Ripple’s (XRP) Market Efficiency in 2024

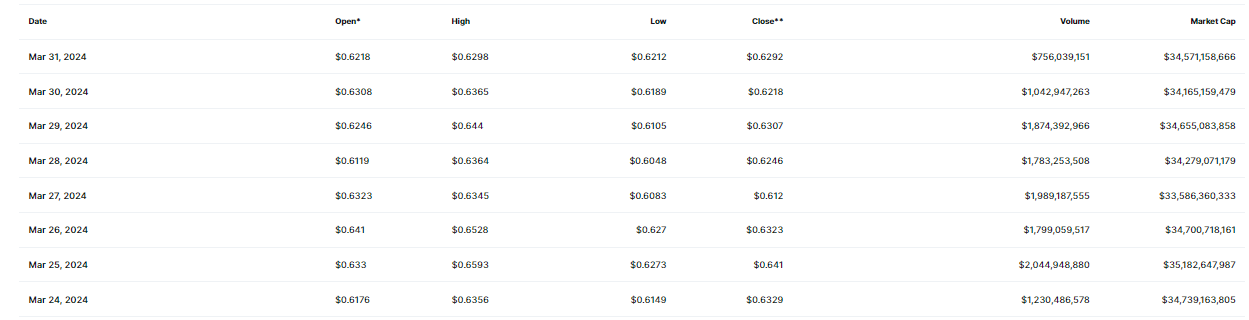

XRP’s market efficiency in 2024 has been characterised by important volatility, reflecting each inner developments and exterior market forces. XRP rode a wave of optimism at first of the yr, sporting a 3.59% rise from $0.615656 to $0.637770 throughout the first three days.

The surge was short-lived, with a curveball hit sending the market right into a spiral which noticed $XRP tumble by 19.93% to land at $0.510681 by mid-January.

Regardless of this setback, XRP demonstrated exceptional resilience, staging a formidable comeback as Q1 progressed. By the top of Q1, XRP had rocketed from its January low to succeed in $0.629763, a spectacular 23.3% surge. This restoration was largely attributed to optimistic developments throughout the Ripple ecosystem and a basic uptick in cryptocurrency market sentiment.

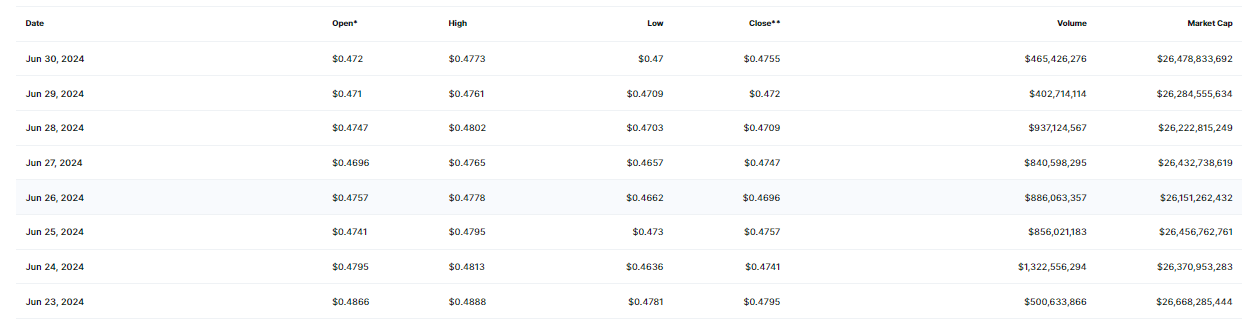

Q2 2024 introduced its personal set of challenges for XRP. April, specifically, was fairly tumultuous. By mid-April, XRP had plummeted 23.2% to $0.483486, erasing a lot of the positive factors from the earlier quarter. Nonetheless, true to its unstable nature, the token managed to claw again a few of its losses, gaining 6.6% to shut the month at $0.515434. This value instability continued into early Q2, with one other dip of seven.75% bringing XRP all the way down to $0.475472.

