For years, Bitcoin fanatics have been anticipating a big change within the worth as a result of involvement of institutional traders. The idea was easy: as firms and enormous monetary entities spend money on Bitcoin, the market would expertise explosive development and a sustained interval of rising costs. Nevertheless, the precise final result has been extra advanced. Though establishments have certainly invested substantial capital in Bitcoin, the anticipated ‘supercycle’ has not unfolded as predicted.

Institutional Accumulation

Institutional participation in Bitcoin has considerably elevated in recent times, marked by substantial purchases from giant firms and the introduction of Bitcoin Change-Traded Funds (ETFs) earlier this yr.

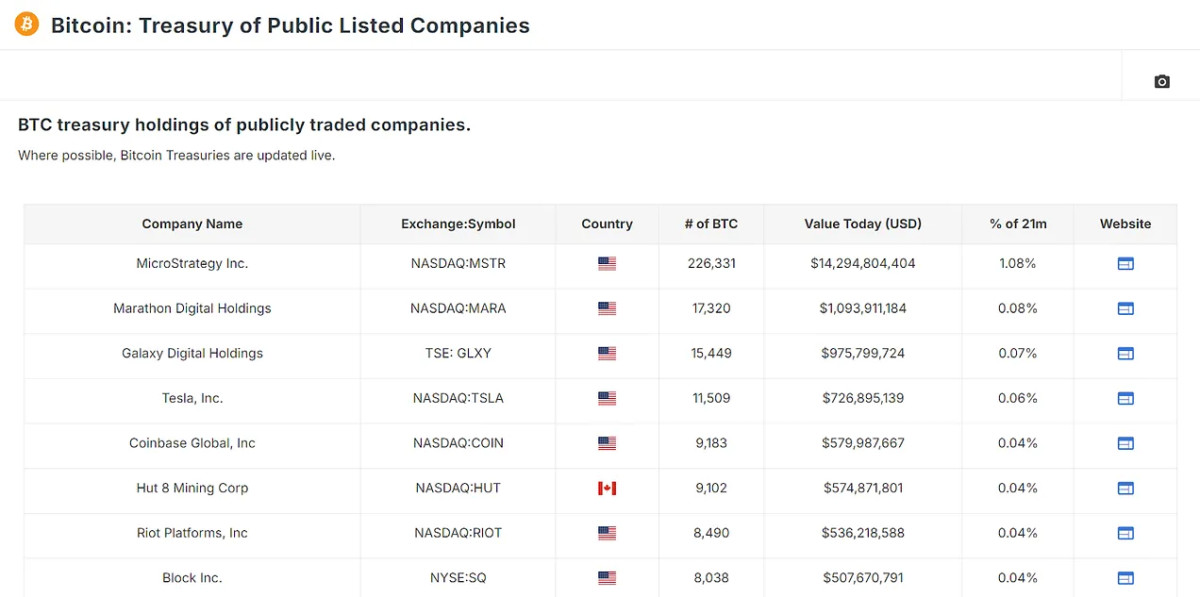

Main this motion is MicroStrategy, which alone holds over 1% of the entire Bitcoin provide. Following MicroStrategy, different outstanding gamers embody Marathon Digital, Galaxy Digital, and even Tesla, with important holdings additionally present in Canadian corporations corresponding to Hut 8 and Hive, in addition to worldwide firms like Nexon in Japan and Phoenix Digital Property within the UK; all of which will be tracked through the brand new Treasury information charts out there on website.

In complete, these firms maintain over 340,000 bitcoin. Nevertheless, the actual game-changer has been the introduction of Bitcoin ETFs. Since their inception, these monetary devices have attracted billions of {dollars} in investments, ensuing within the accumulation of over 91,000 bitcoin in only a few months. Collectively, non-public firms and ETFs management round 1.24 million bitcoin, representing about 6.29% of all circulating bitcoin.

A Have a look at Bitcoin’s Current Value Actions

To grasp the potential future affect of institutional funding, we will take a look at latest Bitcoin value actions because the approval of Bitcoin ETFs in January. On the time, Bitcoin was buying and selling at round $46,000. Though the worth dipped shortly after, a traditional “purchase the rumor, promote the information” state of affairs, the market shortly recovered, and inside two months, Bitcoin’s value had surged by roughly 60%.

This enhance correlates with institutional traders’ accumulation of Bitcoin by way of ETFs. If this sample continues and establishments maintain shopping for on the present or elevated tempo, we may witness a sustained bullish momentum in Bitcoin costs. The important thing issue right here is the idea that these institutional gamers are long-term holders, unlikely to dump their property anytime quickly. This ongoing accumulation would cut back the liquid provide of Bitcoin, requiring much less capital influx to drive costs even larger.

