Este artículo también está disponible en español.

The current improve within the attraction of spot Bitcoin exchange-traded funds (ETFs) in america has quickly ceased.

Associated Studying

On Tuesday, these funds underwent a reversal, leading to web outflows of $79.01 million, following a rare seven-day streak of constructive inflows. Farside Buyers are the supply of this knowledge, an organization that focuses on the evaluation of ETF flows.

A Transient Impediment

The $79 million outflow represents a major shift in sentiment amongst buyers who had beforehand demonstrated a robust curiosity in Bitcoin ETFs. Over the span of two days final week, the market attracted round $1 billion in inflows, implying a strong demand for these monetary merchandise.

The primary reason for this adverse change was Ark and 21Shared’s ARKB, which resulted in a considerable $134.7 million outflow.

BlackRock’s IBIT, the best-performing bitcoin ETF by web belongings, drew $43 million. Constancy’s FBTC and VanEck’s HODL, which acquired $8.8 million and $3.8 million, respectively, additionally helped. There have been no new flows on the remaining eight funds, together with Grayscаle’s GBTC, throughout the day.

Nonetheless, Bitcoin ETFs might carry in additional than $21 billion thus far. This quantity clearly signifies the rising use of Bitcoin as a brand new asset class and it is just going to see extra hedge funds take bigger positions.

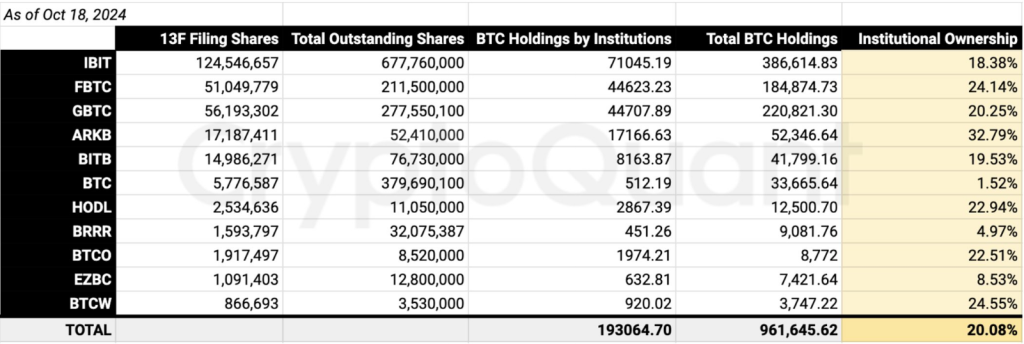

US-traded spot Bitcoin ETFs have additionally seen important curiosity from institutional buyers, with 20% of the market owned by them as of October 22.

Institutional possession of U.S. #Bitcoin Spot ETFs is round 20%, with asset managers holding 193K BTC (per Type 13F filings). pic.twitter.com/9YTOEH3G5w

— Ki Younger Ju (@ki_young_ju) October 22, 2024

Institutional Demand Is Nonetheless Robust

Regardless, whereas the most recent ETF circulation swings have been important in themselves, they cannot distract from what’s an ongoing push in the direction of institutional Bitcoin adoption. Among the many foremost firms who’ve made giant investments in these funds are Goldman Sachs and Millennium Administration.

The SEC’s approval of choices buying and selling on 11 Bitcoin ETFs will assist buyers handle their Bitcoin publicity, boosting curiosity.

By way of extra environment friendly place hedging made attainable by choices buying and selling, buyers may also help to regular the market and decrease volatility over time. Analysts argue that this might draw extra institutional cash to the trade, due to this fact supporting Bitcoin’s fame as a reputable funding software.

Bitcoin ETF: Trying Forward

Though outflows might trigger concern, many analysts are constructive about Bitcoin ETFs. Choices buying and selling’s SEC approval is a turning level that would enhance market effectivity and liquidity.

Extra institutional gamers coming into the area are prone to change the dynamics. The present pause in inflows might be a short lived phenomenon solely; buyers are repositioning their methods given the shift in market circumstances.

