Ethereum (ETH) has been buying and selling inside a day by day vary between $2,300 and $2,800 because the begin of August. Over the previous three days, the value has struggled to interrupt previous the $2,600 mark, elevating considerations amongst analysts and traders.

Associated Studying

This efficiency has led to disappointment, notably when in comparison with Bitcoin’s stronger displaying this 12 months. Crucial information from Farside Buyers reveals lowering curiosity in Ethereum ETFs, which has added to the cautious sentiment surrounding ETH. This decline in curiosity could point out broader considerations about Ethereum’s future efficiency.

As ETH continues to face resistance on the $2,600 degree, the market stays unsure about its skill to interrupt larger. The subsequent few days can be crucial in figuring out whether or not Ethereum can regain its momentum or if it should proceed to lag behind its friends. The market is carefully watching these developments, making this a pivotal second for ETH.

Ethereum ETFs’ Underwhelming Efficiency

The launch of Ethereum ETFs was anticipated with nice pleasure, but it surely rapidly grew to become a “promote the information” occasion. Knowledge from Farside Buyers reveals that Ethereum ETFs have flopped in efficiency since their debut. Each inflows and outflows have gone to just about zero, reflecting an absence of sustained investor curiosity. This response contrasts sharply with the keenness that preceded their launch.

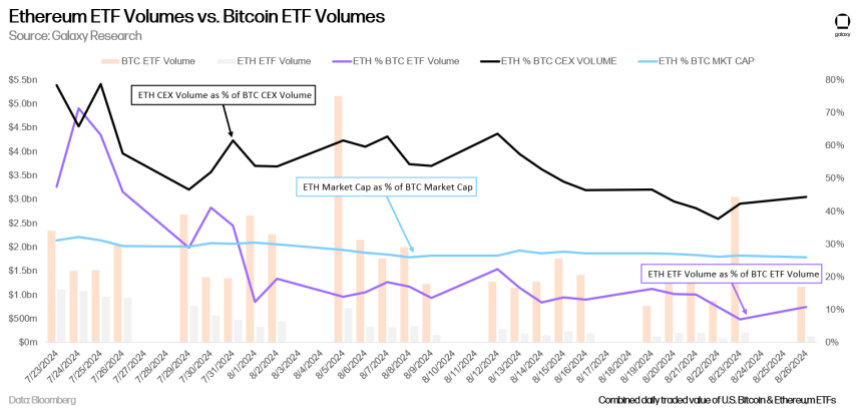

Furthermore, Bloomberg information shared by Galaxy Analysis highlights that Ethereum ETFs are buying and selling at considerably decrease volumes in comparison with Bitcoin ETFs. This discrepancy is notable, notably when contemplating the ETH/BTC buying and selling volumes and market cap ratios on centralized exchanges (CEX). Regardless of Ethereum’s robust market presence, these ETFs aren’t capturing the identical degree of investor consideration as their Bitcoin counterparts.

The present information means that, beneath prevailing market circumstances, traders are extra inclined to favor Bitcoin and even discover alternate options like Solana over Ethereum. The shortage of enthusiasm for Ethereum ETFs underscores the broader market sentiment, the place Bitcoin continues to dominate, leaving Ethereum and its monetary merchandise trailing. This growth raises questions concerning the future attraction of Ethereum ETFs and whether or not they can achieve traction in an more and more aggressive market.

Associated Studying

ETH Value Motion

Ethereum (ETH) is presently buying and selling at $2,522, reflecting a interval of uncertainty because it stays under the $2,600 mark since final Tuesday. This value level is important as a result of $2,600 served as a powerful help degree all through most of August. The truth that it has now became resistance means that ETH may very well be dealing with additional declines within the close to time period.

For bulls to regain management and steer the value upward, breaking previous the $2,600 resistance is essential. Ought to this degree be breached, the subsequent goal can be the native excessive of $2,820, signaling a possible bullish reversal. Nevertheless, if Ethereum fails to reclaim the $2,600 degree, it might result in a continuation of the present downward development, with the subsequent key help degree round $2,310.

Associated Studying

This ongoing battle between help and resistance ranges highlights the significance of the $2,600 mark in figuring out Ethereum’s short-term value route.

Cowl picture from Dall-E, Chart from Tradingview