On October 1, 2024, the favored Solana-based meme coin Bonk (BONK) made a headline because it topped the cryptocurrency market with its spectacular efficiency. Within the ongoing struggling cryptocurrency market, BONK has outperformed main cryptocurrencies like Bitcoin (BTC), Solana (SOL), Ethereum (ETH), and plenty of others with a big worth surge of over 9.5% prior to now 24 hours.

At press time, it’s buying and selling close to $0.0000253 and has skilled important participation from merchants and buyers, leading to a spike of 115% in buying and selling quantity throughout the identical interval.

BONK Technical Evaluation and Upcoming Ranges

In line with skilled technical evaluation, BONK seems bullish and is poised for a big upside rally within the coming days. Lately, it skilled a breakout from a powerful resistance stage of $0.000022 and consolidated for 2 days. With a formidable worth surge right this moment, it broke the consolidation zone, indicating a bullish sign.

Based mostly on the historic worth momentum, if BONK closes its every day candle above the $0.000025 stage, there’s a sturdy risk it may soar by 30% to achieve the $0.000035 stage within the coming days.

At present, BONK is buying and selling above the 200 Exponential Transferring Common (EMA) on a every day timeframe, indicating an uptrend. The 200 EMA is a technical indicator that determines whether or not an asset is in an uptrend or downtrend.

BONK’s On-Chain Metrics

Regardless of a bullish outlook and spectacular worth surge over the previous 24 hours, BONK’s on-chain metrics sign fragile market sentiment. In line with the on-chain analytics agency Coinglass, BONK’s Lengthy/Quick ratio at the moment stands at 0.99, indicating a weak sentiment amongst merchants. Nonetheless, a worth above 1 signifies bullish market sentiment.

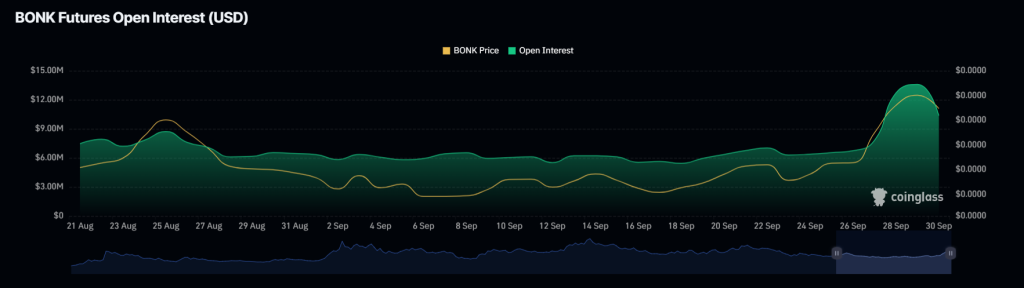

Moreover, its future open curiosity has declined by 3.8% prior to now 24 hours, indicating that merchants have liquidated their positions, doubtlessly as a result of present market sentiment as main cryptocurrencies are experiencing important worth declines.