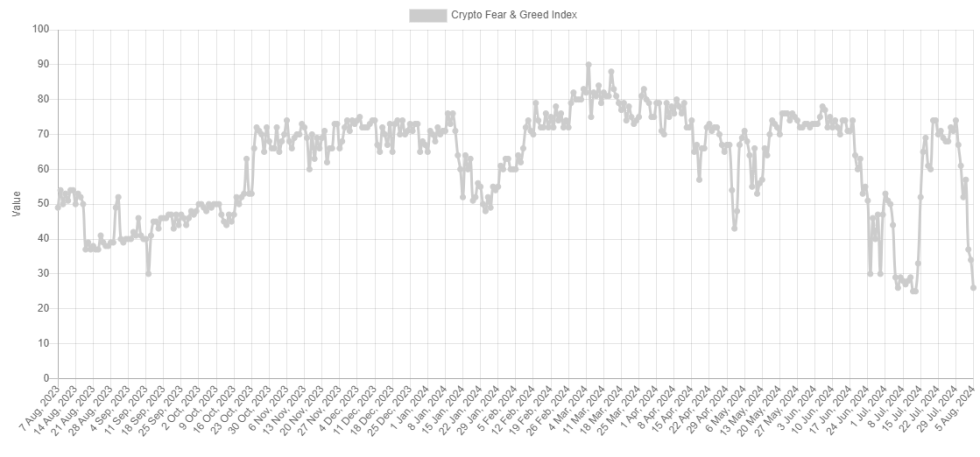

Knowledge exhibits the Bitcoin Worry & Greed Index is correct exterior the doorway of the intense greed territory after the newest crash in BTC’s value.

Bitcoin Worry & Greed Index Is At the moment Deep Into The Worry Area

The “Worry & Greed Index” is an indicator devised by Various that mainly tells us in regards to the sentiment the common dealer holds in direction of the Bitcoin and wider cryptocurrency market proper now.

This indicator determines the sentiment utilizing information of the next 5 elements: volatility, buying and selling quantity, social media sentiment, market cap dominance, and Google Developments.

To signify this mentality, it makes use of a easy scale that runs from zero to hundred. All values above the 53 mark suggest the presence of greed among the many buyers, whereas these below 47 recommend concern available in the market. The area in-between these two thresholds corresponds to impartial sentiment.

Now, here’s what the Bitcoin Worry & Greed Index is at the moment trying like:

The worth of the metric seems to be 26 in the meanwhile | Supply: Various

As is seen above, the Bitcoin Worry & Greed Index has a worth of 26 proper now, which suggests the market is deep into the concern territory. The truth is, this stage is almost deep sufficient to qualify for a particular zone referred to as excessive concern.

Excessive concern happens when the index dips below 25 and corresponds to intense bearish sentiment available in the market. There’s a related zone for the greed aspect, referred to as excessive greed, which takes place above 75.

Apparently, solely per week in the past, the Bitcoin market was sitting on the verge of the latter area, however it’s now already on the alternative finish of the spectrum, because the under chart exhibits.

Seems like the worth of the index has seen a steep drop in current days | Supply: Various

The rationale behind this sharp change in market sentiment is of course the bearish trajectory BTC has adopted over the previous week, together with the crash that has occurred over the past 24 hours.

From the chart, it’s obvious, although, that the grasping market sentiment in direction of the tip of July was solely reached after the same sharp reversal within the indicator from concern ranges just like now.

These lows within the metric within the first half of July had marked a backside for the asset and because it has turned out, the almost extraordinarily grasping values on the finish of the month had made a prime.

This sample is definitely one thing that has traditionally been witnessed; Bitcoin has tended to maneuver within the course reverse to what the gang expects. These opposite strikes have often been essentially the most possible inside the intense zones, because the market expectation is the strongest in them.

Provided that the final couple of reversals occurred simply exterior these zones, although, it’s doable one other one might occur for the cryptocurrency on the present almost extraordinarily fearful stage as properly.

It now stays to be seen how the sentiment among the many Bitcoin buyers develops within the coming days and if a drop into the intense concern zone will occur.

BTC Value

For the reason that drawdown below $50,000, Bitcoin has proven some restoration as its value is now buying and selling round $54,800.

The value of the coin seems to have proven a bounce since its low | Supply: BTCUSD on TradingView

Featured picture from Dall-E, Various.me, chart from TradingView.com