Victoria d’Este

Printed: October 08, 2024 at 7:04 am Up to date: October 08, 2024 at 7:05 am

Edited and fact-checked:

October 08, 2024 at 7:04 am

In Transient

Tether has launched a documentary celebrating its tenth anniversary, inspecting its affect on the cryptocurrency business and its position in financial instability and inflation.

In honor of its tenth anniversary, Tether, the corporate that created the stablecoin USDT, has introduced the publication of a movie. This documentary goals to offer an intensive examination of the background and results of USDT, with a concentrate on areas affected by financial instability and inflation. Within the final ten years, USDT has modified the cryptocurrency business and past, serving as a significant monetary useful resource for thousands and thousands of individuals everywhere in the world.

The Historical past of USDT and Its Improvement

The journey of USDT began in October 2014, when it was referred to as Realcoin. The challenge, which was based by Craig Sellars, Reeve Collins, and Brock Pierce, quickly modified its title to Tether to emphasise its major purpose of providing a dependable cryptocurrency that’s linked to the greenback.

Since its conception, the primary purpose of USDT has been to function as a digital stand-in for the US greenback, enabling customers to retailer and conduct transactions in a extra secure forex, significantly in unstable monetary settings. USDT was first developed utilizing the OmniLayer protocol on the Bitcoin blockchain. Since then, it has unfold to different blockchains, together with as Ethereum and Tron, drastically bettering its use and accessibility.

The primary attribute of the stablecoin is its 1:1 peg to the US greenback, which implies that each USDT token is supported by an equal amount of fiat cash held in reserve. On account of this stability, customers should still benefit from the decentralized, worldwide nature of blockchain know-how with out having to cope with the worth volatility that’s usually related with cryptocurrencies like Bitcoin and Ethereum. Given its dollar-pegged nature, USDT has change into particularly well-liked in nations the place there may be numerous inflation and forex depreciation.

USDT as a Monetary Lifeline in Areas Affected by Inflation

The documentary from Tether emphasizes how USDT has developed right into a monetary lifeline for nations going through excessive inflation, which is considered one of its most necessary options. Customers from Brazil, Argentina, Turkey, and different nations the place inflation has diminished the worth of native currencies are featured within the documentary teaser. In these areas, USDT serves as a digital greenback, offering a dependable substitute for storing and exchanging worth.

As an example, USDT use has exploded in Brazil, the place by 2023 it would signify 80% of all cryptocurrency transactions. In keeping with one interviewee within the video, Tether along with USDT accounts for nearly 90% of Brazil’s each day transaction quantity.

This broad use highlights the necessity in areas the place native financial techniques are failing to keep up shopping for energy for a secure forex. Comparable patterns have been seen in Turkey and Argentina, the place folks have been compelled by hyperinflation to search for alternate means of protecting their wealth from sharp depreciation.

The purpose of the documentary “Stability and Freedom in Chaos” is to attract consideration to the broader results of USDT on monetary inclusion and empowerment. USDT has not solely stabilized nations affected by inflation but additionally made it attainable for these with out entry to conventional banking providers to have interaction within the international monetary system.

This was underlined by Tether CEO Paolo Ardoino, who stated that the corporate has at all times centered on the final mile and supplied monetary know-how options to communities and people which have been “left behind” by conventional banking establishments. Numerous folks in creating nations lack entry to financial institution accounts or will not be eligible for monetary providers due to their distant location or low earnings. USDT acts as a hyperlink between them and the remainder of the world’s monetary system.

A Decade of Progress and Controversy

With a present value of virtually $120 billion, USDT has risen since its debut to change into the largest stablecoin by market capitalization. It now ranks third general amongst cryptocurrencies, behind solely Ethereum and Bitcoin.

