Visa is buying fraud prevention firm Featurespace to boost its personal fraud detection and risk-scoring options.

Phrases of the settlement had been undisclosed and the deal is predicted to shut in 2025 pending regulatory approvals.

The acquisition comes as Visa faces authorized challenges from the U.S. DOJ over alleged monopolization in debit card markets.

Visa signed an settlement to amass fraud prevention firm Featurespace right this moment. Monetary phrases of the deal, which is topic to closing circumstances and regulatory approvals, weren’t disclosed. The deal is predicted to shut in 2025.

Featurespace was based in 2008 as a undertaking in Cambridge College’s engineering division. The U.Ok.-based firm affords AI-based instruments that analyze transaction knowledge to detect fraud. The corporate’s ARIC Threat Hub assesses behavioral analytics in real-time to determine irregular person habits, and leverages machine studying to adapt to altering behaviors and new scams, whereas enhancing accuracy over time.

“Offering our shoppers with options that may adapt to and anticipate the altering menace panorama is of the utmost significance,” mentioned Visa International Head of Worth-added Companies Antony Cahill. “Featurespace’s robust basis in AI will improve our present product portfolio and allow us to deal with our shoppers’ most advanced and urgent challenges. We sit up for welcoming the Featurespace group to Visa.”

Visa expects that Featurespace will complement and strengthen its present portfolio of fraud detection and risk-scoring options. By leveraging Featurespace’s experience, Visa will empower its shoppers to handle funds fraud in real-time whereas minimizing false positives and finally slicing prices.

“Over the previous 12 years we now have served the monetary companies trade, constructing an organization that has gone from energy to energy, and we’re thrilled to grow to be part of Visa,” mentioned Featurespace Founder Dave Excell. “With Visa, we will carry the innovation, integrity and goal of our platform and our group to extra cost service suppliers and finally, cease extra individuals from changing into victims of economic crime.”

Shadowing right this moment’s deal is Visa’s earlier failed buy of Plaid. In 2021, Visa was pressured to terminate its deliberate $5.3 billion acquisition of economic knowledge entry firm Plaid. On the time, the U.S. Division of Justice (DOJ) filed a civil antitrust lawsuit that ended the merger a couple of 12 months after discussions had been initiated. The lawsuit argued that Visa needed to amass Plaid to guard its U.S. debit enterprise in opposition to the specter of the fintech. Visa argued that the DOJ didn’t perceive its enterprise and the aggressive panorama, saying that Plaid would complement its present capabilities.

Visa’s deliberate acquisition of Featurespace is kind of totally different than that of Plaid, nevertheless. That’s as a result of the fintech will possible be seen as enhancing Visa’s present fraud administration capabilities and doesn’t pose the identical aggressive dangers because the Plaid deal did.

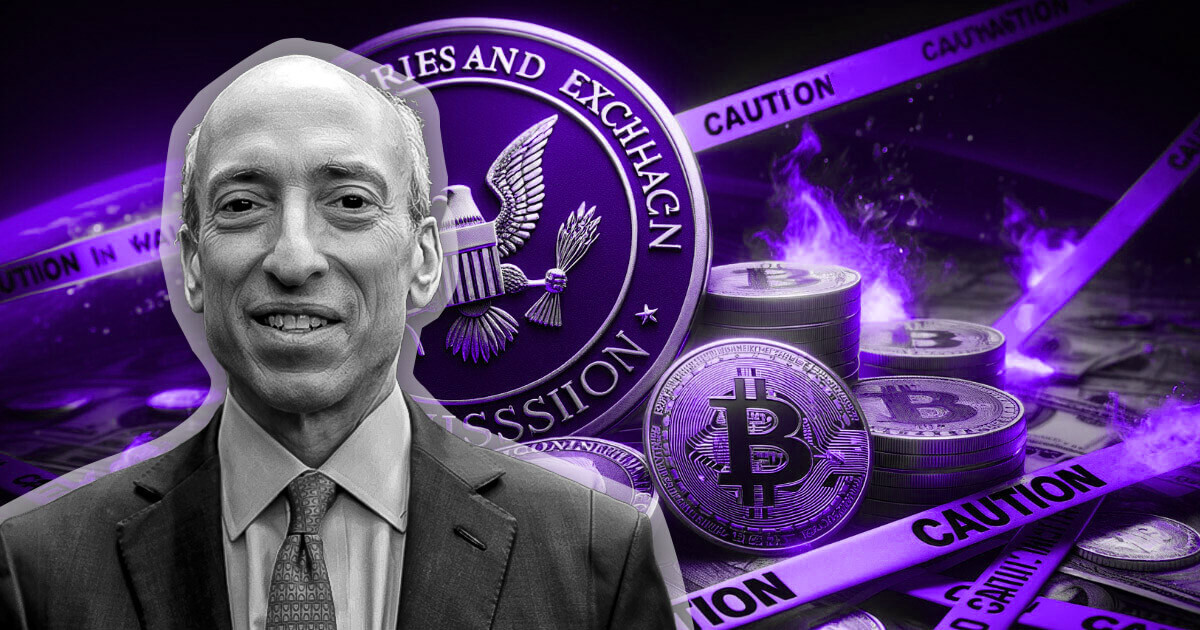

Even nonetheless, the Featurespace deal comes at an attention-grabbing time for Visa. The funds large is re-living a few of its 2021 woes with the DOJ. The division sued Visa earlier this week, alleging that it’s monopolizing debit card markets. “We allege that Visa has unlawfully amassed the facility to extract charges that far exceed what it may cost in a aggressive market,” mentioned Lawyer Common Merrick Garland. “Retailers and banks go alongside these prices to customers, both by elevating costs or lowering high quality or service. Consequently, Visa’s illegal conduct impacts not simply the worth of 1 factor – however the value of almost every part.”

As some specialists have identified, nevertheless, banks and retailers have a number of cost rails to select from, and that Visa’s international market share is just a results of capitalism.

Photograph by Florenz Mendoza

Views: 237