Algorand’s ALGO has emerged as a standout performer within the cryptocurrency market within the first half of 2024, constructing on its spectacular momentum from late 2023 the place it noticed a 43% quarter-over-quarter rise in its transaction quantity and a 124.5% improve in its market worth, from $0.1033 in October to $0.2319 by December 31. This momentum carried into Q1 2024, with Algorand’s market capitalization rising by 18% quarter-over-quarter to succeed in $2.1 billion.

As a blockchain platform recognized for its pace, safety, and scalability, Algorand has attracted important consideration from traders and builders alike. This evaluation explores Algorand’s market efficiency, the elements driving its development, and professional predictions for its future.

ALGO’s Market Momentum in 2024

ALGO kicked off 2024 with robust momentum. On January 1, 2024, ALGO was buying and selling at $0.2228, and shortly surged to $0.2439 inside 24 hours. Nonetheless, by the top of January, it had dropped 32.5% to $0.1648.

Regardless of this setback, ALGO bounced again, rising 40.2% to $0.231 by February’s finish. It continued climbing, reaching $0.3206 by mid-March, however then fell 18.8%, ending Q1 at $0.2602.

At the beginning of Q2, ALGO noticed a short 2.96% improve to $0.2679 however quickly plummeted 29.9% to $0.1878 by mid-April. The token ended April at $0.1924, displaying a slight 2.45% achieve.

ALGO’s worth fluctuated in Might, dropping to $0.1713 within the first half of the month after which rising to $0.1849 inside two days. It closed Might at $0.1898, up from the beginning of the month.

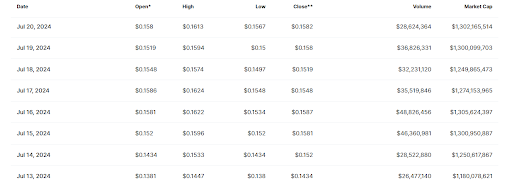

June mirrored Might’s volatility with a bearish pattern; ALGO dropped 21.0% to $0.152 by mid-June and ended Q2 at $0.1446, a 4.9% lower. In July, ALGO noticed a rebound, rising 11.6% to $0.1613 within the first 20 days.

Components Influencing ALGO’s Efficiency in 2024

Algorand’s robust efficiency in This autumn 2023 may need set the stage for its outing in 2024 H1. The blockchain added greater than 1.9 million new addresses (a 72% improve quarter-over-quarter) and noticed a 58% improve in transaction quantity—Transactions exceeded 5.5 million (highest previously yr).

Algorand made a splash in late 2023 with a flurry of thrilling updates, rolling out cool new options like a market for code snippets, and a system for tokenizing farmland.

Including to the joy, the Orange memecoin venture stepped into the highlight in Q1 2024. Orange’s distinctive “proof-of-transaction” system rewarded customers with ORA tokens for his or her exercise. With the power to regulate their transaction charges and ALGO funds, customers flocked to the platform, peaking at over 43 million transactions in simply 24 hours.

What Consultants Say concerning the Way forward for ALGO

The way forward for Algorand’s ALGO has been a subject of a lot hypothesis amongst cryptocurrency analysts and forecasting platforms. Whereas opinions fluctuate, there appears to be a common consensus that ALGO is a long-term funding, with predictions starting from cautiously optimistic to extremely bullish.

Within the quick time period, WalletInvestor stays optimistic regardless of bearish alerts, predicting ALGO may attain a excessive of $0.542 in 2024, with a year-end worth between $0.127 and $0.488. Changelly provides a extra conservative estimate for 2024, projecting a median worth of $0.171, with potential peaks of $0.149 in September and $0.167 in December.

Looking forward to 2025, analysts’ opinions diverge additional. CryptoNewsZ’s David Cox anticipates sluggish development, with ALGO probably reaching $0.57 by year-end. DigitalCoinPrice maintains a extra cautious stance, anticipating ALGO to commerce between $0.3 and $0.35. Changelly’s projection for 2025 aligns intently with DigitalCoinPrice, forecasting a median of $0.2560.

Transferring into 2026 and past, predictions grow to be extra various. Previsioni Bitcoin foresees acceleration in 2026, with ALGO probably hitting a excessive of $0.8428. In addition they spotlight a doable shopping for alternative at $0.45 in July. Changelly’s 2026 outlook is extra modest, projecting a median of $0.3578.

Lengthy-term projections present the widest disparity. Merchants Union analysts predict minimal progress, with ALGO reaching solely $0.2984 by 2030 and $0.4811 by 2034. CoinPriceForecast‘s predictions aligns considerably with this conservative outlook, predicting ALGO will rise to $0.37 by 2030 and fluctuate between $0.44 and $0.46 by 2034. In stark distinction, Coincu analysts are extremely optimistic, projecting a most of $4 by 2030 and a spread between $2.1 and $5.05 by 2034.

Buyers ought to observe that these predictions are speculative and topic to alter primarily based on market situations, technological developments, and regulatory developments. It’s essential to conduct thorough analysis and think about a number of views when making funding selections within the risky cryptocurrency market.

Lastly, as Algorand continues to develop its expertise and ecosystem, the longer term efficiency of its native token will doubtless depend upon its skill to keep up innovation, handle challenges in governance and stablecoin markets, and adapt to the evolving regulatory panorama within the cryptocurrency sector.

Disclaimer: This text is meant solely for informational functions and shouldn’t be thought-about buying and selling or funding recommendation. Nothing herein ought to be construed as monetary, authorized, or tax recommendation. Buying and selling or investing in cryptocurrencies carries a substantial danger of economic loss. At all times conduct due diligence.

If you want to learn extra market analyses like this, go to DeFi Planet and observe us on Twitter, LinkedIn, Fb, Instagram, and CoinMarketCap Group.

“Take management of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics instruments.”