Este artículo también está disponible en español.

Stacks struggles to face on stage floor because it continues to fall regardless of the market’s try to rebound within the brief time period. In line with CoinGecko, STX bled 15% since final week with the token trying to reverse the downward momentum with a virtually 4% uptick up to now 24 hours.

Associated Studying

Stacks has been teasing the group, creating hype for the upcoming Nakamoto Improve with their ‘21 Days of Nakamoto’ occasion. The occasion, which commenced again on the twenty eighth of August, began September with a complete suite of surprises for traders and group members.

NFTs And Monetary Grants Again On The Menu For Stacks

On a current X publish, Megapont was revealed to be Stacks’s September 3 shock for the celebration of the upcoming mainnet launch of the Nakamoto improve. Megapont is an NFT venture, launched and operates totally on the Stacks blockchain.

Let’s have fun a mega improve for Stacks! 🧡

And who higher to have fun with than one thing actually mega…

Welcome again, @MegapontNFT!Orange Listing: https://t.co/fOeckrNRVH pic.twitter.com/Z46xH5g1QL

— stacks.btc (@Stacks) September 2, 2024

The venture launched Nakapack, a 5,000-strong NFT assortment to be given out to the Stacks group. Customers on the platform can mint the NFTs with out a price, however they have to be whitelisted for this to occur. Regardless of 95% of circulated NFTs now being deemed nugatory by a current report, Megapont’s dedication to its group would possibly spark curiosity in NFTs throughout the Bitcoin L2 ecosystem.

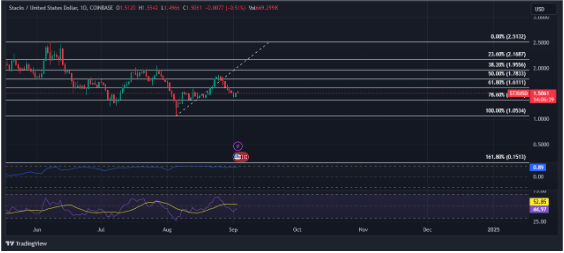

STXCUSD buying and selling at $1.51 on the 24-hour chart: TradingView.com

One other improvement that can assist Stacks in the long run is the second cohort of grants for community-voted applications on-chain. On the thread, seven applications have been featured every granted $50,000 to help their improvement course of. In whole, over 31 applications have been given monetary help.

$1.3-$1.6 Chokes STX’s Upside Potential

As of writing, STX is held tightly by the $1.3-$1.6 buying and selling vary, hampering the token’s upside potential shortly. This leaves the bulls in an attention-grabbing place which has the chance to interrupt by way of the $1.7 worth ceiling.

STX’s relative power index (RSI) means that the token will try to stabilize in its present buying and selling vary which provides the bulls a much-needed platform to leap out from. Nevertheless, its comparatively steady stage reveals that the bears nonetheless have some power, sufficient to cancel the bullish momentum that’s presently forming.

Associated Studying

Within the brief time period, the bears could have the higher hand except the market makes one other leap ahead, creating sufficient momentum for STX to have a breakthrough. Nevertheless, the meager features the broader market skilled have little to no impact on STX’s future efficiency. Worry, uncertainty, and doubt nonetheless plagues market sentiment for the token.

For now, traders and merchants ought to train warning whereas monitoring the broader market’s motion earlier than making a call. STX’s important correlation with BTC is each a boon and a curse for traders as any swing made by the latter could have a powerful affect on the efficiency of the previous.

Featured picture from Host Service provider Companies, chart from TradingView