In a thread shared together with his 538,000 followers on X, crypto analyst Miles Deutscher highlights the important significance of retail traders to the sustainability of the crypto bull market. To know the potential return of the crypto bull run, Deutscher believes it’s important to grasp what has occurred lately. Deutscher recollects the substantial rally from March 2020 by November 2021, highlighting the acute beneficial properties made throughout varied altcoins.

Understanding The Crypto Bull Run Dynamics

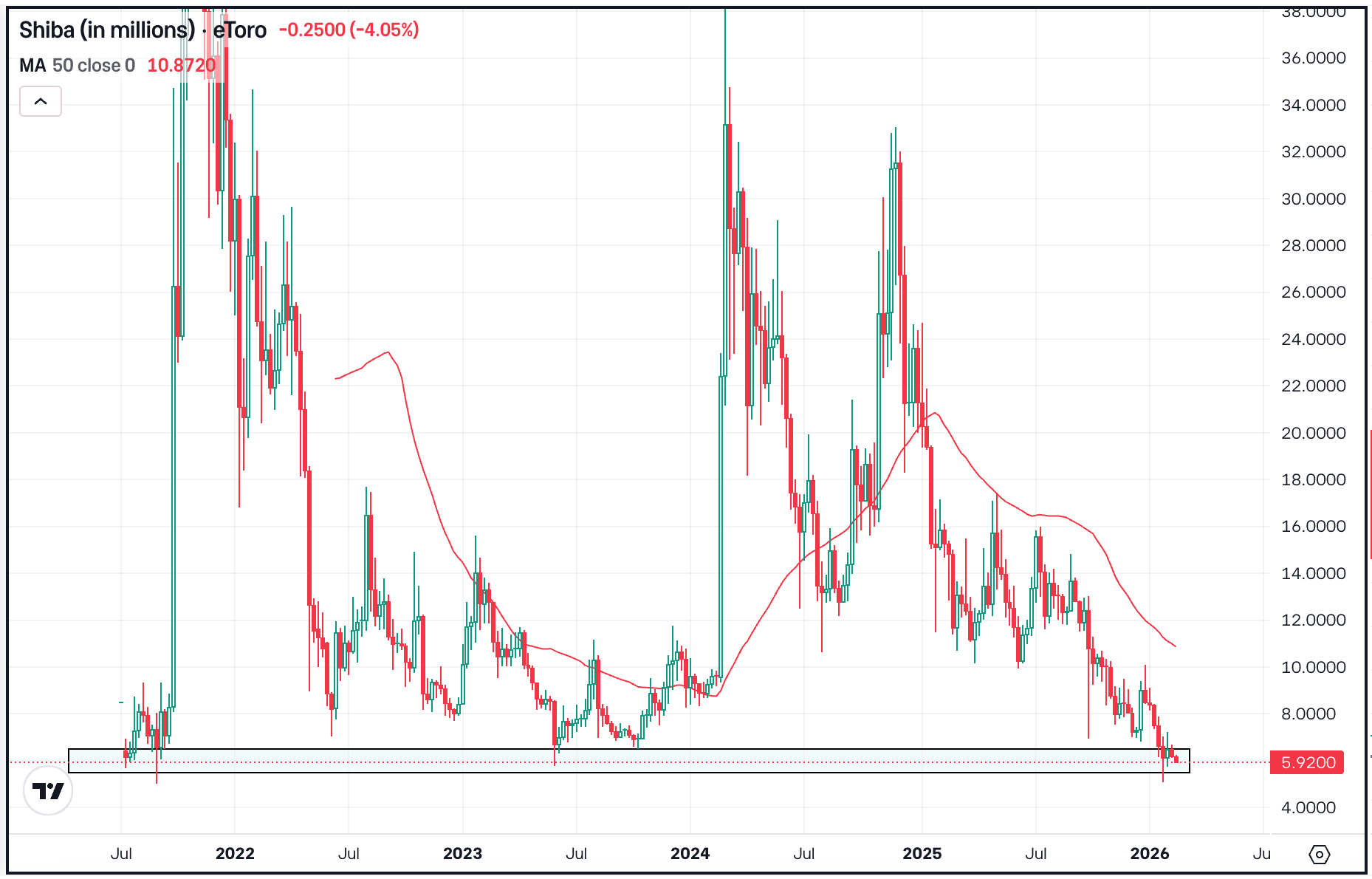

“From March 2020 till November 2021, the crypto market rallied 2,672%, with many alts pulling 50-100x+ multiples,” Deutscher states, pointing to a interval characterised by vital monetary stimulus and elevated public curiosity as a result of world lockdowns. Nonetheless, the glory days had been short-lived, as Deutscher identified, marking the height of the market in November 2021 adopted by a steep decline.

