MATIC bulls fumbled the bag after the market panic that turned the correction part right into a nosedive. The newest market information reveals MATIC took a beating with a 33% wipe in worth since final week. Hostile market surroundings and macroeconomic fears proceed to plague the broader monetary world.

Associated Studying

The crypto market was not spared. The entire market depreciated by nearly 17% previously 24 hours, marking a interval of robust bearish stress. Regardless of the overwhelming downward trajectory the market has taken, on-chain developments proceed which may gradual the bearish wave, however it’s going to take time earlier than the worth mediates again to reasonable ranges.

Extra Developments

Polygon’s place continues to solidify because it marks a number of developments that enhance consumer expertise on the platform. Messari, an unbiased crypto analysis platform, not too long ago launched its report, offering an outline of the Polygon ecosystem.

In abstract, the report notes a number of developments within the platform that occurred throughout the 2nd quarter of the 12 months. Primarily, the neighborhood has reached a consensus on upgrades that can positively have an effect on the community’s usability and efficiency. Certainly one of these would be the change from MATIC to POL, which is scheduled to happen on September 4th.

To draw devs to Polygon, the platform created a $1 billion Neighborhood Grants Program (CGP), supporting devs and builders of Polygon financially. Based on a June blogpost, Season 1 of the CGP will function a 35 million MATIC pool which is roughly equal to $12.9 million utilizing at this time’s costs.

Uniswap has additionally launched its Uniswap v3 marketing campaign on Polygon with different $250k in rewards on Oku, a crypto buying and selling platform. It will enhance investor confidence within the platform because it reveals that regardless of hostile market circumstances, Polygon stays a significant participant within the DeFi house.

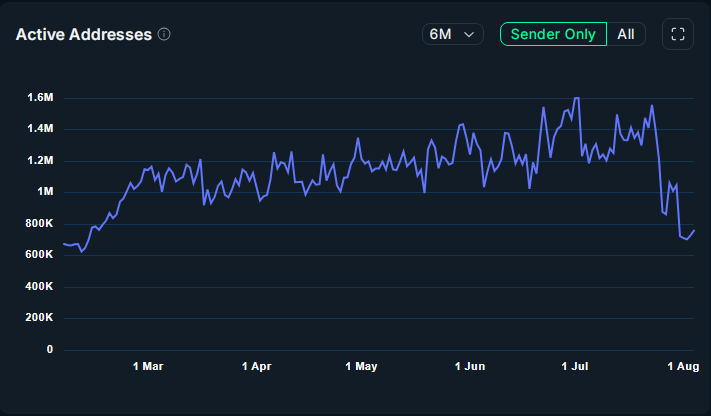

That is seen within the present metrics the platform is working on. Nansen’s information reveals a rise in lively addresses and transactions previously 24 hours, an important indicator of development exercise if it wasn’t for the air of bearishness surrounding the market.

DefiLlama, alternatively, reveals the opposite aspect of the coin with main outflows on all chains beneath the Polygon ecosystem.

MATIC: Extra Ache On The Manner For Traders?

Because the market continues its painful descent, traders are poised to let go of their MATIC holdings. Latest market information reveals that traders are dashing to exchanges to promote fairly than maintain and experience the bearish wave.

This may be seen in MATIC’s worth which continues to check the $0.339 assist degree.

Associated Studying

The market overreaction attributable to cascading fears throughout the broader monetary spectrum stays to threaten any future bullish motion. As of the second, MATIC is all the way down to March 2021 ranges, a brand new low after 2024’s early bull runs led by main cryptocurrencies like Bitcoin and Ethereum.

Traders and merchants ought to consider their positions to stay within the inexperienced. If potential, they’ll attempt to make the most of the state of affairs by shorting the token.

Featured picture from Pexels, chart from TradingView