Associated Studying

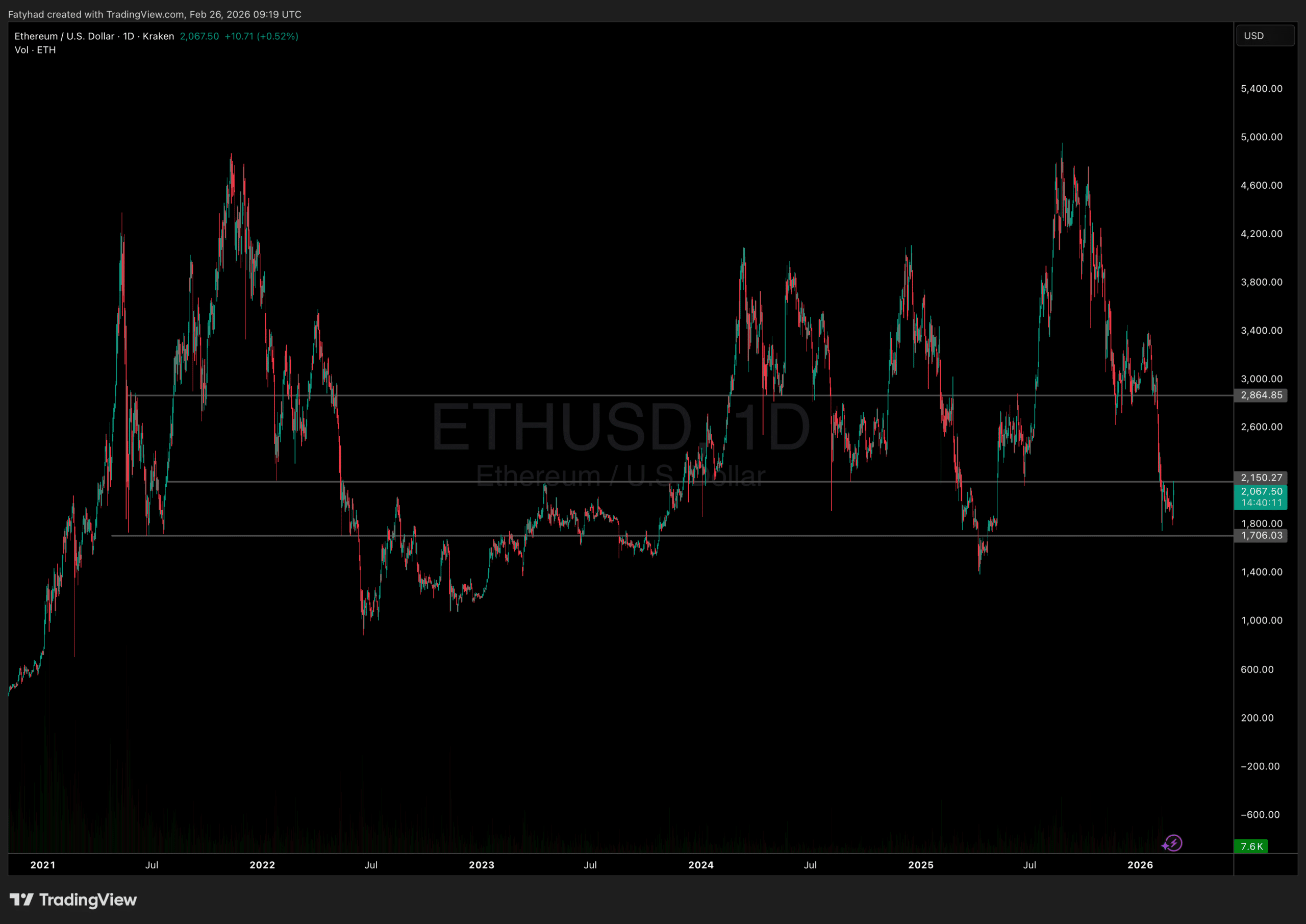

The outlook for spot Bitcoin ETFs, trying into the long run, seems fairly constructive with the present uptick in adoption from the institutional area and buying and selling of Bitcoin at or close to three-month highs.

The current outflows from spot Bitcoin ETFs might point out a short lived setback; nonetheless, the prevailing development of heightened institutional curiosity and regulatory assist signifies that this asset class is right here to remain. Buyers will likely be intently monitoring the fast evolution of this marketplace for any new developments.

Featured picture from The Rio Instances, chart from TradingView