The downward spiral was accentuated by the LUNA & UST collapse in Could 2022, which not solely erased vital market worth but in addition exacerbated the decline throughout the broader crypto market. “Crypto technically topped in November 2021. However it wasn’t till Could 2022 that crypto can be delivered its remaining demise blow: The LUNA & UST collapse,” he defined, illustrating the precariousness of crypto investments throughout that interval.

Associated Studying

The aftermath of those occasions led to a widespread exodus of retail traders, who had been both financially devastated or disillusioned by the dramatic downturns. “In the event you had been burnt financially, you left. In the event you weren’t burnt financially, you continue to left (worth/time capitulation),” Deutscher explains, capturing the deep-seated nervousness that permeated the retail investor base following the market’s collapse.

Regardless of the difficult surroundings, 2023 ushered in a brand new wave of optimism with vital institutional actions, notably BlackRock’s software for a Bitcoin spot ETF in June, which was later accepted. “On the sixteenth of June, BlackRock utilized for a Bitcoin spot ETF […] This not solely signaled a optimistic catalyst on the horizon however a paradigm shift in the way in which BTC was being considered by main establishments,” Deutscher highlighted, pointing to a vital second that probably marked the start of a brand new period for Bitcoin and probably the broader crypto market.

As of January 2024, the crypto market had seen a surge in Bitcoin costs, reaching new all-time highs following the profitable launch of the ETF. “Over $17b has flowed into the BTC spot ETFs to date this yr,” Deutscher notes, underscoring the numerous affect of institutional funding on Bitcoin’s valuation and the broader market sentiment.

Nonetheless, Deutscher tempers expectations relating to the altcoin market, which has not seen parallel success. The dearth of an analogous rally in altcoins is attributed by Deutscher to the brand new market dynamics launched by the ETF, which altered conventional liquidity flows and funding patterns. “The first driver of this cycle has been the BTC ETF. That is vastly completely different from the final cycle, the place the first driver was macro circumstances,” he remarks.

When Will The Bull Run Return?

Trying forward, Deutscher speculates on the circumstances that may entice retail traders to return. He emphasizes the vital function of Bitcoin attaining new all-time highs, suggesting that Bitcoin reaching or surpassing $100,000 might ignite renewed curiosity throughout the crypto sector. “Sure, most of the aforementioned points like altcoin dispersion would nonetheless exist, however it will undoubtedly pave over some cracks. A BTC rally = media consideration, individuals entrance working an altcoin rotation, renewed optimism,” he added.

Associated Studying

Deutscher additionally highlights the pure inclination of people in direction of playing, noting that the joys of excessive returns may rapidly entice retail traders again to the market if altcoins present sustained rallies. He referenced the Pareto precept to remind followers that vital market beneficial properties typically happen late within the funding cycle.

“80% of beneficial properties in a bull market come within the final 20%, of the transfer. Retail joins the celebration late. We merely may be too early (by way of cycle period we comparatively nonetheless are), Deutscher states.

Moreover, he factors to the potential of rising applied sciences in AI, gaming, and decentralized finance (DeFi) to create compelling new use circumstances for crypto. He advised that only a few profitable functions might drive widespread adoption, fostering a extra sustainable curiosity within the crypto market.

Due to that Deutscher stays optimistic in regards to the return of retail traders. He concludes, “so in conclusion, sure – retail is (largely) gone. There are legitimate explanation why, and this cycle is essentially completely different due to them. However it gained’t take a lot for retail to return. And that day could also be prior to you suppose.”

At press time, BTC traded at $59,650.

Featured picture created with DALL.E, chart from TradingView.com