Bitcoin’s breakout above $60,000 appears to have triggered a brand new spark of optimism amongst merchants. The market has been flat for many of August after experiencing a major drop firstly of the month, which is why the comparatively slight worth enhance above the $60,000 threshold was sufficient to inject the market with a major quantity of capital.

That is evident within the spike in open curiosity between Aug. 21 and Aug. 22. Information from CoinGlass confirmed that open curiosity in Bitcoin futures elevated from $30.21 billion to $32.08 billion in 24 hours.

Open curiosity measures the whole quantity or worth of excellent derivatives contracts which have but to be settled. When analyzing futures, OI is an important metric because it reveals the circulation of capital into the market.

An increase in OI signifies that more cash is coming into the market as merchants open new positions. Conversely, a decline in OI reveals that contracts are being closed or liquidated, with capital exiting the market. Monitoring OI helps gauge market exercise and predict potential worth volatility.

The $2 billion enhance between Aug. 21 and Aug. 22 reveals a sudden and aggressive inflow of capital into the derivatives market. As the rise follows Bitcoin’s rise from $59,000 to above $60,000, we will safely assume that the value broke a psychologically essential stage and triggered a brand new wave of bullish sentiment amongst derivatives merchants. The distribution of calls and places throughout Bitcoin choices reveals that merchants are opening new lengthy positions and anticipating additional worth appreciation.

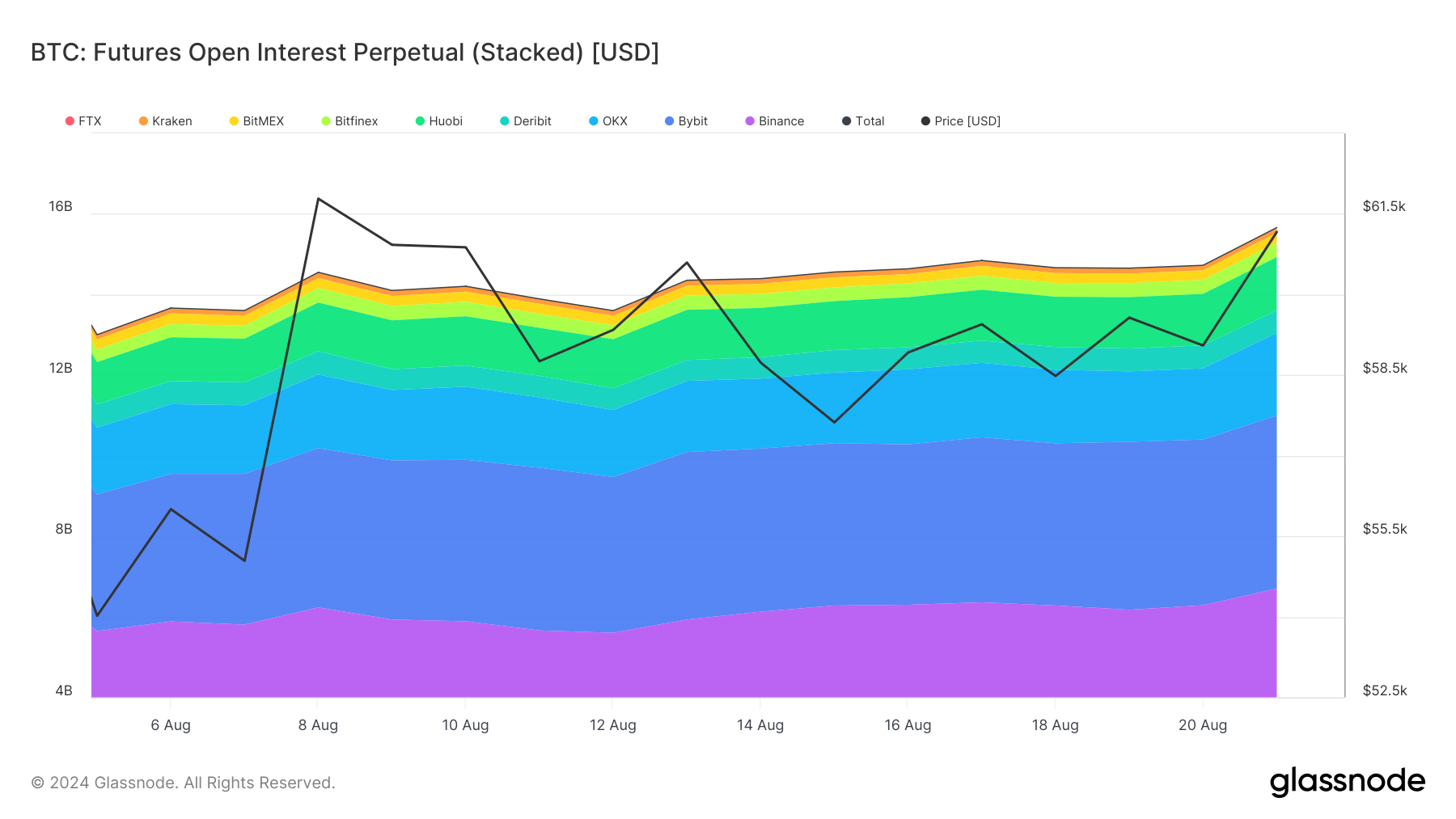

The same development is noticed in perpetual futures as nicely. Perpetual futures OI rose considerably between Aug. 21 and Aug. 22, following a constant enhance over the earlier weeks. By Aug. 21, perpetual futures OI had reached $15.66 billion — a considerable enhance from $13 billion on Aug. 5.

Perpetual futures are a sort of by-product that differs from conventional futures as they don’t have an expiry date, permitting merchants to carry positions indefinitely. This attribute makes perpetual futures significantly engaging for speculative buying and selling, as merchants can capitalize on short-term worth actions with out worrying about contract expiration.

The parallel rise in conventional and perpetual futures signifies that the general market sentiment is bullish, with institutional and retail traders growing their publicity to Bitcoin. Conventional futures have a tendency to draw extra institutional traders, as regulated platforms just like the CME see the best OI and buying and selling quantity.

The rise in CME’s OI from $8.76 billion on Aug. 21 to $9.65 billion on Aug. 22 confirms this institutional curiosity. In distinction, perpetual futures are extra widespread on platforms like Binance, Bybit, and OKX, which primarily cater to retail merchants. The rise in OI on these platforms, significantly the substantial rise on Binance from $6.70 billion to $7.18 billion, signifies rising retail participation.

The distinction between conventional and perpetual futures lies of their expiration dates and the way they mirror market sentiment. Conventional futures point out long-term market expectations, as they contain fastened contract intervals and infrequently greater capital necessities.

However, Perpetual futures are extra delicate to short-term market tendencies resulting from their lack of expiration and using funding charges to maintain costs near the spot worth of Bitcoin. Due to this fact, modifications in perpetual futures OI can sign quick shifts in market sentiment and dealer positioning.

The mixed enhance in each varieties of futures OI suggests a broad-based bullish sentiment throughout completely different investor courses. Bitcoin’s worth enhance helps this narrative, clearly reflecting the inflow of capital into the market.

Nevertheless, the fast rise in OI additionally raises the potential for elevated volatility. If the market doesn’t proceed its upward trajectory, the massive variety of open positions might result in sharp corrections as merchants rush to shut their positions, particularly within the extra speculative perpetual futures market.

The put up Bitcoin’s climb above $60k causes futures open curiosity to surge $2B in a day appeared first on CryptoSlate.