The Cash Multiplier Impact: Amplifying the Impression

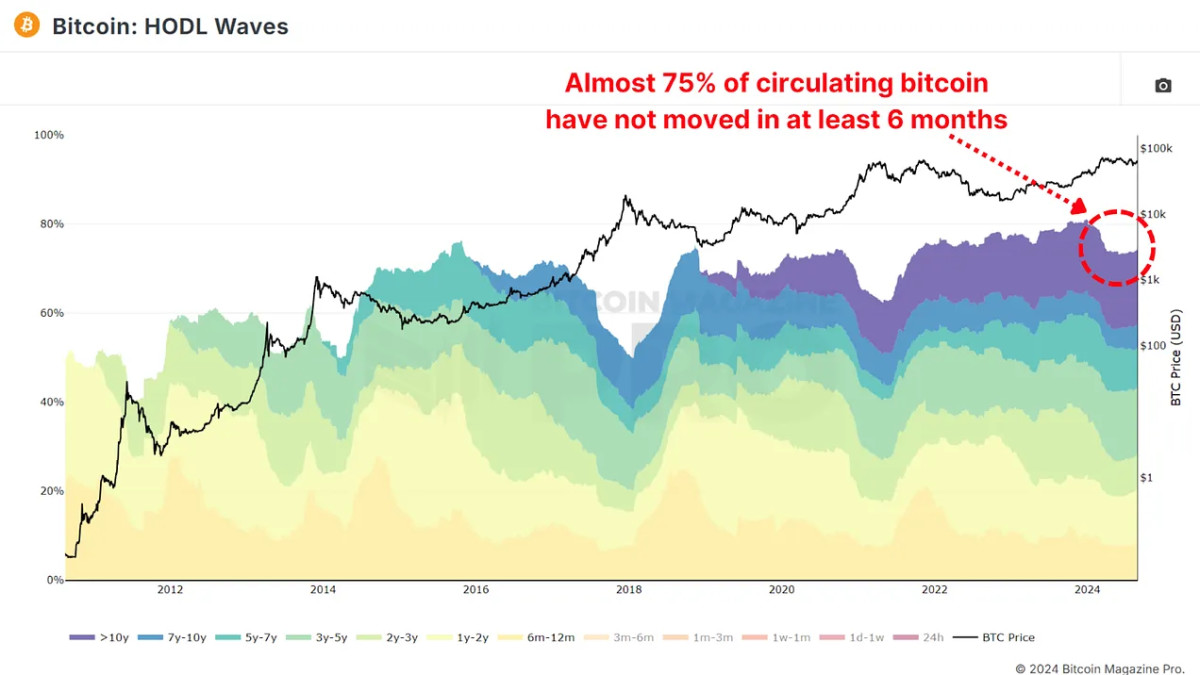

The buildup of property by institutional gamers is critical. Its potential affect in the marketplace is much more profound when you think about the cash multiplier impact. The precept is easy: when a big portion of an asset’s provide is faraway from lively circulation, such because the almost 75% of provide that hasn’t moved in at the least six months as outlined by the HODL Waves, the worth of the remaining circulating provide will be extra unstable. Every greenback invested has a magnified affect on the general market cap.

For Bitcoin, with roughly 25% of its provide being liquid and actively traded, the cash multiplier impact will be notably potent. If we assume this illiquidity ends in a $1 market influx enhance available in the market cap by $4 (4x cash multiplier), institutional possession of 6.29% of all bitcoin may successfully affect round 25% of the circulating provide.

If establishments had been to start offloading their holdings, the market would possible expertise a big downturn. Particularly as this could possible set off retail holders to start offloading their bitcoin too. Conversely, if these establishments proceed to purchase, the BTC value may surge dramatically, notably in the event that they preserve their positions as long-term holders. This dynamic underscores the double-edged nature of institutional involvement in Bitcoin, because it slowly then all of a sudden possesses a larger affect on the asset.

Conclusion

Institutional funding in Bitcoin has each constructive and adverse points. It brings legitimacy and capital that might drive Bitcoin costs to new heights, particularly if these entities are dedicated long run. Nevertheless, the focus of Bitcoin within the arms of some establishments may result in heightened volatility and important draw back danger if these gamers resolve to exit their positions.

For a extra in-depth look into this matter, try a latest YouTube video right here: