The Bitcoin value motion prior to now two weeks has reiterated its risky nature regardless of the regular circulation of institutional cash. The cryptocurrency surged within the final days of September from $53,500 to a excessive of $66,000, solely to tug again to $61,000 within the first few days of October, displaying its unpredictable nature.

Apparently, Bitcoin’s rally to reaching $66,000 has led to a change within the investing dynamics amongst holder cohorts. Moreover, this alteration in dynamics reveals that its reversal and retest after the rally is not completely dangerous information for Bitcoin’s value. The truth is, this shift means that the pullback may very well be setting the stage for a extra resilient long-term value outlook for Bitcoin.

Bitcoin’s Rejection At $66,000

Bitcoin’s latest break above $66,000 final week led to the creation of the primary increased excessive since June. This notable Bitcoin growth was famous by on-chain analytics platform Glassnode in a latest report. Bitcoin, which had initially created a better low of $53,000 in September, finally went on to interrupt above the August excessive of $64,500. In keeping with the report, the creation of this increased excessive led to a change within the profitability of short-term and long-term holder cohorts, with many extra bitcoins transferring into the long-term threshold.

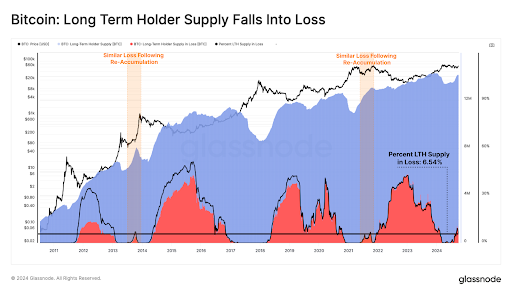

Significantly, the latest rally has seen many cash acquired in shut proximity to the $73,780 all-time excessive now being held for over 155 days. This, in flip, has seen many of those cash, that are in losses, now transferring to long-term holder standing. Though solely 6.54% of long-term holders are in losses, they account for 47.4% of all cash in losses. Whereas this won’t bode properly in the mean time for these long-term holders, Glassnode notes that that is truly widespread throughout re-accumulation phases, as seen within the 2013, 2019 and 2021 durations. Historical past exhibits that these have usually led to cost rallies.

On the opposite finish, profitability has improved massively amongst short-term holders. Glassnode information exhibits {that a} important variety of cash which are nonetheless within the short-term cohort have a value foundation between $53,000 and $66,000. Apparently, the final rally has pushed the profitability of short-term holder provide to over 62%. Notably, profit-taking volumes at the moment are 14.17 instances bigger than for loss-taking. As such, the monetary stress on short-term holders has now been eased, and plenty of of them now have incentives to maintain holding.

What Subsequent For Bitcoin?

Regardless of Bitcoin’s latest reversal at $66,000, the cryptocurrency finds itself in a stronger and extra worthwhile place for buyers across the board in comparison with the place it stood only a month in the past. Moreover, the rejection at $66,000 has given buyers, particularly long-term holders, one other probability to load up on their holdings.

On the time of writing, Bitcoin is buying and selling at $61,200.

Featured picture created with Dall.E, chart from Tradingview.com