Alisa Davidson

Revealed: November 04, 2024 at 6:37 am Up to date: November 04, 2024 at 6:37 am

Edited and fact-checked:

November 04, 2024 at 6:37 am

In Temporary

QCP Capital notes the market’s cautious sentiment, as evidenced by sideways value motion over the weekend and a discount in leveraged perpetual contract positions.

Singapore-based cryptocurrency buying and selling agency QCP Capital launched a brand new market evaluation indicating that Kamala Harris and Donald Trump are in an in depth contest, as the percentages on Polymarket have aligned extra intently with present ballot estimates. Whereas Polymarket odds nonetheless favor Trump at 55%, this determine has dropped from 66% only a week earlier.

Moreover, the market’s cautious sentiment is mirrored within the sideways value motion over the weekend and the discount in leveraged perpetual contract positions, which fell from $30 billion to $26 billion throughout exchanges. QCP Capital suggests this can be a interval of calm earlier than a possible breakout from the extended vary, presumably resulting in new all-time highs.

The choices market has additionally skilled a surge in shopping for exercise, notably for $75,000 name choices set to run out on the finish of November, which has been notable since final Friday. Because the election date approaches, the variety of associated choices positions is growing, with implied volatility exceeding 87 on Friday, whereas precise volatility stays round 40.

Analysts count on spot costs to fluctuate inside this vary till the election outcomes turn into clearer this week. A victory for Donald Trump might result in a swift value enhance, whereas a win for Kamala Harris might consequence within the reverse impact.

Bitcoin Trades Beneath $69,000, Whereas General Crypto Market Faces Decline

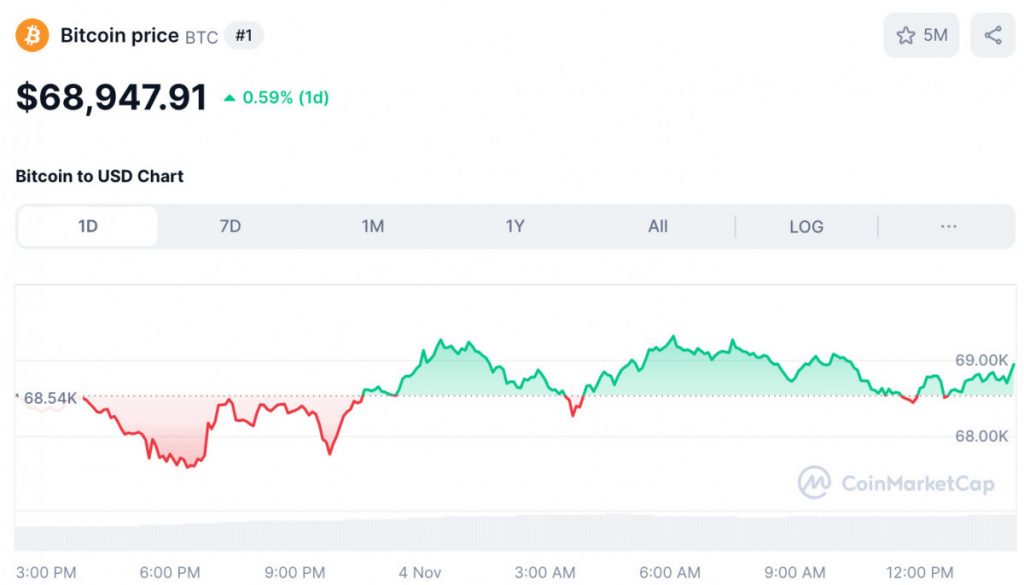

As of this writing, Bitcoin is buying and selling at $68,947, reflecting a 0.59% enhance during the last 24 hours. The cryptocurrency reached an intraday low of $67,574 and a excessive of $69,324. Bitcoin’s market capitalization stands at $1.36 trillion, with its market dominance growing by 1.37% from yesterday to 60.49%. This upward motion corresponds with appreciable weekly inflows of $2.22 billion into spot Bitcoin exchange-traded funds (ETFs), based on information from SoSoValue.

In distinction, the worldwide cryptocurrency market capitalization has skilled a decline of 1.83%, dropping to $2.25 trillion. Nevertheless, the full cryptocurrency market quantity has seen a considerable enhance of 25.50%, rising to $72.44 billion as we speak, as reported by CoinMarketCap.

Disclaimer

In step with the Belief Venture tips, please observe that the knowledge offered on this web page will not be supposed to be and shouldn’t be interpreted as authorized, tax, funding, monetary, or every other type of recommendation. You will need to solely make investments what you possibly can afford to lose and to hunt unbiased monetary recommendation when you have any doubts. For additional data, we advise referring to the phrases and circumstances in addition to the assistance and assist pages offered by the issuer or advertiser. MetaversePost is dedicated to correct, unbiased reporting, however market circumstances are topic to vary with out discover.

About The Writer

Alisa, a devoted journalist on the MPost, makes a speciality of cryptocurrency, zero-knowledge proofs, investments, and the expansive realm of Web3. With a eager eye for rising tendencies and applied sciences, she delivers complete protection to tell and have interaction readers within the ever-evolving panorama of digital finance.

Extra articles

Alisa Davidson

Alisa, a devoted journalist on the MPost, makes a speciality of cryptocurrency, zero-knowledge proofs, investments, and the expansive realm of Web3. With a eager eye for rising tendencies and applied sciences, she delivers complete protection to tell and have interaction readers within the ever-evolving panorama of digital finance.