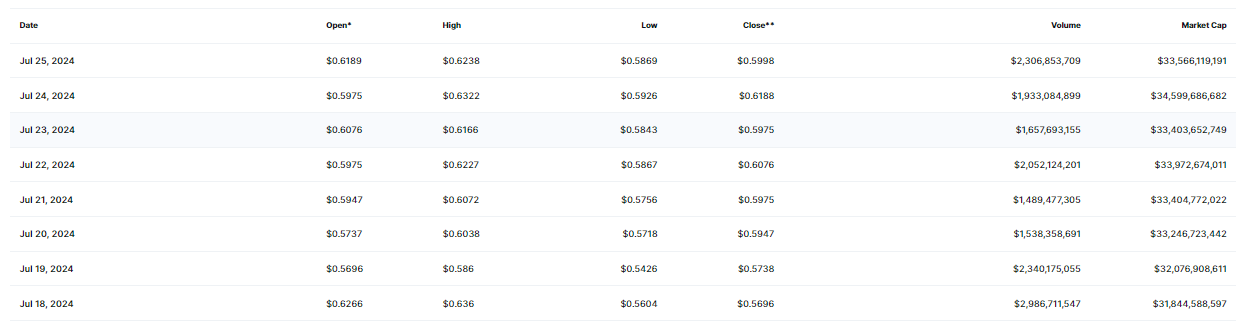

July was pivotal for XRP. Throughout the first 15 days of the month, XRP shot up by 13.4% to succeed in $0.539384. The rally didn’t cease there, because the token climbed one other 15.65% over the following 10 days, hitting $0.623824. As of July 29, XRP was buying and selling barely above $0.60.

Elements Influencing XRP’s Market Worth

A number of components have performed essential roles in influencing XRP’s market worth up to now. The broader cryptocurrency market skilled a sluggish begin to the yr, with many digital belongings underperforming because of macroeconomic circumstances and investor warning. This market-wide downturn additionally affected XRP, inflicting its value to fall as half of a bigger pattern of volatility throughout the sector although it began the yr on the excessive constructing on a bullish momentum from 2023 This autumn.

The ongoing authorized battle between Ripple and the U.S. Securities and Change Fee (SEC) continues to be a significant component affecting XRP’s value. The unresolved nature of this authorized battle has weighed closely on investor sentiment and contributed considerably to XRP’s value volatility. Notably, the case is awaiting the ultimate judgement as each events have filed the ultimate set of their replies. The SEC sought a $2 billion high quality which Ripple has deemed unreasonable and as a substitute argued for a $10 million penalty.

READ MORE: U.S. SEC Recordsdata Last Reply in Ongoing Ripple Lawsuit

Regardless of these challenges, Ripple has made important strides in increasing its partnerships and introducing new options and use circumstances which has been instrumental in rising exercise on the XRP Ledger.

READ MORE: Ripple Companions with SBI Group and HashKey DX to Introduce Blockchain-Based mostly Monetary Options to Japanese Companies

A major increase to XRP’s value got here with the launch of the XLS-30 replace in March. This improve launched a new function to the XRP Ledger: an automatic market maker (AMM). The addition of AMM performance improved buying and selling and liquidity on the platform, attracting extra builders and customers. This elevated community exercise made buyers extra assured, which boosted the token’s value.

On July 16, the XRP Ledger noticed a report 4 million transactions in a single day, its highest in six months. The common variety of transactions per ledger soared to 204, representing a 250% enhance from earlier within the month. This dramatic rise in exercise suggests rising curiosity and adoption, which may drive up demand for XRP in the long run.

Analysts Predictions and Future Outlook

Wanting forward, analysts and group members are cautiously optimistic about XRP’s future. As of late July 2024, there have been rumours of a possible settlement announcement within the SEC case, presumably linked to a non-public SEC assembly scheduled for the top of the identical month. This hypothesis has contributed to the latest value enhance, with some analysts predicting that XRP may attain $0.7 and even $0.75 by the top of Q3 2024.

Feedback from Ripple’s CEO, Brad Garlinghouse, in an interview with Bloomberg in early July 2024, have added to the hypothesis that the prolonged authorized battle with the SEC may quickly be resolved. This optimism has not solely pushed up the worth of XRP but in addition elevated exercise on the community.

In the long run, crypto Crypto Bitlord’s prediction that Ripple (XRP) may outpace Ethereum by 2024 has generated a whole lot of buzz and debate. Based on the analyst, the token presents a compelling funding prospect because of anticipated main developments, a confirmed monitor report of success, and inspiring technical indicators. In reality, Bitlord advocates for buying and holding Ripple (XRP) as a technique to probably obtain future returns.

One other analyst, Widespread Sense Crypto, has forecasted that XRP may rise by an astonishing 16,500%, surpassing the $100 mark in 2024.

Whereas XRP has demonstrated its means to get well from setbacks and capitalize on optimistic developments, its journey by means of the rest of 2024 and past will possible proceed to be marked by volatility. As at all times, buyers and fanatics ought to stay knowledgeable and cautious of their strategy to this dynamic digital asset.

Disclaimer: This text is meant solely for informational functions and shouldn’t be thought-about buying and selling or funding recommendation. Nothing herein must be construed as monetary, authorized, or tax recommendation. Buying and selling or investing in cryptocurrencies carries a substantial danger of economic loss. At all times conduct due diligence.

If you want to learn extra market analyses like this, go to DeFi Planet and comply with us on Twitter, LinkedIn, Fb, Instagram, and CoinMarketCap Group.

“Take management of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics instruments.”