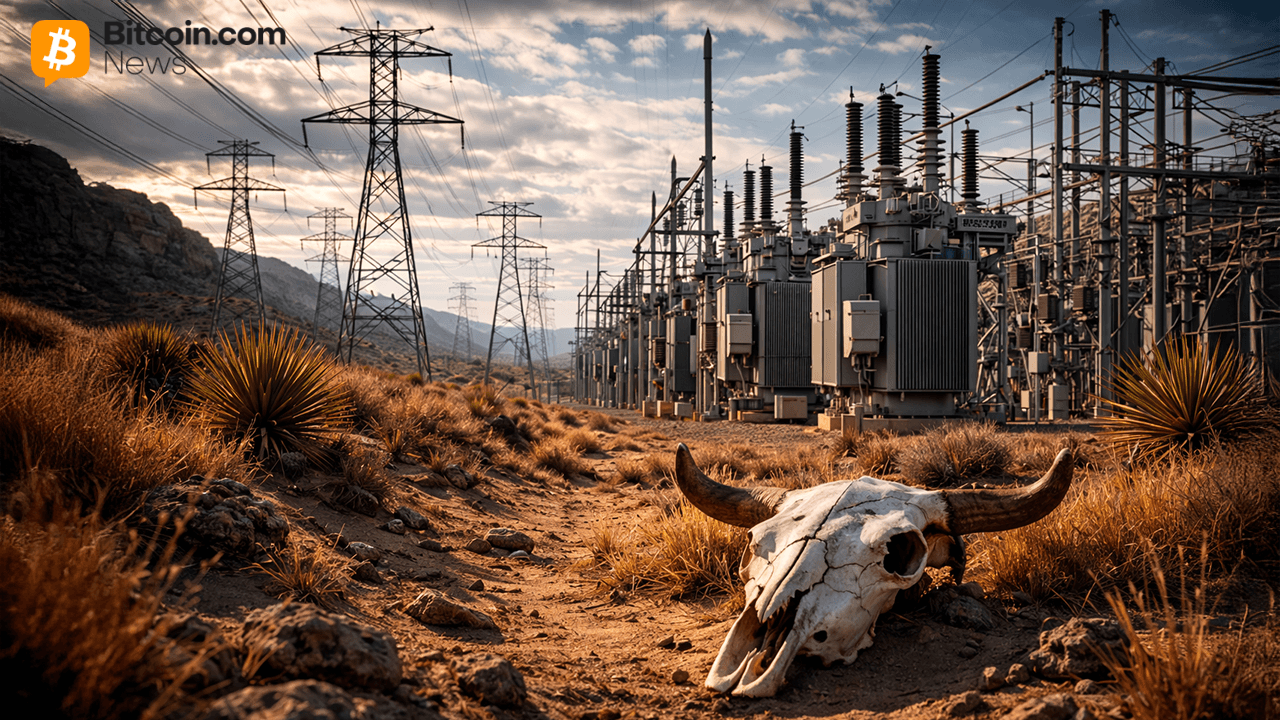

The corporate reported $13.9 million in energy credit for the quarter, together with $4.4 million from demand response applications, which helped scale back its common vitality price.

Riot ended the second quarter with $646.5 million in working capital, together with $481.2 million in money available, and held 9,334 unencumbered Bitcoin, valued at roughly $585.0 million.

Wanting forward, Riot Platforms anticipates attaining a complete self-mining hash fee capability of 36 EH/s by the top of 2024 and growing its 2025 deployed hash fee steerage from 40 EH/s to 56 EH/s.

Growth

Riot CEO Jason Les highlighted the corporate’s achievements, together with the profitable energization of its second large-scale facility in Corsicana, Texas. The ability added two buildings with a complete capability of 200 megawatts (MW), with the remaining two buildings anticipated to be operational by the top of 2024.

Moreover, Riot expanded operations at its Rockdale Facility and practically doubled its put in hash fee to 22 exahashes per second (EH/s) by the top of the quarter.

In July, Riot Platforms additional strengthened its progress pipeline by buying Block Mining Inc., a vertically built-in Bitcoin miner in Kentucky. The acquisition introduced 60 MW of energy capability throughout two services, with potential enlargement to over 300 MW by the top of 2025.

The corporate plans to leverage its sturdy stability sheet and skilled growth groups to proceed constructing best-in-class Bitcoin mining services.

Talked about on this article