Onchain Highlights

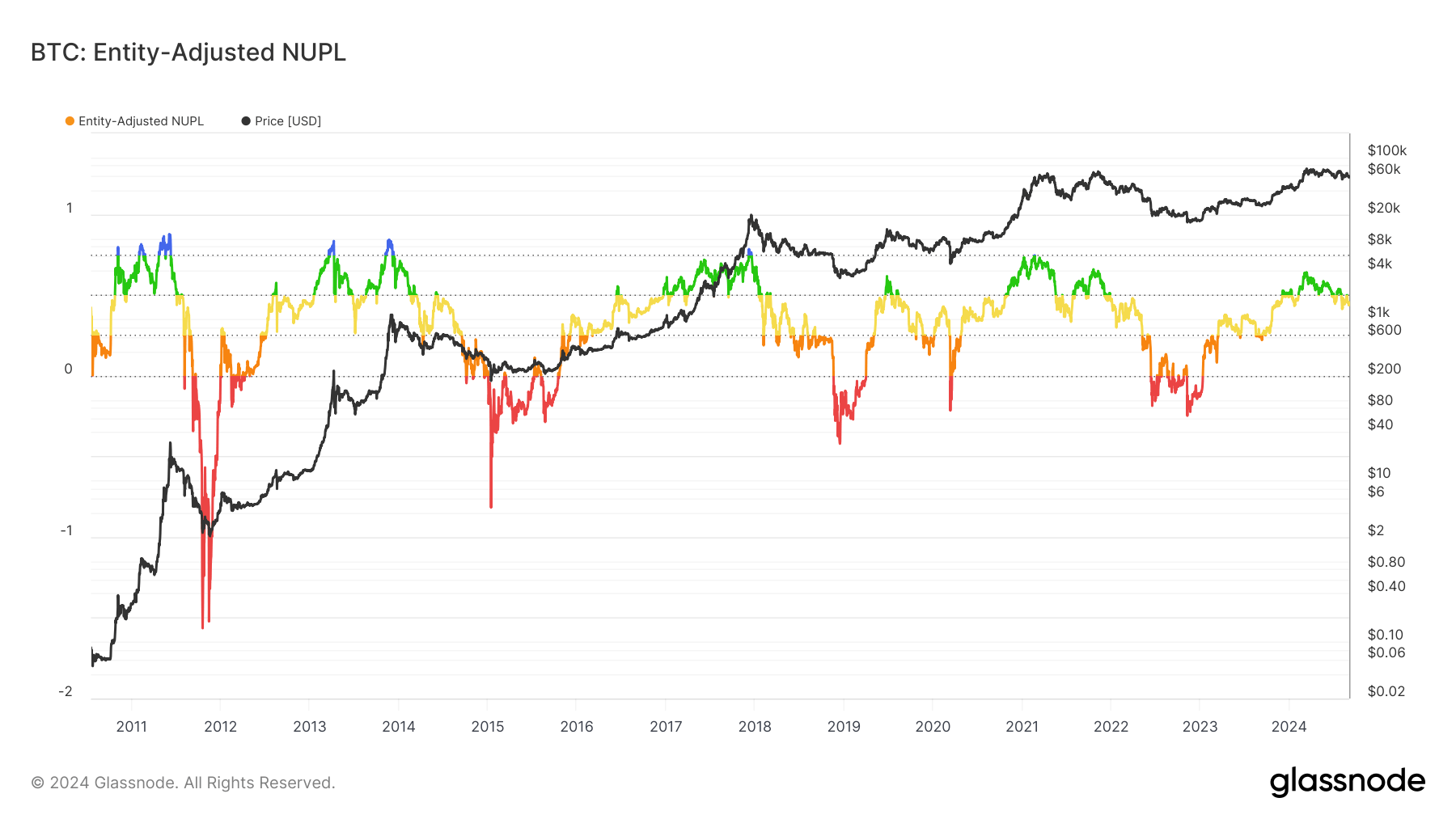

DEFINITION: Entity-adjusted NUPL is an improved variant of Internet Unrealized Revenue/Loss (NUPL) that discards transactions between addresses of the identical entity (“in-house” transactions). It solely accounts for actual financial exercise and offers an improved market sign in comparison with its uncooked UTXO-based counterpart.

Bitcoin’s Entity-Adjusted NUPL has been in a downtrend since mid-2024, reflecting elevated market uncertainty. This metric, which excludes inside transactions and focuses on exterior financial exercise, has shifted from constructive territory early within the 12 months to impartial and now near-loss ranges.

Traditionally, related shifts in NUPL values have signaled market corrections or prolonged consolidation phases. The sample aligns with Bitcoin’s current value actions, because it continues to hover beneath the $60,000 mark.

Evaluating this to earlier intervals, an analogous downturn in NUPL was noticed following the 2017 and 2021 bull cycles, previous Bitcoin’s market retracements. Whereas NUPL is presently trending decrease, earlier cycles have demonstrated {that a} transition into the yellow and purple zones typically precedes a restoration part. The current state highlights a possible shift in market sentiment, reflecting warning and diminished profitability for market contributors.