Fast Take

Latest knowledge from Farside reveals vital outflows from Bitcoin ETFs on Sept. 5, totaling $211.1 million. This marks the seventh consecutive buying and selling day of outflows, with no ETF issuers reporting any inflows on Sept. 5. 4 main issuers skilled notable outflows: Constancy’s FBTC noticed the most important drop with $149.5 million, adopted by Bitwise’s BITB with $30.0 million, Grayscale’s GBTC with $23.2 million, and BTC ETFs with $8.4 million.

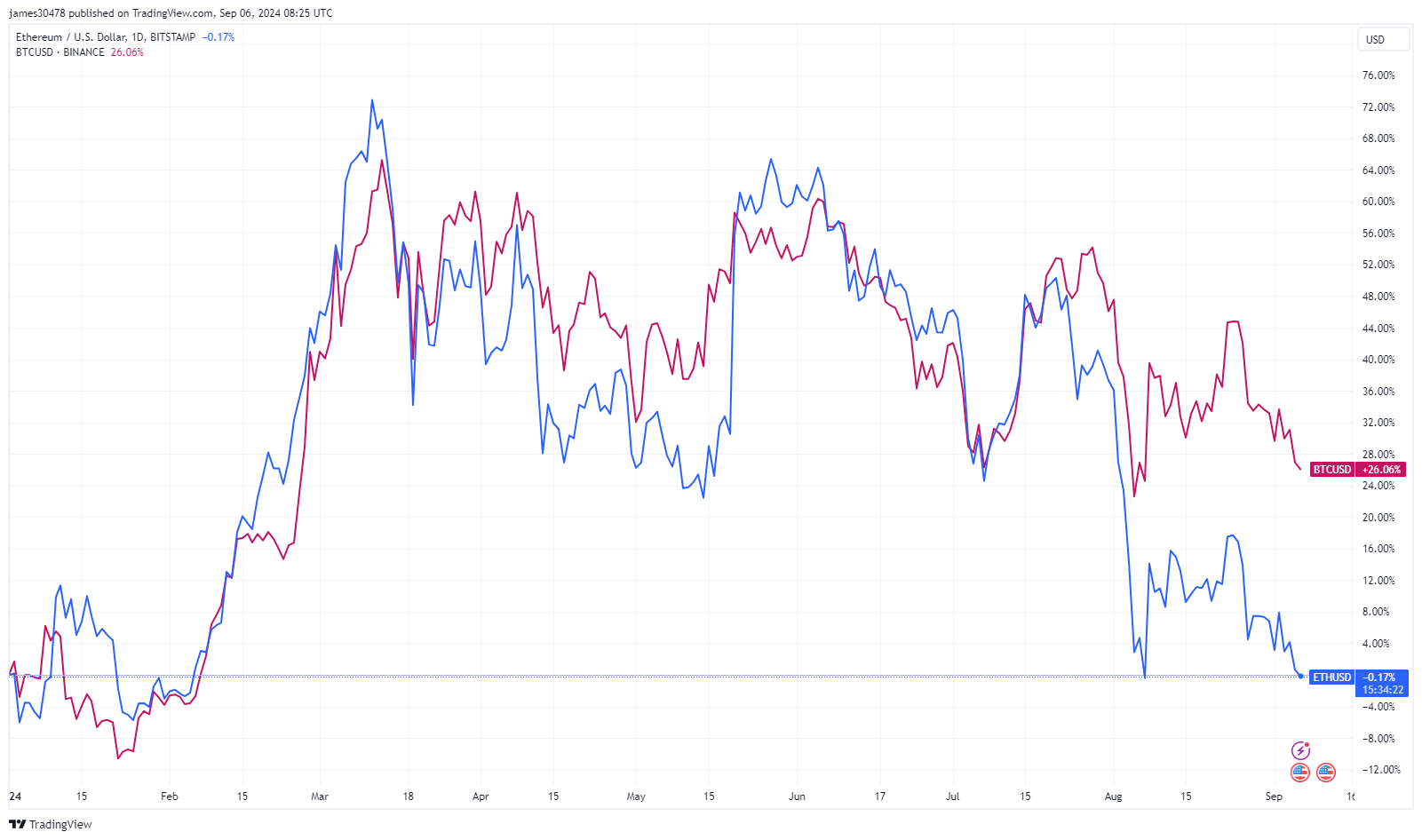

Since Aug. 27, over $1 billion has exited BTC ETFs, bringing whole web flows to $17.1 billion. Throughout this era, Bitcoin’s value has dropped from roughly $62,000 to $55,500.

Ethereum ETFs have seen considerably much less exercise. There was a modest $0.2 million outflow, with most motion concentrated round Grayscale’s merchandise. Grayscale’s ETHE noticed a $7.4 million outflow, whereas ETH ETFs recorded a $7.2 million influx. Regardless of these adjustments, whole outflows for Ethereum ETFs have now reached $562.5 million, in line with Farside knowledge, and the value of Ethereum is now adverse for the 12 months.