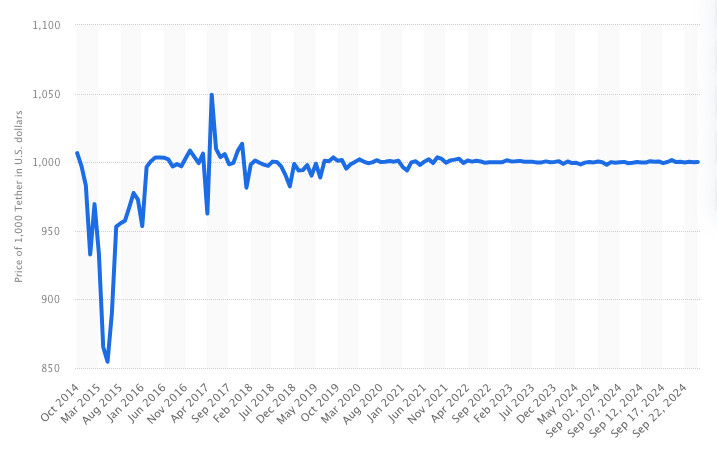

Picture: Statista

Nevertheless, there was some dispute about Tether’s success. Through the years, considerations over the transparency of the reserves supporting USDT have given rise to regulatory scrutiny and judicial challenges. However these worries, USDT has persevered and stored its greenback peg, solidifying its place as a necessary participant within the crypto ecosystem.

Tether’s tenacity within the face of those difficulties is likely one of the movie’s foremost themes. Tether has collaborated extensively with worldwide regulation enforcement organizations to battle fraud and different criminal activity with USDT. Tether performed a big position in serving to the US Division of Justice accumulate roughly $6 million that was related to fraudulent actions.

Moreover, the enterprise has teamed up with over 180 regulation enforcement organizations to freeze $1.8 billion in property linked to illicit exercise. These initiatives present that Tether is devoted to upholding the integrity of its platform regardless of its ongoing growth into new markets and areas of affect.

When inspecting the previous value historical past of USDT, it may be seen that the stablecoin has largely stored its 1:1 peg to the US greenback. There have been sporadic swings, such the momentary dip to $0.5885 in 2015, however they’ve been few and transient. Tens of millions of customers throughout the globe have come to belief the stablecoin due to its sturdiness and consistency over time.

The Way forward for USDT and Stablecoins

The aim of USDT on the earth of finance has grown a lot past its authentic purpose of providing a dependable digital forex. For thousands and thousands of individuals at present, particularly in areas coping with inflation and financial uncertainty, it’s a necessary software. Its standing as a retailer of worth, a conduit to the bigger cryptocurrency market, and a way of trade has cemented its position within the monetary business.

Nevertheless, the way forward for USDT and stablecoins will definitely be influenced by the event of regulatory frameworks. Stablecoins’ place within the monetary system is being examined extra intently by governments everywhere in the world, particularly in mild of its potential to upend established banking and financial practices. With USDT’s rising recognition and clout, it’s anticipated to come across elevated regulatory obstacles and calls for for higher openness about its reserves and actions.

In conclusion, Tether and its flagship product, USDT, have undergone main adjustments over the previous ten years. USDT has developed into a vital part of the worldwide monetary ecosystem from its modest beginnings as a software to facilitate crypto buying and selling to its present operate as a monetary lifeline for thousands and thousands in nations affected by inflation.

A deeper take a look at this journey and insights into the obstacles and achievements which have formed Tether’s first ten years will likely be supplied by the soon-to-be documentary. USDT will certainly proceed to be on the forefront of this revolution as stablecoins proceed to develop and alter the monetary panorama.

Disclaimer

According to the Belief Mission tips, please be aware that the data supplied on this web page isn’t meant to be and shouldn’t be interpreted as authorized, tax, funding, monetary, or another type of recommendation. It is very important solely make investments what you may afford to lose and to hunt impartial monetary recommendation when you have any doubts. For additional data, we propose referring to the phrases and circumstances in addition to the assistance and assist pages supplied by the issuer or advertiser. MetaversePost is dedicated to correct, unbiased reporting, however market circumstances are topic to alter with out discover.

About The Writer

Victoria is a author on a wide range of know-how matters together with Web3.0, AI and cryptocurrencies. Her in depth expertise permits her to put in writing insightful articles for the broader viewers.

Extra articles

Victoria d’Este

Victoria is a author on a wide range of know-how matters together with Web3.0, AI and cryptocurrencies. Her in depth expertise permits her to put in writing insightful articles for the broader viewers.