On-chain information reveals the Bitcoin ‘Obvious Demand’ indicator has flipped again to optimistic. Right here’s what this might imply for the asset’s value.

Bitcoin Obvious Demand Has Surged Again Into Constructive Territory

In a brand new publish on X, Ki Younger Ju, the founder and CEO of the on-chain analytics agency CryptoQuant, mentioned the newest development within the Obvious Demand indicator for Bitcoin.

“Obvious demand is the distinction between manufacturing and modifications in stock,” notes Younger Ju. “For Bitcoin, manufacturing refers to mining issuance, whereas stock refers to inactive provide for over a yr.”

The mining issuance right here measures the overall quantity of BTC that the miners produce by including blocks to the community and receiving rewards. On the identical time, the one-year inactive provide contains the tokens that haven’t been transferred on the blockchain for a couple of yr.

Beneath is the chart for the Obvious Demand for Bitcoin shared by the analyst.

The development within the 30-day sum of the metric over the previous few years | Supply: @ki_young_ju on X

As is seen within the graph, the Bitcoin Obvious Demand had risen to extremely optimistic ranges throughout the rally to the brand new all-time excessive (ATH) within the yr’s first quarter.

A optimistic worth suggests the lower within the BTC stock is bigger than its manufacturing. “If the lower in stock exceeds manufacturing, demand is rising, and vice versa,” explains the CryptoQuant CEO.

Nonetheless, the excessive demand for the cryptocurrency couldn’t be maintained because the metric had slumped to impartial values quickly after the asset’s value had fallen into its consolidation part.

Nonetheless, this development of sideways motion round practically impartial ranges seems to have lastly been damaged just lately, because the metric has witnessed a optimistic spike.

To date, the Obvious Demand hasn’t reached ranges wherever close to as excessive as again throughout the March ATH, however its present worth continues to be fairly notable, indicating that demand has returned for the coin.

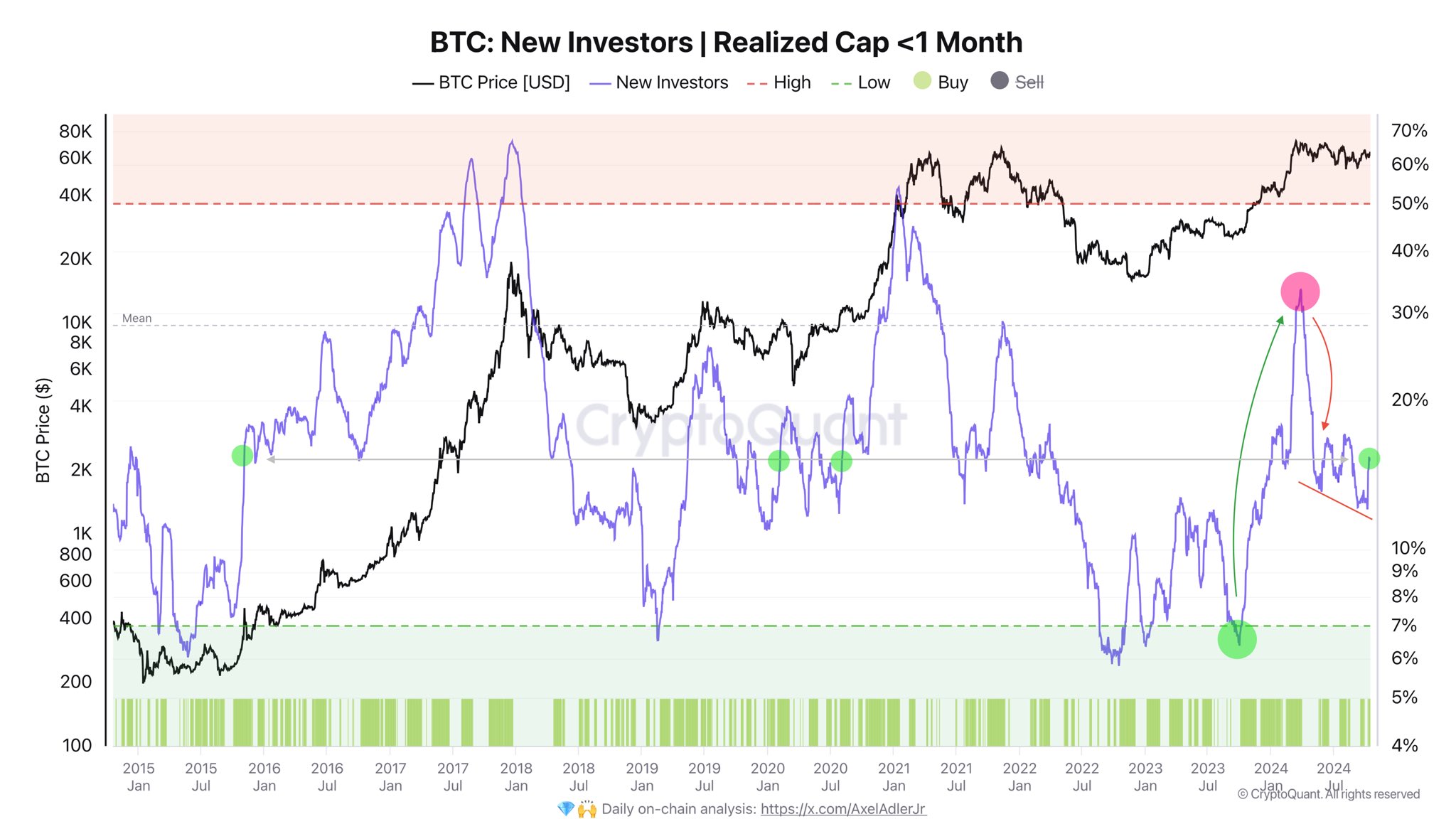

One other metric that alerts that recent demand is coming into Bitcoin is the Realized Cap of the brand new buyers, as CryptoQuant writer Axel Adler Jr. identified in a brand new publish on X.

The worth of the metric seems to have seen an increase in latest days | Supply: @AxelAdlerJr on X

The Realized Cap is an indicator that, in brief, retains monitor of the overall quantity of capital that the Bitcoin buyers as an entire have invested into the cryptocurrency.

Within the chart, the information for the Realized Cap, particularly for the “new buyers”, is proven, that are the holders who bought their cash inside the previous month. This metric can proxy for the brand new capital coming into the asset.

“Demand for coin purchases from new buyers has resumed, with a 3% enhance over the past 10 days. It is a optimistic sign for the market,” notes the analyst.

BTC Worth

Bitcoin had neared the $68,000 degree earlier within the day, nevertheless it seems to have seen a pullback, because it’s now again at $66,100.

Appears like the value of the coin has been on the rise just lately | Supply: BTCUSDT on TradingView

Featured picture from Dall-E, CryptoQuant.com, chart from TradingView.com