Este artículo también está disponible en español.

Nearly 70% of institutional traders in Ethereum (ETH) are taking part in ETH staking, with 60.6% of them utilizing third-party staking platforms.

Ethereum Staking Panorama At A Look

Based on a report by Blockworks Analysis, 69.2% of institutional traders holding Ethereum are engaged in staking the platform’s native ETH token. Of those, 78.8% are funding corporations and asset managers.

Associated Studying

Notably, barely a couple of out of 5 institutional traders – or 22.6% – of the respondents mentioned that ETH or an ETH-based liquid staking token (LST) constitutes greater than 60% of their whole portfolio allocation.

The report notes a seismic transformation within the Ethereum staking panorama for the reason that community transitioned from a proof-of-work (PoW) to proof-of-stake (PoS) consensus mechanism through the Merge improve.

At current, there are near 1.1 million on-chain validators staking 34.8 million ETH on the community. Following the Merge, Ethereum community contributors had been allowed to withdraw their ETH solely after the Shapella improve in April 2023.

After the preliminary part of ETH withdrawals, the community has seen regular inflows, indicating robust demand for ETH staking. At current, 28.9% of the overall ETH provide is staked, making it the community with the best greenback worth of staked belongings, valued at over $115 billion.

It’s value noting that the annualized yield from staking ETH is round 3%. As extra ETH is staked, the yield decreases proportionally. Nonetheless, community validators may earn further ETH by precedence transaction charges in periods of excessive community exercise.

Third-Social gathering Staking Overshadows Solo Staking

Anybody can take part in ETH staking, both as a solo staker or by delegating their ETH to a third-party staking platform. Whereas solo staking offers the staker full management over their ETH, it comes with a excessive entry barrier of staking at the very least 32 ETH – value greater than $83,000 at present market worth of $2,616.

Conversely, holders can stake with as little as 0.1 ETH by third-party stakers however should quit on a point of management over their belongings. Lately, Ethereum co-founder Vitalik Buterin careworn the necessity to decrease entry necessities for ETH solo stakers to make sure larger community decentralization.

At present, about 18.7% of stakers are solo stakers. Nonetheless, the pattern reveals that solo staking is dropping recognition as a result of excessive entry threshold and the inefficiency of locked capital. The report explains:

As soon as locked in staking, ETH can not be used for different monetary actions all through the DeFi ecosystem. Because of this one can not present liquidity to a wide range of DeFi primitives, or collateralize one’s ETH to take out loans in opposition to it. This presents a possibility price for solo stakers, who should additionally account for the dynamic community reward charges of staked ETH to make sure they’re maximizing their risk-adjusted yield potential.

Because of this, third-party staking options are rising in popularity amongst ETH stakers. Nonetheless, such platforms – dominated by centralized exchanges and liquid staking protocols – elevate considerations about community centralization.

Near 48.6% of ETH stakers leveraging third-party staking platforms are utilizing only one built-in platform corresponding to Coinbase, Binance, Kiln, and others.

The report highlights key elements driving institutional traders to make use of third-party platforms, together with platform status, supported networks, pricing, ease of onboarding, aggressive prices, and platform experience.

Associated Studying

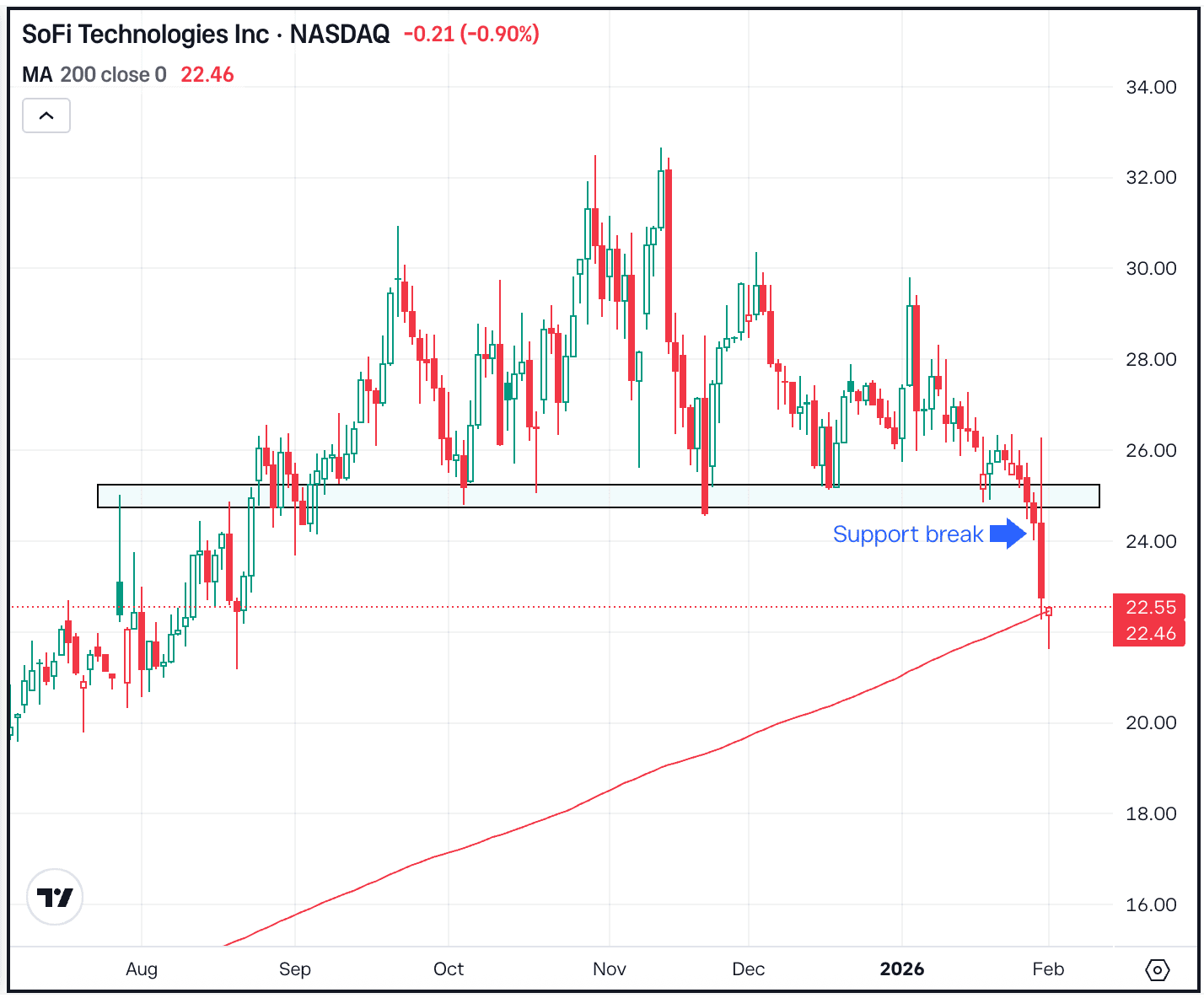

Though the Ethereum staking ecosystem is evolving, this development has not but been mirrored in ETH’s worth. ETH has considerably underperformed in opposition to BTC for an prolonged interval, solely not too long ago gaining traction after the US Federal Reserve’s (Fed) resolution to chop rates of interest.

Nonetheless, some crypto analysis corporations stay optimistic about ETH’s potential comeback in opposition to BTC later this 12 months. As of press time, ETH is buying and selling at $2,616, up 0.8% previously 24 hours.

Featured picture from Unsplash, Charts from Blockworks Analysis and Tradingview.com