Amid the continued unsure cryptocurrency market sentiment, Chainlink (LINK) is poised for a value decline because it has fashioned a bearish value motion sample on its every day time-frame. Along with LINK’s bearish outlook, its value has began declining alongside different main cryptocurrencies.

LINK Worth Momentum

At press time, LINK is buying and selling close to the $10.52 stage and has skilled a value decline of over 2.7% previously 24 hours. Throughout this era, its buying and selling quantity has dropped by 19%, indicating decrease participation from merchants and traders, probably as a result of bearish value motion sample.

LINK Technical Evaluation and Upcoming Stage

In accordance with skilled technical evaluation, LINK has fashioned a bearish head-and-shoulder value motion sample on the every day time-frame. Moreover, with the current value drop it has damaged its essential descending trendline help, which has been in place since August 2024.

Based mostly on the current value momentum, if LINK breaches the neckline of this bearish sample and closes a every day candle under the $10.30 stage, there’s a robust risk that the asset might expertise a 13% value decline, probably reaching the $9 stage within the coming days.

As of now, LINK is buying and selling under the 200 Exponential Shifting Common (EMA) indicating a downtrend. Merchants and traders typically watch the 200 EMA when constructing positions, whether or not on the lengthy or brief facet.

Bearish On-Chain Metrics

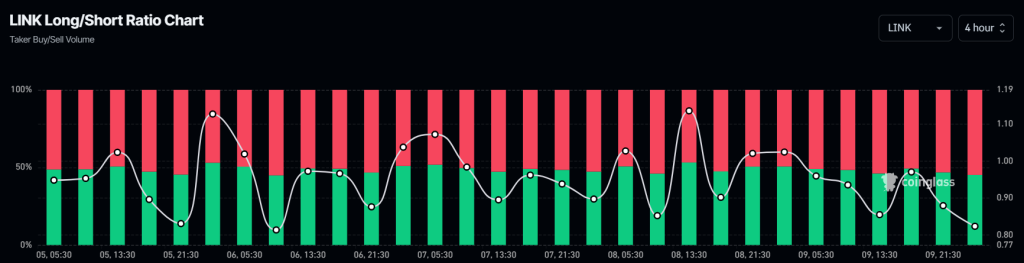

LINK’s bearish outlook is additional supported by on-chain metrics. In accordance with the on-chain analytics agency Coinglass, LINK’s Lengthy/Quick ratio at the moment stands at 0.82 stage, indicating robust bearish market sentiment amongst merchants. Moreover, its future open curiosity has elevated by 5.2% previously 24 hours, which is at the moment a bearish signal for LINK holders.

Each time the lengthy/brief ratio is under 1 and open curiosity will increase, it signifies that merchants have began shorting.

At the moment, 54.84% of high merchants maintain brief positions, whereas 45.16% maintain lengthy positions. It seems that merchants have began betting on the brief facet as they imagine that the value will go down.