On September 11, 2024, Web Laptop (ICP) made waves within the cryptocurrency market with its spectacular value efficiency. Nonetheless, based mostly on its chart and value motion, it seems that ICP is only one step away from a possible 25% rally.

Web Laptop (ICP) Worth Efficiency

At press time, ICP is buying and selling close to $8.8 degree and has skilled a value surge of over 15% within the final 24 hours. In the meantime, its buying and selling quantity has elevated by 60% throughout the identical interval, indicating larger buyers and merchants participation amid the continuing value restoration.

ICP Technical Evaluation and Upcoming Ranges

In keeping with knowledgeable technical evaluation, Web Laptop (ICP) seems bullish regardless of buying and selling beneath the 200 Exponential Shifting Common (EMA) on the every day timeframe. At the moment, ICP is dealing with sturdy resistance close to the $8.9 degree.

That is the second time because the starting of August 2024 that the ICP value has reached that resistance degree. The final time ICP reached that degree, it underwent important promoting strain, leading to a steep value decline of almost 20%.

Nonetheless, this time, dealer and investor participation is totally different, and the sentiment has shifted, rising the probability that ICP might breach this resistance degree. If ICP breaks out this resistance degree and closes a every day candle above $9, there’s a sturdy chance it might soar by 25%, reaching the $11 degree within the coming days.

This bullish thesis is simply legitimate if the ICP value closes its every day candle above $9, in any other case, it could fail.

Bullish On-Chain Metrics

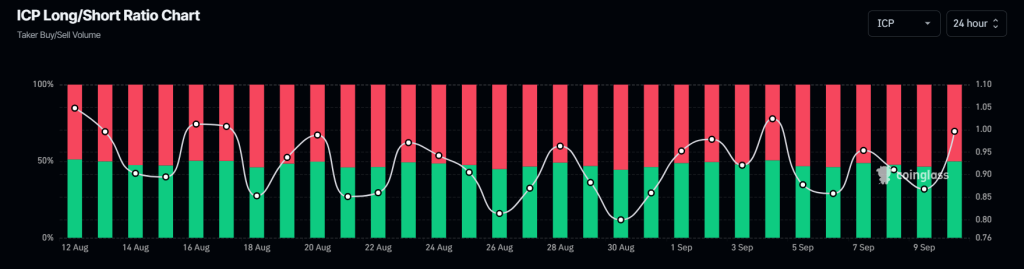

Furthermore, Web Laptop’s (ICP) bullish outlook can also be supported by on-chain metrics. Coinglass’s ICP Lengthy/Brief ratio presently stands at +1.019, reflecting bullish market sentiment. Moreover, ICP’s futures open curiosity has elevated by 21%, indicating extra futures-long positions have been constructed within the final 24 hours. Notably, this OI has been steadily rising.

In keeping with the information, a constructive lengthy/brief ratio and rising future open curiosity alerts potential shopping for alternatives. Merchants and buyers usually take this whereas constructing lengthy/brief positions.